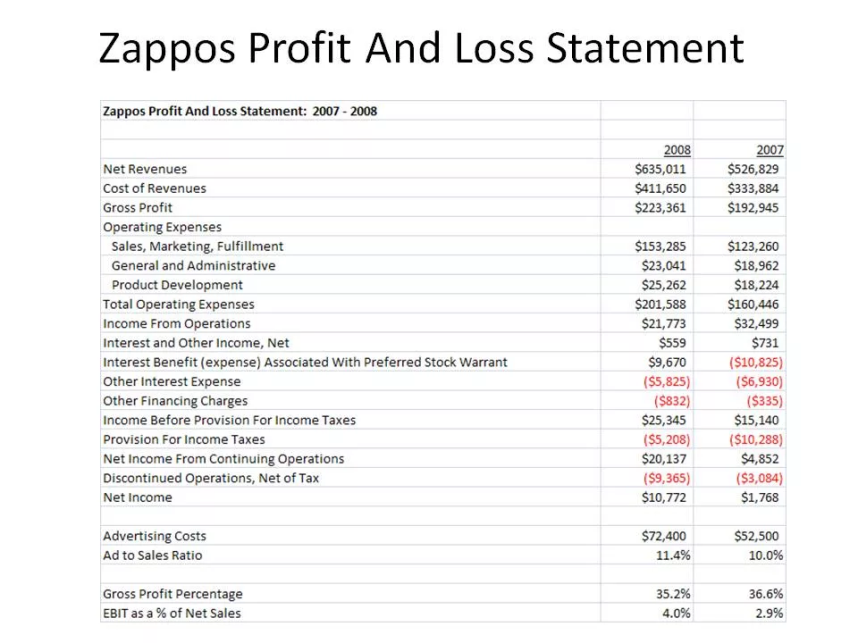

Financial results are Profit and Loss from the company’s activities. To determine them, you need to deduct expenses from your income. If the difference is positive, the company has made a profit. If it’s negative, a loss, the financial result can be determined when the income and expenses for the period are known. In accounting, profit loss is determined for the month. But no one prevents you from determining the financial result for each operation of the business. It is only important to determine the income and expenses for it correctly.

Account Profit: How to Calculate

Revenue is an increase in economic benefits resulting from the receipt of assets or the repayment of liabilities, resulting in an increase in the company’s capital. The exception is the founders ‘ deposits. It is not the simplest definition, but when you calculate, it clearly separates money receipts from income. It is important to understand two points.Revenue in accounting is generated when a company receives any assets, not just money. Or, when its obligations to contractors are reduced.

- The receipt of assets or repayment of liabilities will be the company’s income only if its capital becomes larger.

This is an increase in economic benefits. In order for an increase in assets to become income, you must not receive the same or greater increase in liabilities as a result of the transaction. In order for a reduction in liabilities to become income, you must not receive the same or greater reduction in assets as a result of the transaction.

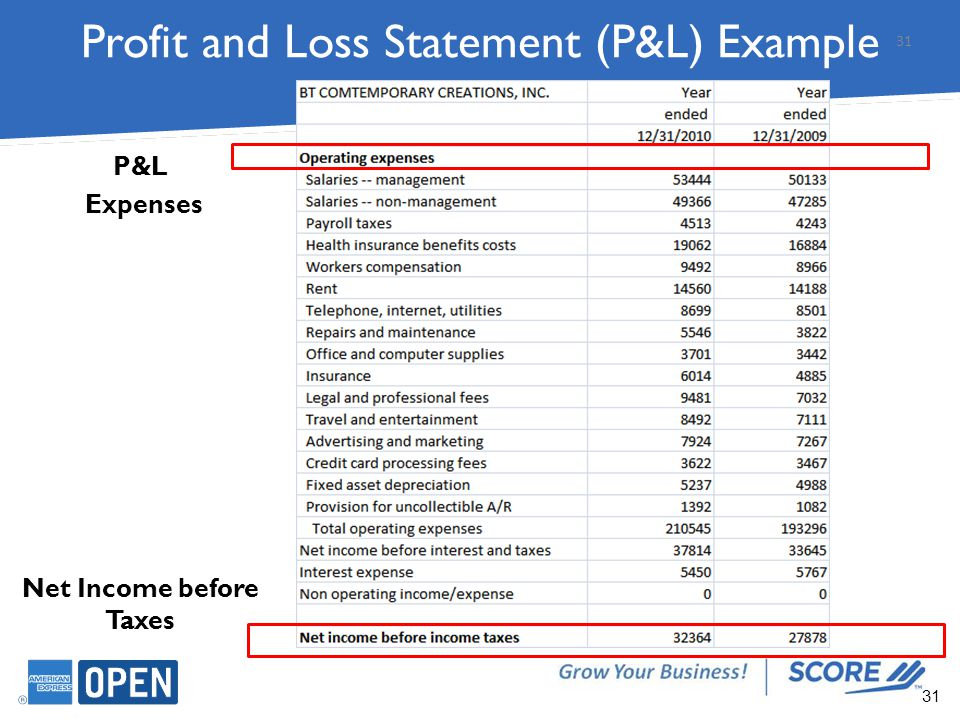

Kinds of accounting profit

In the profit loss, report income is very important. There are several kinds of accounting profit:

- net profit;

- gross profit;

- operating income;

- retained earnings.

Gross Profit in the report is the difference between revenue from the sale of products (revenue) and production costs (cost). It shows the effect of the company’s production activities. And it is really expensive for the company. If the gross profit is zero or negative, it is time to close or seriously review the production process. Inefficient production will not save either good management or excellent marketing with sales.Retained Earnings-net profit minus dividends to founders. Part of the net profit should be given to the founders for contributing their assets to the authorized capital. Then the current year’s net profit increases the retained earnings remaining from statements of previous years. Now, you know how to calculate accounting profit.

Income and expenses

Expenses in the loss report is a decrease in economic benefits resulting from the disposal of assets or the occurrence of liabilities, resulting in a decrease in the company’s capital. The exception is the reduction of capital by the decision of the company’s owners. Expenses are defined as a mirror of income. And just as clearly here are separated payments of money from expenses. It is important to understand two points:

- 1. Expenses of money occur when a company gives away any assets, not just money, and pays the tax. Or, when its obligations to contractors increase.

- 2. the disposal of assets or the occurrence of liabilities will be an expense of the company only if its capital becomes less.

This is a reduction in economic benefits. In order for a reduction in assets to become an expense, you must not receive the same or greater reduction in liabilities as a result of the transaction. Also, you should pay attention to deductible expenses.

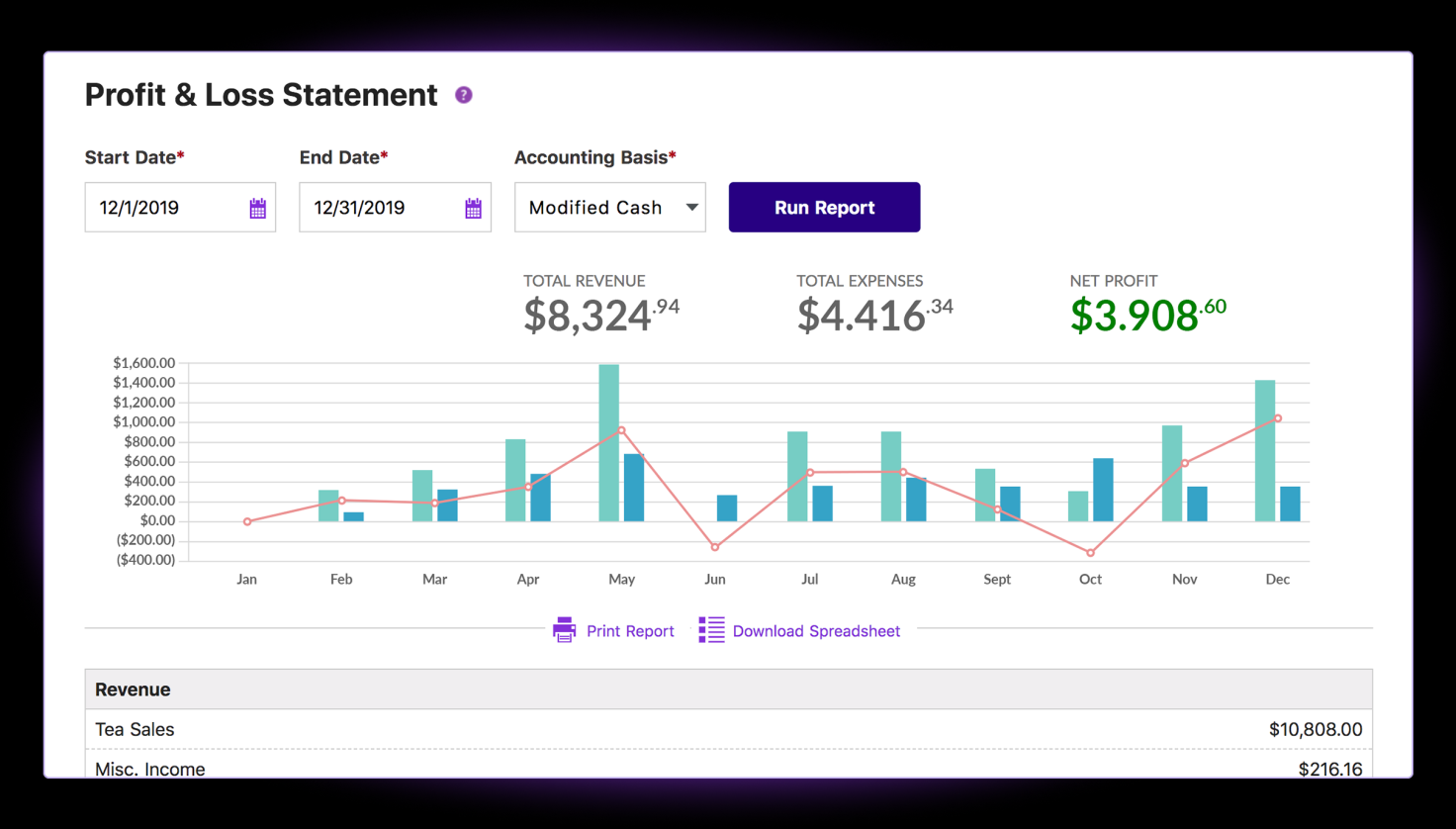

How often to calculate the accounting profit

The frequency of calculating income and expenses in the income statement may vary. This depends on the following factors:

- amount of money received;

- nature of the business;

- the volume of expenditures;

- the profitability of the company.

The recommended frequency of calculations and making a profit loss report is once a month. Accounting profit loss is quite a simple procedure.