Accrued cost — AccountingTools

Accrued expenses vs. accounts payable

Is accrued expense an asset or liability?

Accrual accounting is a method of tracking such accumulated payments, either as accrued expenses or accounts payable. Accrued expenses are those liabilities which have built up over time and are due to be paid. Accounts payable, on the other hand, are current liabilities that will be paid in the near future.

The electricity company needs to wait until the end of the month to receive its revenues, despite the during-the-month expenses that it has. Meanwhile, it must acknowledge that it expects future income. Accrual accounting, therefore, gives the company a means of tracking its financial position more accurately. If a business records its transactions under the cash basis of accounting, then it does not use accruals.A prepaid expense is first categorized as a current asset on the company’s balance sheet. To continue with the preceding example, the $500 entry would reverse in the following month, with a credit to the office supplies expense account and a debit to the accrued expenses liability account.

Why are accrued expenses and accounts payable recorded?

Both accrued expenses and accounts payable are current liabilities, meaning they are short-term debts to be paid within a year. During everyday operations, you buy goods and services for your business. To organize expenses and keep your small business cash flow on track, you might need to record accrued liabilities in your accounting books. For example, a company can list $6,000 as a current asset under the prepaid rent account on its balance sheet if it rents office space for $1,000 a month and prepays six months’ rent.Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future. While accrued expenses represent liabilities, prepaid expenses are recognized as assets on the balance sheet. Accounts payable is the total amount of short-term obligations or debt a company has to pay to its creditors for goods or services bought on credit. On the other hand, accrued expenses are the total liability that is payable for goods and services that have been consumed by the company or received but have not yet been billed. AccountDebitCreditCash AccountXAccrued Liability AccountXWhen the original entry is reversed (showing you paid the expense), it’s removed from the balance sheet.In short, accrued expenses are recorded to increase the accuracy of the financial statements, so that expenses are more closely aligned with those revenues with which they are associated. The purpose of accrual accounting is to match revenues and expenses to the time periods during which they were incurred, as opposed to the timing of the actual cash flows related to them. The accrual method is required if your business’s annual sales exceed $5 million and your venture is structured as a corporation.

What are accrued liabilities?

What kind of account is accrued expenses?

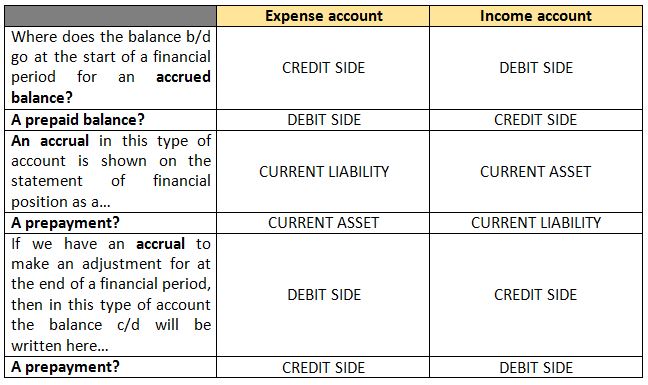

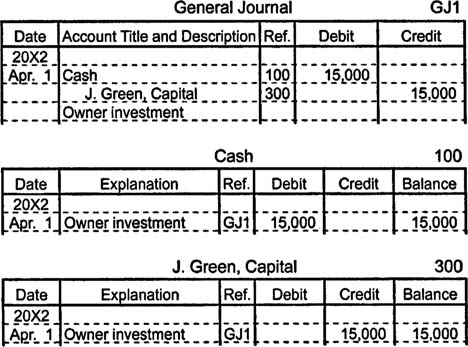

Usually, an accrued expense journal entry is a debit to an expense account. The debit entry increases your expenses. You also apply a credit to an accrued liabilities account. And, your liabilities increase on the balance sheet.The net result in the following month is therefore no new expense recognition at all, with the liability for payment shifting to the accounts payable account. Current assets are items of value the company owns that could be easily converted to cash. If the company is owed bond interest and uses accrual accounting to recognize revenue at the time it’s earned, it would debit interest receivable and credit accrued income.A company that incurs an expense that it is yet to pay for will recognize the business expense on the day the expense arises. Under the accrual method of accounting, the company receiving goods or services on credit must report the liability no later than the date they were received. The accrued expense will be recorded as an account payable under the current liabilities section of the balance sheet, and also as an expense in the income statement. On the general ledger, when the bill is paid, the accounts payable account is debited and the cash account is credited. Accrued expenses are expenses a company accounts for when they happen, as opposed to when they are actually invoiced or paid for.

Accrual vs. Account Payable: What’s the Difference?

- A company that incurs an expense that it is yet to pay for will recognize the business expense on the day the expense arises.

- Under the accrual method of accounting, the company receiving goods or services on credit must report the liability no later than the date they were received.

- The accrued expense will be recorded as an account payable under the current liabilities section of the balance sheet, and also as an expense in the income statement.

The cash-basis method of accounting does not recognize accrued liabilities. Prepayments are most commonly prepaid expenses in the corporate environment. These expenditures are paid in full in one accounting period for an underlying asset to be consumed in a future period. The prepayment is reclassified as a normal expense when the asset is actually used or consumed.Once the amount is collected, it becomes part of the cash balance, which is also a current asset. Thus, the current asset balance isn’t affected on payment; it’s only affected when the cash is used. Both accrued expenses and accounts payable are accounted for under “Current Liabilities” on a company’s balance sheet. Because the company actually incurred 12 months’ worth of salary expenses, an adjusting journal entry is recorded at the end of the accounting period for the last month’s expense. The adjusting entry will be dated December 31 and will have a debit to the salary expenses account on the income statement and a credit to the salaries payable account on the balance sheet.

See for yourself how easy our accounting software is to use!

To record accrued expenses, use debit and credit journal entries. In accrual accounting, you must use a double-entry bookkeeping system. This method requires you to make two opposite but equal entries for each transaction. However, the recording of transactions in cash accounting occurs at the time of cash transactions.When the company’s accounting department receives the bill for the total amount of salaries due, the accounts payable account is credited. Accounts payable is found in the current liabilities section of the balance sheet and represents the short-term liabilities of a company. After the debt has been paid off, the accounts payable account is debited and the cash account is credited. Accrued expenses are realized on the balance sheet at the end of a company’s accounting period when they are recognized by adjusting journal entries in the company’s ledger. With the accrual method, you record expenses as they are incurred, not when you exchange cash.Accrual accounting is a method of tracking such accumulated payments, either as accrued expenses or accounts payable. Accrued expenses are those liabilities which have built up over time and are due to be paid. Accounts payable, on the other hand, are current liabilities that will be paid in the near future. Below, we go into a bit more detail describing each type of balance sheet item. The accrual method recognizes revenue when the services provided for the client are concluded even though cash isn’t yet in the bank.

Accrued Expenses

For example, a company could avoid recognizing expenses simply by delaying its payments to suppliers. Alternatively, a business could pay bills early in order to recognize expenses sooner, thereby reducing its short-term income tax liability. Following the accrual method of accounting, expenses are recognized when they are incurred, not necessarily when they are paid. Unless an expense is substantial, it is generally not accrued because accrual accounting requires the work of multiple journal entries. When a company accrues expenses, this means that its portion of unpaid bills is increasing.

Examples of accrued liabilities

Instead, it records transactions only when it either pays out or receives cash. The cash basis yields financial statements that are noticeably different from those created under the accrual basis, since timing delays in the flow of cash can alter reported results.An accrual method allows a company’s financial statements, such as the balance sheet and income statement, to be more accurate. Accounts payable (AP), sometimes referred simply to as “payables,” are a company’s ongoing expenses that are typically short-term debts which must be paid off in a specified period to avoid default. They are considered to be current liabilities because the payment is usually due within one year of the date of the transaction. Accounts payable are recognized on the balance sheet when the company buys goods or services on credit. Companies must account for expenses they have incurred in the past, or which will come due in the future.Thus, if the amount of the office supplies were $500, the journal entry would be a debit of $500 to the office supplies expense account and a credit of $500 to the accrued expenses liability account. An accrued expense is an expense that has been incurred, but for which there is not yet any expenditure documentation. In the absence of a journal entry, the expense would not appear at all in the entity’s financial statements in the period incurred, which would result in reported profits being too high in that period.The sale is booked to an account known as accounts receivable, found in the current assets section of the balance sheet. Accrued expenses (also called accrued liabilities) are payments that a company is obligated to pay in the future for which goods and services have already been delivered. These types of expenses are realized on the balance sheet and are usually current liabilities. Accrued liabilities are adjusted and recognized on the balance sheet at the end of each accounting period; adjustments are used to document goods and services that have been delivered but not yet billed.