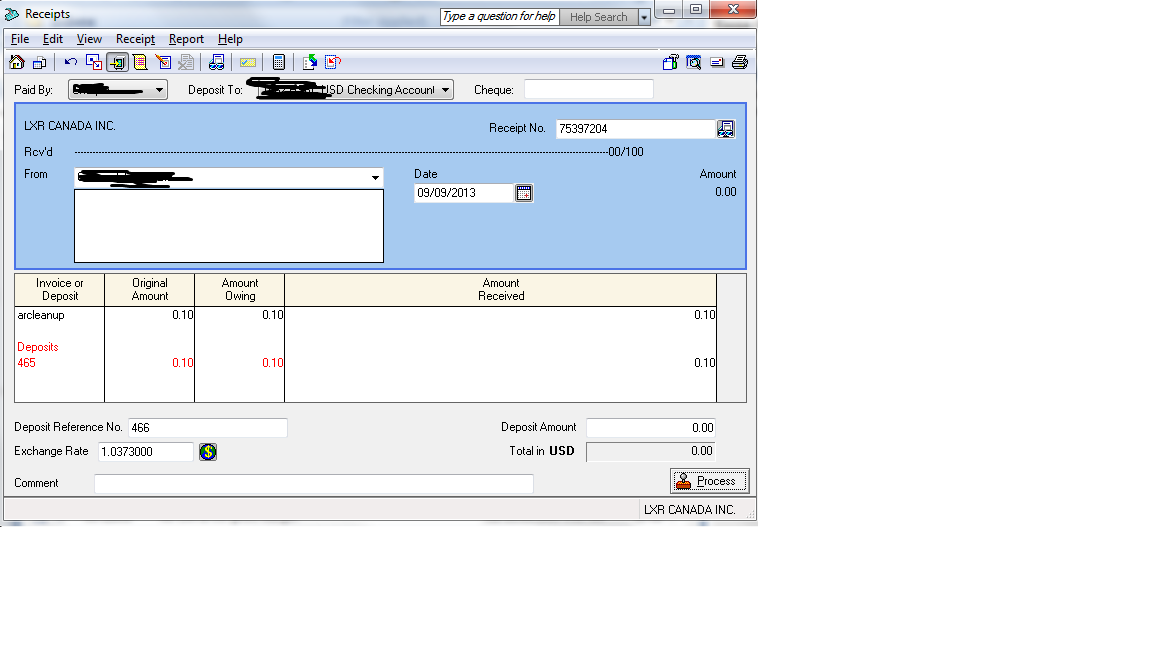

Accounts Payable Aging ScheduleIf you have invoices that have not been posted to the general ledger, deduct them from the aging report’s total. Then compare the modified total on your aging report with your general ledger balance for accounts payable to see if they match.

Risk of Not Using AP Aging Reports

If not, examine the details of your accounts payable account in the general ledger to determine the problem. For example, this might happen if manual entries were made to the general ledger but not in the accounts payable system. Companies will use the information on an accounts receivable aging report to create collection letters to send to customers with overdue balances.It is the counterpart to the accounts receivable aging report, which is used to track current amounts owed the company by its customers, as well as unused credit memos. The accounts receivable aging report is useful in determining the allowance for doubtful accounts. The report helps to estimate the value of bad debts to be written off in the company’s financial statements. In some cases, even tax authorities use the receivables aging report to learn more about the sales cycle and repayment timeline of the company’s customers.In this case, evaluate the seriousness of the situation, such as the creditor’s response to the nonpayment. If you have an accounts payable clerk, you can have her run aging reports; however, you should make the ultimate decision about where payments must go.A periodic report that categorizes a company’s accounts payable according to the length of time an unpaid invoice has been outstanding. Similar to accounts receivable aging, it is a critical management tool as well as an analytic tool that helps determine the financial health of a company by its ability to pay its bills on time. Credit memos and partially paid invoices will also be listed on the A/P Aging. An accounts receivable aging report or receivable aging report refers to a summary of all receivables due from customers at any given point in time.

How to Use an Accounts Payable Aging Report

Since accounts payable aging reports are typically based on the time that has passed since the invoice was received, it is crucial to remember that not all payment schedules are the same. Some vendors allow thirty days for payment; others have shorter or longer windows. This means that the bill that has been outstanding the longest might not actually be the first one due.Accounts receivable aging (tabulated via an aged receivables report) is a periodic report that categorizes a company’s accounts receivable according to the length of time an invoice has been outstanding. It is used as a gauge to determine the financial health of a company’s customers. Unlike an accounts receivable aging report, which shows what your customers owe you, an accounts payable aging report gives a breakdown of what you owe your suppliers. The itemization includes a list of the company’s outstanding invoices.

What Is an Aged Accounts Payable Report?

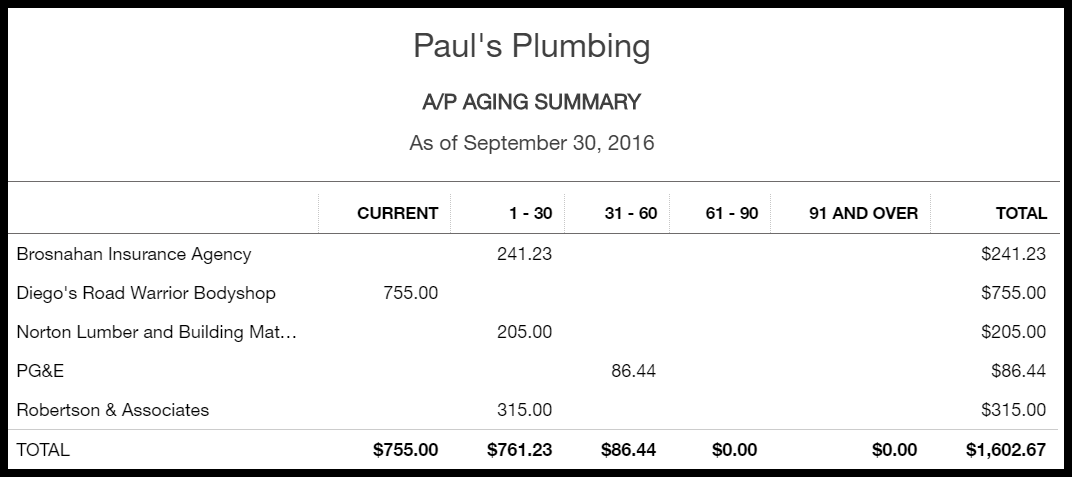

The typical column headers include 30-day windows of time, and the rows represent the receivables of each customer. The purpose of the accounts payable aging report is to provide a comprehensive summary report of outstanding amounts owed to the suppliers who provide goods and services to your company.

The Value Accounts Payable Aging Reports

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding. The findings from accounts receivable aging reports may be improved in various ways. First, accounts receivable are derivations of the extension of credit. If a company experiences difficulty collecting accounts, as evidenced by the accounts receivable aging report, specific customers may be extended business on a cash-only basis. Therefore, the aging report is helpful in laying out credit and selling practices.The report breaks down receivables due from all customers into different aging categories based on the number of days since the respective invoices were raised. The accounts receivable aging report is beneficial for estimating the total amount to be written off. Invoices that are past due for longer periods of time have a higher default rate as a result of the higher likelihood of default. The sum of the products from each outstanding date range provides an estimate regarding the number of uncollectible receivables. An accounts payable aging report (or AP aging report) is a vital accounting document that outlines the due dates of the bills and invoices a business needs to pay.

- Unlike an accounts receivable aging report, which shows what your customers owe you, an accounts payable aging report gives a breakdown of what you owe your suppliers.

- It is used as a gauge to determine the financial health of a company’s customers.

- Accounts receivable aging (tabulated via an aged receivables report) is a periodic report that categorizes a company’s accounts receivable according to the length of time an invoice has been outstanding.

Lean More About Financial Reporting:

They also check whether the policy for calculating the allowance for doubtful accounts is in line with the credit policy. Aged accounts payable reports are the opposite of aged accounts receivable reports. An accounts receivable aging report allows you to view the balances that are owed to your company by customers.The aged receivables report, or table, depicting accounts receivable aging provides details of specific receivables based on age. The specific receivables are aggregated at the bottom of the table to display the total receivables of a company, based on the number of days the invoice is past due.An aging report comes in handy when you need to reconcile your accounts payable to your general ledger. The ledger is the primary accounting record used to record the company’s financial transactions. The amounts in your accounts payable system and the accounts payable account in your general ledger should match; you may reconcile the two every month by running an accounts payable aging report.The opposite of an AP aging report is an accounts receivable aging report, which offers a timeline of when a business can expect to receive payments. Typically, an AP aging report is organized into separate “buckets,” with each bucket representing a 30-day period. These buckets allow a business owner to quickly recognize the payments due in the present month, the following month, and so forth. Older receivables can signify a weak collection process and impact your cash flow. Accounts receivable aging reports allow you to monitor your unpaid invoices and contact late-paying customers.

Example of an accounts payable aging report

Similarly, an accounts payable aging report allows you to view the balances you owe to other companies for supplies, inventory and services your company receives. Several pieces of information are found on a standard accounts payable report. While the world as we know it certainly will not end if you forgo scrutinizing a few accounts payable aging reports, you do run the risk of missing an opportunity or finding yourself in trouble with creditors. Since these tasks are vital to a company’s success, the time spent running and reviewing accounts payable aging reports is generally time well spent.

See for yourself how easy our accounting software is to use!

You can create an aging spreadsheet yourself or via accounting software. Accounts receivable aging is useful in determining the allowance for doubtful accounts. When estimating the amount of bad debt to report on a company’s financial statements, the accounts receivable aging report is useful to estimate the total amount to be written off. The primary useful feature is the aggregation of receivables based on the length of time the invoice has been past due.When reviewing the report and planning your payments, it is vital that you keep actual due dates in mind. In addition, some vendors offer discounts when payment is received within a certain period of time; if this discount is substantial, it may serve as an incentive to pay their invoices before others. An aging report is particularly useful if your cash flow is tight and you cannot pay your invoices on time. You can refer to it to decide who should get paid now and which payments can be delayed.