19.05.2020 by Harry Vance

Loan vs. Lend – What’s the Difference?You can check whether it’s a direct lender or lead generation company and whether they’re transparent about the fees and other loan details. If you can’t find enough information on the loan you’re applying for on... Read more

18.05.2020 by Harry Vance

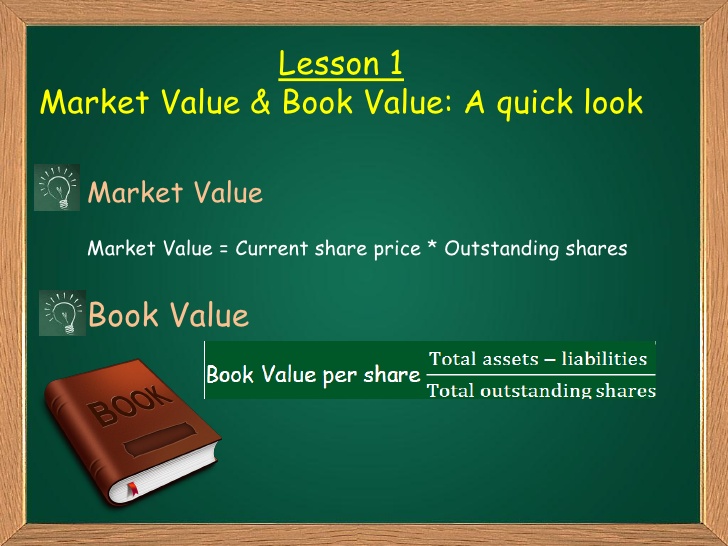

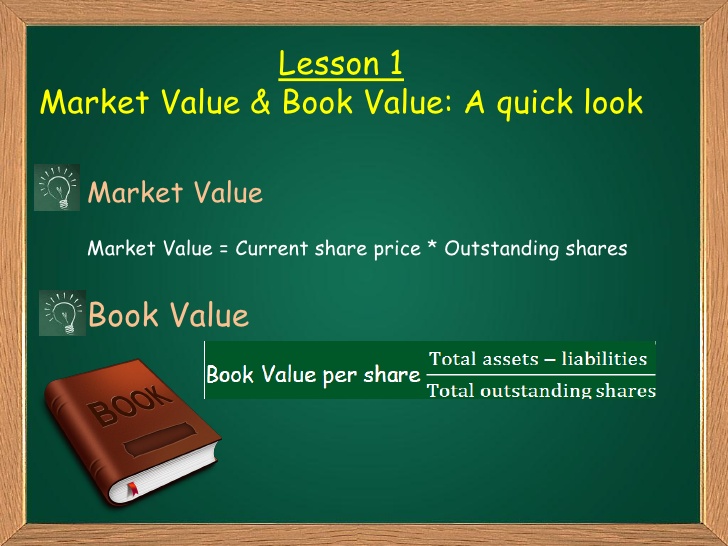

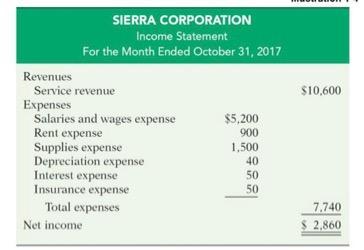

What's the Difference Between Book Value vs. Market Value?Book Value Vs. Market Value: An OverviewIn this scenario, the market is giving investors an opportunity to buy a company for less than its stated net worth, meaning the stock price is lower th... Read more

18.05.2020 by Harry Vance

How Are Book Value and Market Value Different?Book value simply implies the value of the company on its books, often referred to as accounting value. It's the accounting value once assets and liabilities have been accounted for by a company's auditor... Read more

18.05.2020 by Harry Vance

Book of prime entryBooks of original entryWhich is the book of original entry in accounting?Books of original entry refers to the accounting journals in which business transactions are initially recorded. The information in these books is then summar... Read more

15.05.2020 by Harry Vance

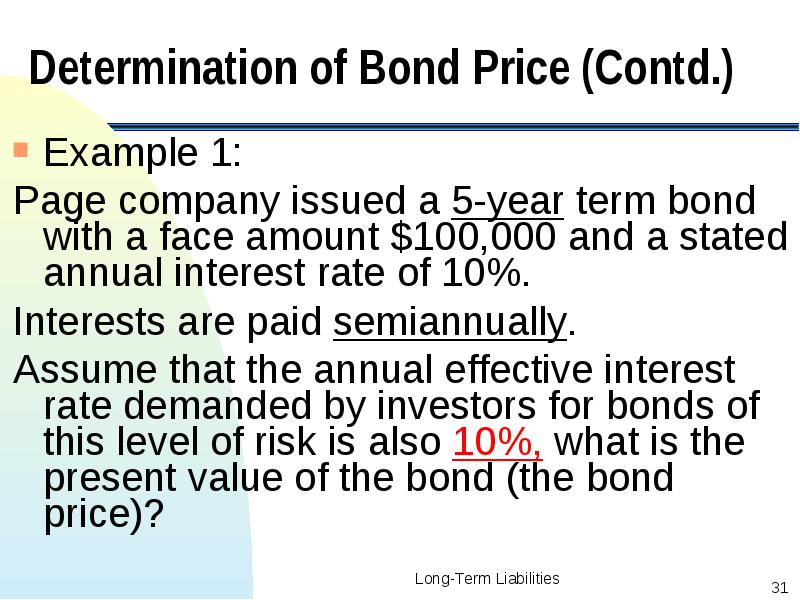

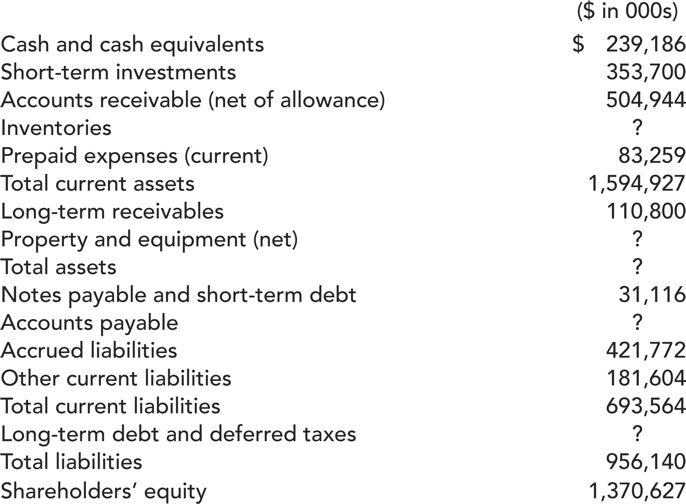

Where is the premium or discount on bonds payable presented on the balance sheet?The central government soon observed the economic advantages of printing paper money, issuing a monopoly right of several of the deposit shops to the issuance of these c... Read more

15.05.2020 by Harry Vance

Are bonds payable reported as a current liability if they mature in six months?Lower Default RiskWhile the sinking fund helps companies ensure they have enough funds set aside to pay off their debt, in some cases, they may also use the funds to repur... Read more

15.05.2020 by Harry Vance

How to Report Taxes of a Municipal Bond Bought at a PremiumJoin PRO or PRO Plus and Get Lifetime Access to Our Premium MaterialsThe average annual return over the last ten years was 6.51% as of February 2020. Looking at average annual returns over th... Read more

14.05.2020 by Harry Vance

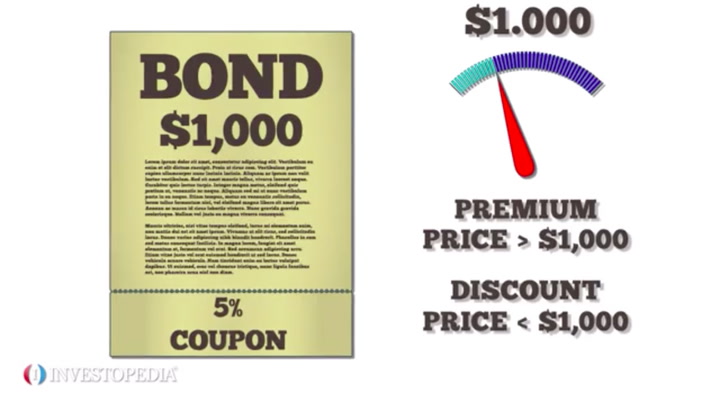

Amortization of Financing CostsWhen a new bond is issued, it comes with a stated coupon that shows the amount of interest bondholders will earn. For example, a bond with a par value of $1,000 and a coupon rate of 3% will pay annual interest of $30. I... Read more

14.05.2020 by Harry Vance

How bonds workCurrent YieldThe real value of a fixed rate bond is susceptible to loss due to inflation. Because the bonds are long-term securities, rising prices over time can erode the purchasing power of each interest payment a bond makes.What is B... Read more

14.05.2020 by Harry Vance

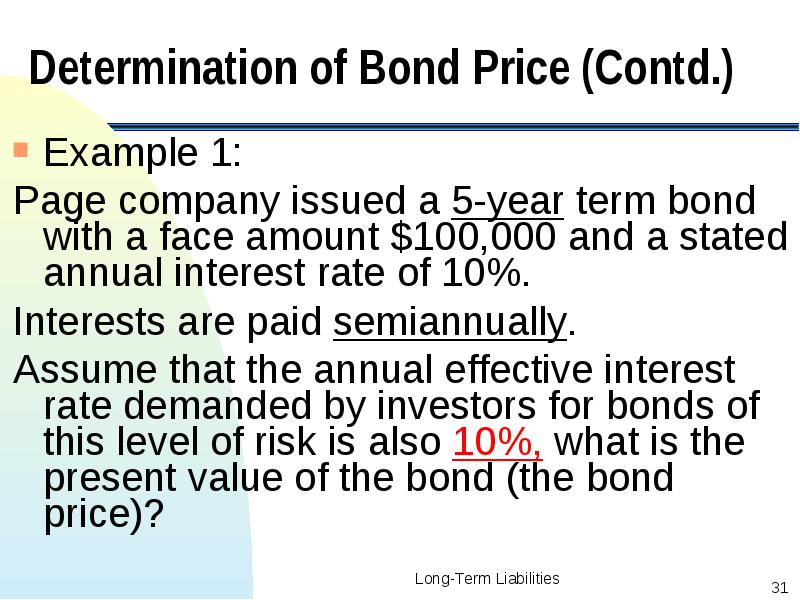

The amortization of premium on bonds payable — AccountingToolsFirst, it greatly reduces the credit risk of the loan or bond because the principal of the loan is repaid over time, rather than all at once upon maturity, when the risk of default is the... Read more