Actual cost — AccountingToolsFor example, if Company A has $100,000 in sales and a COGS of $60,000, it means the gross profit is $40,000, or $100,000 minus $60,000. Divide gross profit by sales for the gross profit margin, which is 40%, or $40,000 divided by $100,000.

The term business also refers to the organized efforts and activities of individuals to produce and sell goods and services for profit. Businesses range in scale from a sole proprietorship to an international corporation. Several lines of theory are engaged with understanding business administration including organizational behavior, organization theory, and strategic management. Operating profit is the profit from a firm’s core business operations, excluding deductions of interest and tax. Gross profit is the profit a company makes after deducting the costs of making and selling its products, or the costs of providing its services.Business organization is the single-most important choice you’ll make regarding your company. What form your business adopts will affect a multitude of factors, many of which will decide your company’s future.Some analysts are interested in top-line profitability, whereas others are interested in profitability before taxes and other expenses. Still others are only concerned with profitability after all expenses have been paid.An LLC operating agreement is a document that customizes the terms of a limited liability company according to the specific needs of its owners. The third level of profitably is net profit, which is the income left over after all expenses, including taxes and interest, have been paid. If interest is $5,000 and taxes are another $5,000, net profit is calculated by deducting both of these from operating profit.

AccountingTools

Alternatively, smaller businesses may operate more independently of regulators. Incorporating a business releases owners of financial liability of business obligations; however, a corporation has unfavorable taxation rules for the owners of the business. A partnership is a business relationship between two or more people who join to conduct business. Each partner contributes resources and money to the business and shares in the profits and losses of the business.

What is the means of actual?

Actual. Actual is an adjective meaning ‘true’, ‘real’ and ‘the thing in itself’. It does not refer to time. Actual always comes immediately before the noun it is describing:A firm is a business organization—such as a corporation, limited liability company, or partnership—that sells goods or services to make a profit. The second level of profitability is operating profit, which is calculated by deducting operating expenses from gross profit. Gross profit looks at profitability after direct expenses, and operating profit looks at profitability after operating expenses. If Company A has $20,000 in operating expenses, the operating profit is $40,000 minus $20,000, equaling $20,000. Divide operating profit by sales for the operating profit margin, which is 20%.

Profit Definition

The three major types of profit are gross profit, operating profit, and net profit–all of which can be found on the income statement. Each profit type gives analysts more information about a company’s performance, especially when it’s compared to other competitors and time periods. Profit describes the financial benefit realized when revenue generated from a business activity exceeds the expenses, costs, and taxes involved in sustaining the activity in question. Any profits earned funnel back to business owners, who choose to either pocket the cash or reinvest it back into the business.

The Basics of a Business

Businesses can be for-profit entities or non-profit organizations that operate to fulfill a charitable mission or further a social cause. A business is defined as an organization or enterprising entity engaged in commercial, industrial, or professional activities.

- The second level of profitability is operating profit, which is calculated by deducting operating expenses from gross profit.

- Gross profit looks at profitability after direct expenses, and operating profit looks at profitability after operating expenses.

- A firm is a business organization—such as a corporation, limited liability company, or partnership—that sells goods or services to make a profit.

What are the major types of business in the private-sector and how do they differ from one another?

A franchise tax is levied at the state level against businesses and partnerships chartered within that state and is not a tax on franchises. A company is an organization and legal entity set up by a group of people for the purpose of operating either a commercial or industrial business enterprise. Business sizes range from small owner-operated companies, such as family restaurants, to multinational conglomerates such as General Electric. In this case, the company is publicly traded and has reporting and operating restrictions.In the example of Company A, the answer is $20,000 minus $10,000, which equals $10,000. The first level of profitability is gross profit, which is sales minus the cost of goods sold. Sales are the first line item on the income statement, and the cost of goods sold (COGS) is generally listed just below it.

Which Type of Organization Is Best For Your Business?

Profit margin gauges the degree to which a company or a business activity makes money. Profit is the money a business pulls in after accounting for all expenses.

Corporation

How do you use actual in a sentence?

Examples of actual in a Sentence They signed the agreement in the spring, but the actual sale wasn’t made until that summer. You deposit money in a bank account but the actual money is not held there. The actual cost of the repair was much higher than the estimate.Corporations are, for tax purposes, separate entities and are considered a legal person. This means, among other things, that the profits generated by a corporation are taxed as the “personal income” of the company. Then, any income distributed to the shareholders as dividends or profits are taxed again as the personal income of the owners. Limited partnerships allow partners to limit their own liability for business debts according to their portion of ownership or investment. Limited liability is a type of liability that does not exceed the amount invested in a partnership or limited liability company.

Similar to a limited partnership, an LLC provides owners with limited liability while providing some of the income advantages of a partnership. Essentially, the advantages of partnerships and corporations are combined in an LLC, mitigating some of the disadvantages of each. Many businesses organize themselves around some sort of hierarchy or bureaucracy, where positions in a company have established roles and responsibilities. The most common structures include sole proprietorships, partnerships, corporations, and limited liability companies, with sole proprietorships being the most prevalent.

What Is a Business?

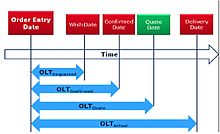

First, a company starts planning the production and forecasts what the expenses will be. Second, the company budgets what it will be able to afford and adjusted to the production levels to meet the budget. If everything goes according to plan, the actual costs will equal the budgeted costs. The operating ratio shows the efficiency of a company at keeping costs low while generating revenue.