27.05.2020 by Harry Vance

Salvage value — AccountingToolsAlso covered are assets that a company constructs as a separate project and intends to sell or lease, such as a real estate development, a large office building, or a ship. Capitalized costs include certain financing an... Read more

26.05.2020 by Harry Vance

Capital DefinitionIn this realm, the capital market is where investable capital for non-financial companies is available. Capital markets in corporate finance may also refer to equity funding, excluding debt. Capital markets may trade in other financ... Read more

26.05.2020 by Harry Vance

Capital maintenance — AccountingToolsPhysical Capital MaintenanceThese changes took different forms in different countries, but they combined to pave the way for capitalism. In England peasants were evicted from rural areas so that nobles could use t... Read more

26.05.2020 by Harry Vance

Capital Lease DefinitionHow a Capital Lease WorksA capital lease is the other type of lease, and unlike an operating lease, a capital lease requires the lessee to bear some of the risks and benefits of owning the asset, even though it never actually... Read more

25.05.2020 by Harry Vance

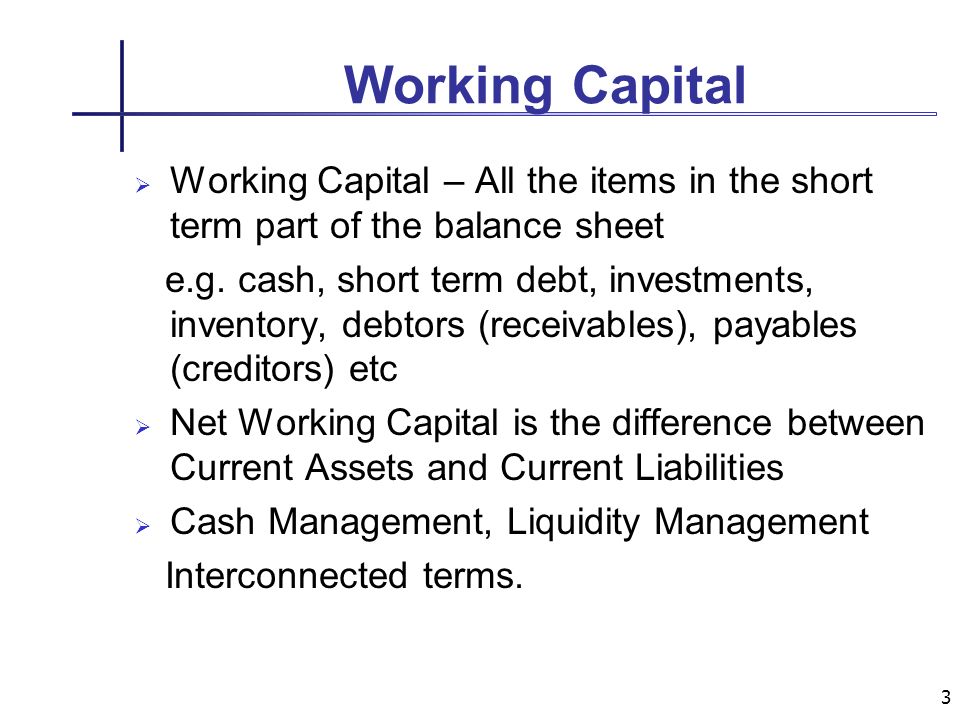

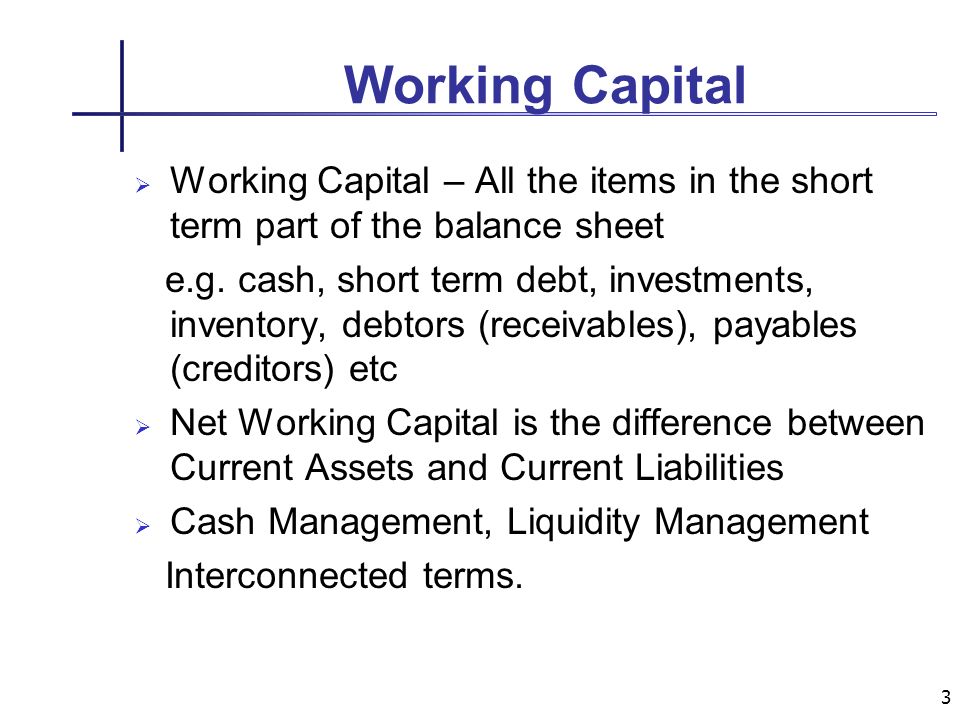

What is Inventory? Meaning Definition ExamplesInventory to Working Capital ExplanationThe working capital ratio remains an important basic measure of the current relationship between assets and liabilities. To calculate the working capital, compare a... Read more

25.05.2020 by Harry Vance

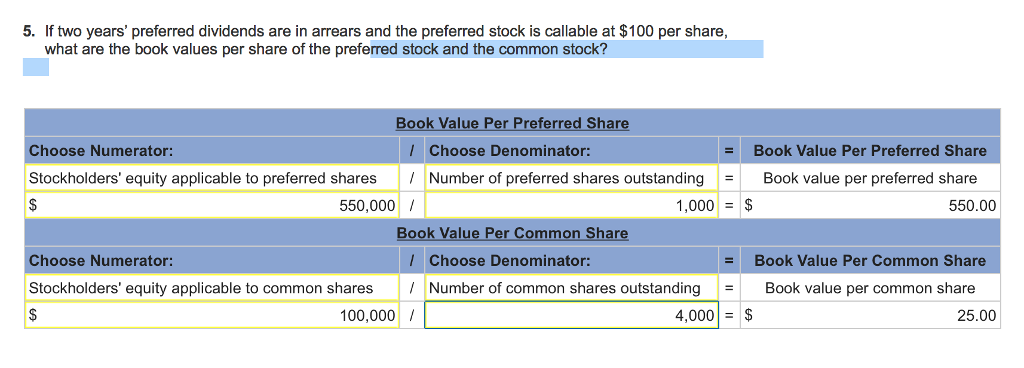

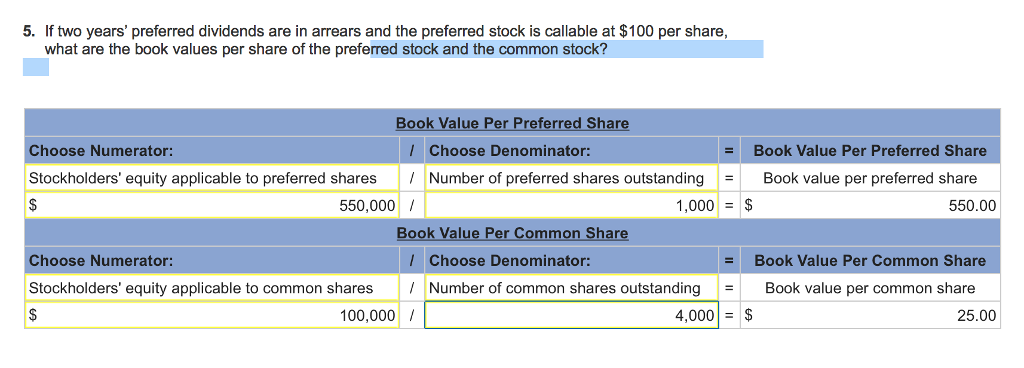

How to Sell Preferred StockPreferred stockholders enjoy a fixed dividend that, while not absolutely guaranteed, is nonetheless considered essentially an obligation the company must pay. Preferred stockholders must be paid their due dividends before t... Read more

25.05.2020 by Harry Vance

Callable Bond DefinitionWhy Companies Issue BondsWhy would a company issue a callable bond?Companies issue callable bonds to allow them to take advantage of a possible drop in interest rates at some point in the future. The issuing company can redeem... Read more

22.05.2020 by Harry Vance

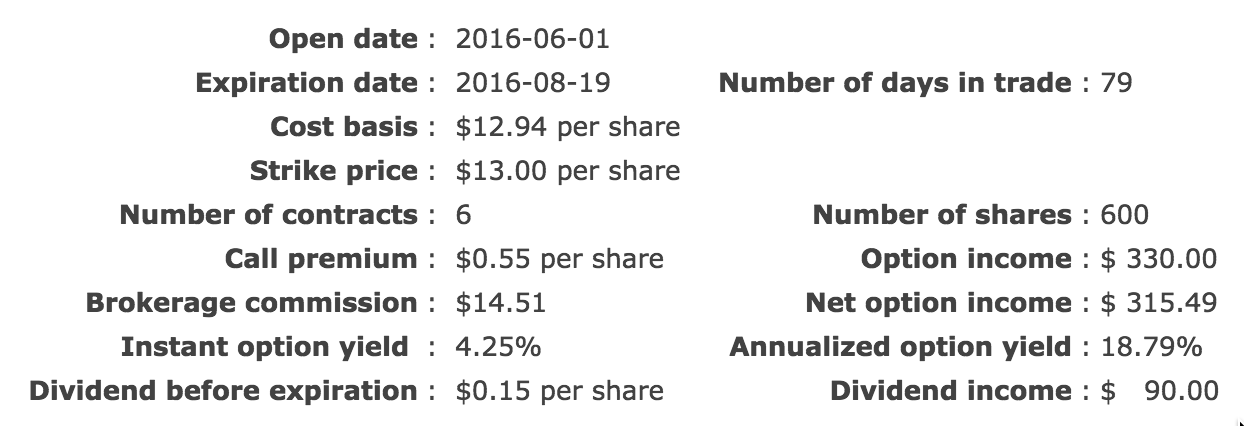

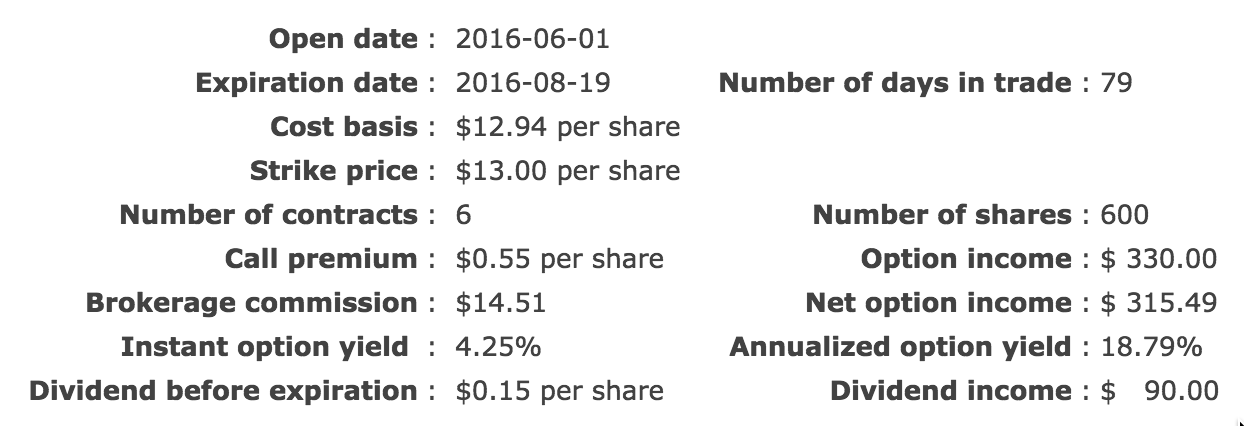

The Basics of Options ProfitabilityBuying three call options will cost $900 (3 contracts x 100 shares x $3). A call option writer stands to make a profit if the underlying stock stays below the strike price.This put would have intrinsic value -- mone... Read more

22.05.2020 by Harry Vance

Time Decay In OptionsThe put buyer either believes that the underlying asset's price will fall by the exercise date or hopes to protect a long position in it. The put buyer's prospect (risk) of gain is limited to the option's strike price less the un... Read more

22.05.2020 by Harry Vance

A little BS on BX cables. Armored or Metal Clad Cables used in exterior installations.Wenatchee and Chelan Real Estate Inspection Services.What is bone marrow?PP 2.0 is spearheaded by Paul Wong from the International Network on Personal Meaning and S... Read more