24.04.2020 by Harry Vance

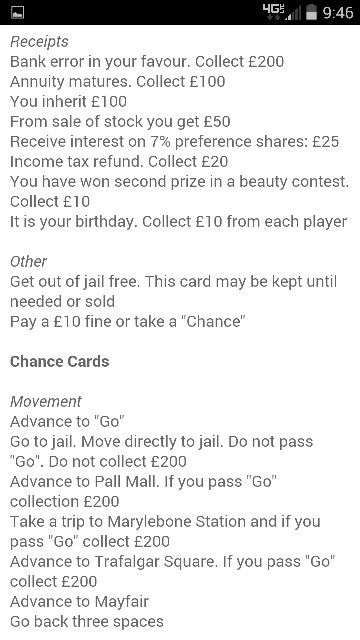

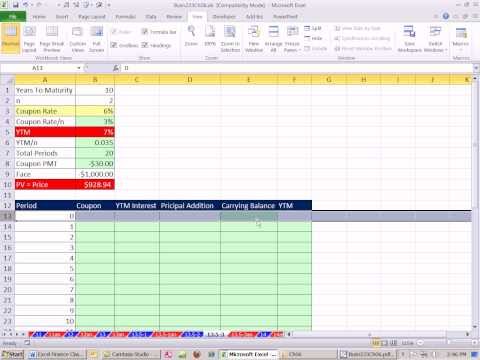

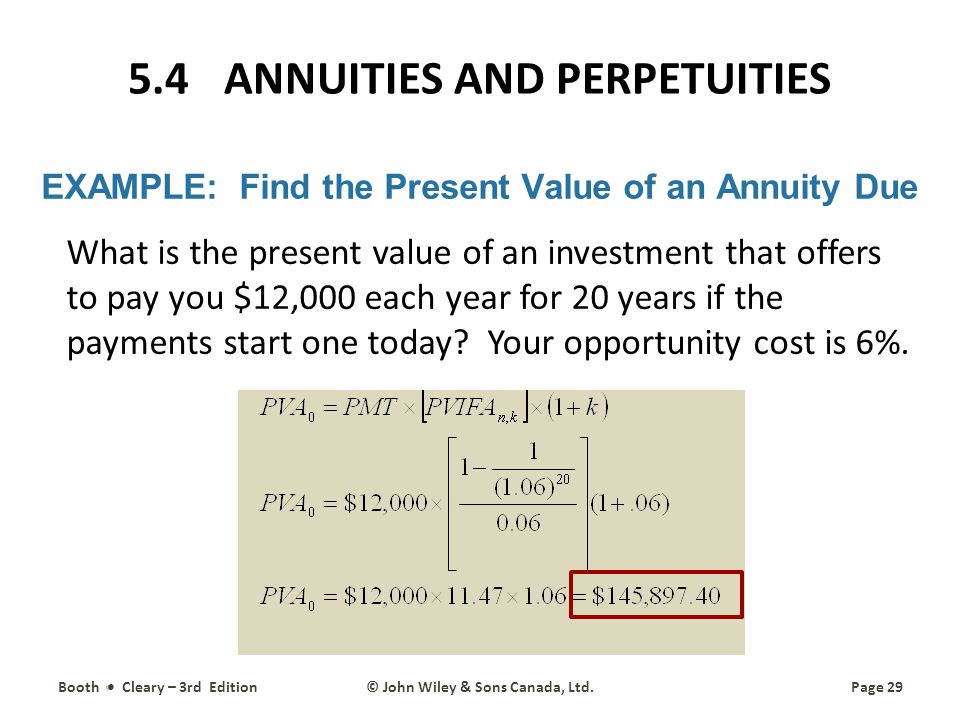

How to Calculate the Present Value of an Annuity DueIn contrast, an annuity due features payments occurring at the beginning of each period. Many monthly bills, such as rent, mortgages, car payments, and cellphone payments are annuities due because t... Read more

24.04.2020 by Harry Vance

How do I know if buying an annuity is right for me?Variable annuities allow the owner to receive greater future cash flows if investments of the annuity fund do well and smaller payments if its investments do poorly. This provides for less stable cas... Read more

24.04.2020 by Harry Vance

Ordinary Annuity DefinitionIn return, the insurer (the insurance company) agrees to make periodic payments to you (the insured) beginning immediately or at some date in the future. The information provided is not intended to be a recommendation to pu... Read more

23.04.2020 by Harry Vance

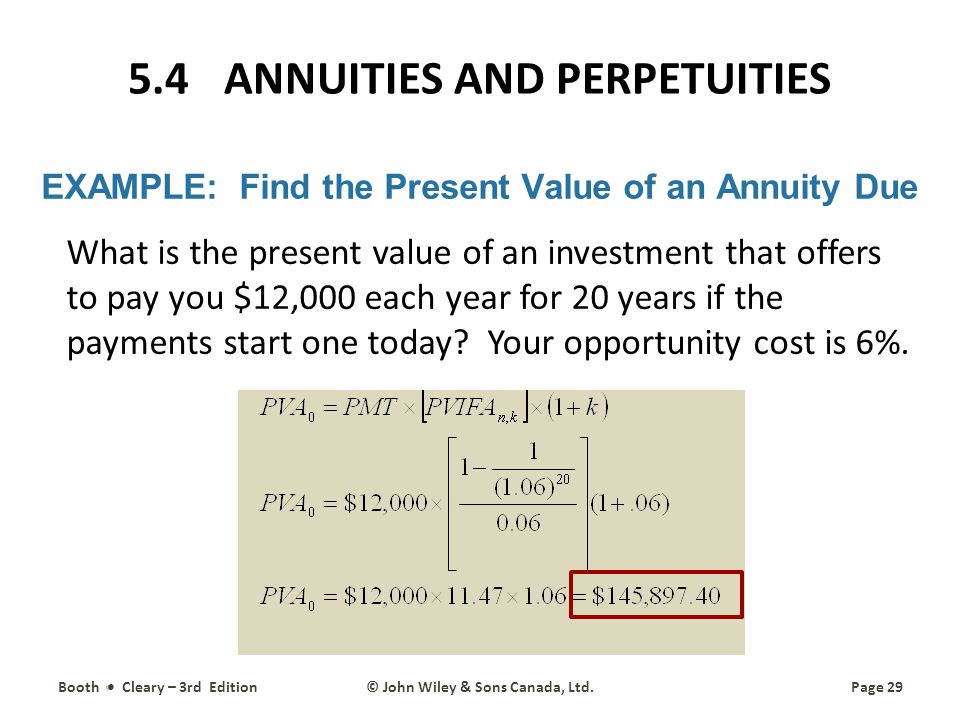

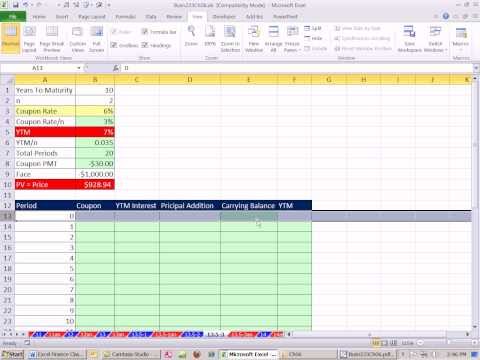

Amortization schedule — AccountingToolsAmortization in ActionEach time you make a payment on a loan you pay some interest along with a part of the principal. The principal is the original loan amount, or the balance that you must pay off. By making r... Read more

23.04.2020 by Harry Vance

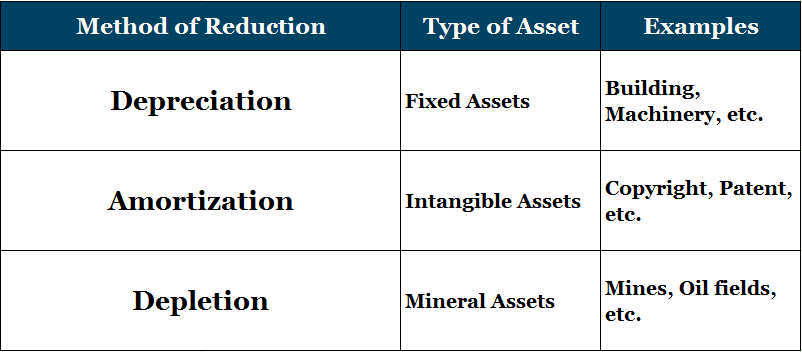

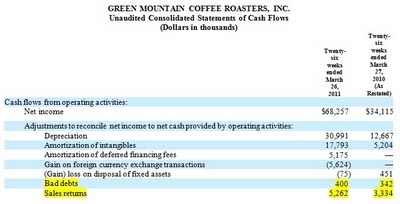

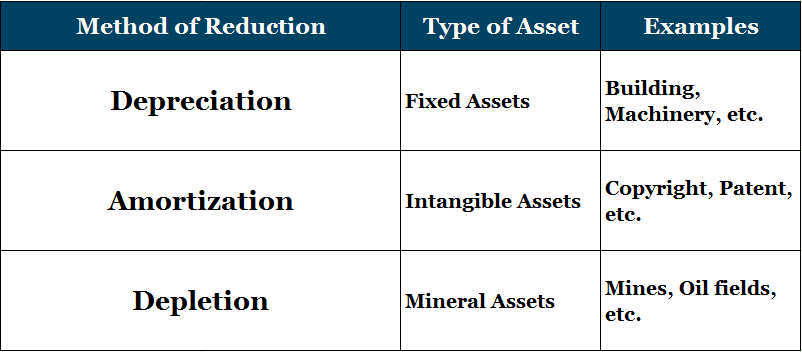

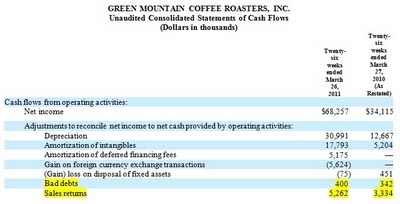

GoodwillThis differs from tangible assets which are depreciated (resulting in a depreciation expense) over their useful life. U.S. GAAP has very specific rules regarding the recognition of intangible assets on financial statements. With that said, a... Read more

23.04.2020 by Harry Vance

Amortization of Financing CostsAccounting On Us Newsletter SignupConsequently, as a bond's book value increases, the amount of interest expense increases. Additionally, amortization of these costs should now be recorded as interest expense. Going for... Read more

23.04.2020 by Harry Vance

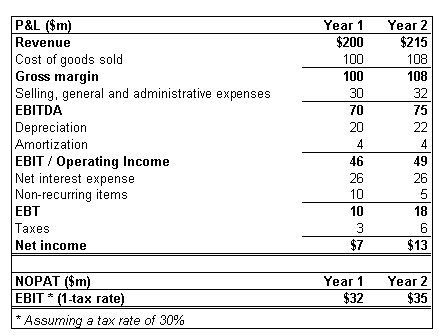

What is amortization and why do we amortize?What's the Difference Between Amortization and Depreciation in Accounting?What is an example of amortization?Amortization expense is the write-off of an intangible asset over its expected period of use, whi... Read more

22.04.2020 by Harry Vance

How Does Amortization Impact Interest Rates?Amortization expense is an income statement account affecting profit and loss. The offsetting entry is a balance sheet account, accumulated amortization, which is a contra account that nets against the amor... Read more

22.04.2020 by Harry Vance

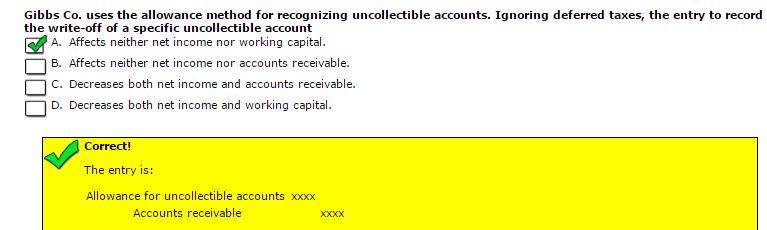

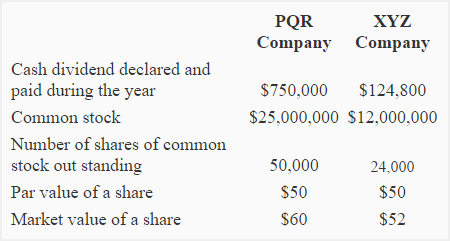

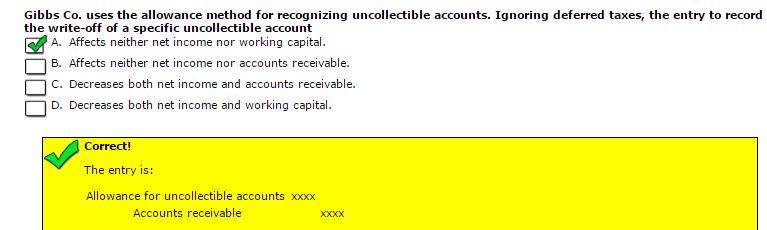

Allowance For Doubtful Accounts DefinitionRegardless of which percentage is used, either percentage would probably result in a reasonable estimate of uncollectible accounts receivable. Using the 1.70% estimate, the Nicholas Corporation would prepare... Read more

21.04.2020 by Harry Vance

allowance for doubtful accounts definition and meaningUnderstanding the Allowance For Doubtful AccountsWhen we look at the account's receivable, we meet the final two criteria pretty easily. There was a past transaction, there was a sale and it is un... Read more