allowance for doubtful accounts definition and meaning

Understanding the Allowance For Doubtful Accounts

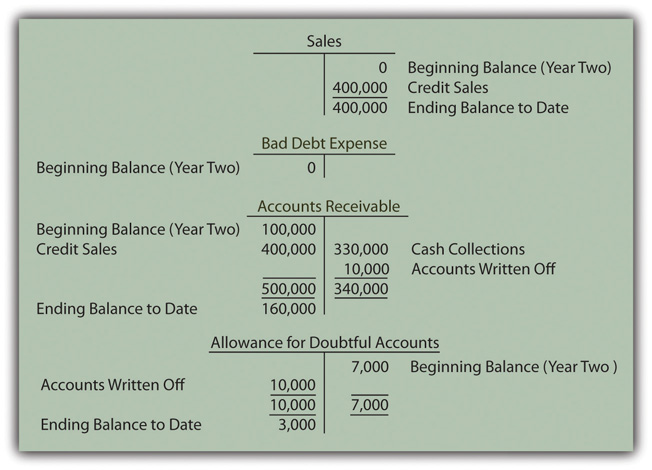

When we look at the account’s receivable, we meet the final two criteria pretty easily. There was a past transaction, there was a sale and it is under my control. I have the legal right to pursue payment to that in case somebody tries not to pay me. The question becomes, what about the probable future economic benefit? At the end of 2015 they have a $900,000 balance in their accounts receivable, that is people owe them $900,000 that they haven’t paid them yet.So we’re going to have to reduce that asset with the $2,000 credit, how do we get that entry to balance? Well, we’re going to debit our allowance for uncollectible accounts by $2,000. If you think about what we’ve done here, we’ve just decreased the asset and its counter asset by exactly the same amount. The other thing I want you to notice is there’s no impact on the income statement here.We got our balance sheet right, we figured out it’s about $885,000 of probable future economic benefit. And then we reflected on our income statement an amount that was needed in order to get that balance sheet to the correct amount. This might be a little clearer to you if we go ahead and look at the next year for this company. They’ve already collected on $9,900,000 of these credit sales and so there’s $1,000,000 left in their balance.They’ve gone into bankruptcy and our attorneys tell us there’s really no way to collect that amount. Well, now we would look at our accounts receivable and say, even though legally we were owed $1 million, we know we’re not going to collect $2,000 of that.

Accounts Receivable Aging Method

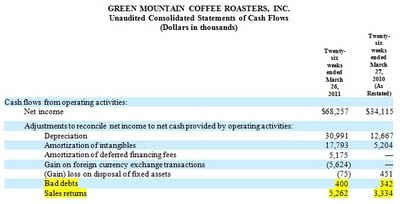

And the related bad debt expense because of the fact that they’re not going to get this value. Well, generally the way to go about this would be to start with something we call the aging of the accounts. That’s where you take all the accounts and you break them down into categories based on how far past due are they. You can see in this example, a large portion of our accounts are actually current, people aren’t supposed to have paid us yet.For example, maybe that 90 day passed due amount is a disputed amount where the client’s saying, you didn’t actually send me what I asked for, or the items you sent me weren’t of high enough quality. Maybe in some situations, we have some sense that, just in general, the geographic area of the country that the client’s doing business in isn’t doing great.Our income statement’s going to reflect that $6,000 of additional loss this period because of bad debt expense. At this point, we have all of our financial statements correct based on these expectations. And there’s only one issue still hanging out there, which is what do we do once we figure out actually who’s not going to pay us? Remember, that $21,000 was based on expectations where we thought about the general market, as well as some specific knowledge we had. Let’s imagine that, at the beginning of the next period, January 5th, say, of 2017, we find out that Jones, Inc is not going to pay us $2,000 that they owe us.

The allowance for doubtful accounts

And then the income statement is just whatever has to happen in order to get our balance sheet correct. Well, we’d report $979,000 of net accounts receivable, that’s the expected collections, not what’s actually due to us of the million, but we are expect we’re going to collect in this situation.

Allowance for doubtful accounts at a glance

- In this video, we’re going to talk about a related item, which is accounts receivable.

- You often receive accounts receivable in return for whatever it is you’ve given up to create revenue.

- Welcome, in the last couple of videos we’ve discussed revenue recognition and how to handle that from an accountant standpoint.

We can add in all the activity from this period, our $10,000,000 of sales, our $9,900,000 of collections, which gets us to our ending balance of $1,000,000. Now the question becomes, how big of an allowance for uncollectible accounts do we need to have related to that $1,000,000?Now, when we put together our balance sheet to provide to outsiders, what we’re going to show is a net accounts receivable of $885,000. Of course, when you look at that, you ask yourself, well, where did that $15,000 go then that I now say I’m not going to collect? Well, we’re going to show that on the income statement as something we call bad debt expense. That reflects the cost of having done business during this period and not being able to collect on some of the things that our customers owe us.The macro environment might have changed, because it’s our second year in business, we may just have better sense of what’s going to be normal in our accounts. You can see here that we upped our estimate to 1% of our current not being collected. And we’ve changed some of our other estimates as well, in particular, our over 90 days amount.And when we do this through each of our age categories and add it all up, we’ve determined there’s about $15,000 that we think we may not collect. So if you put this together with the $900,000 that we’re owed, the amount that we actually expect to collect, that is our probable future economic benefit is $885,000. Based on our definition of asset, that’s the amount that should show up on our balance sheet to tell people this is the value we actually think that we have.Welcome, in the last couple of videos we’ve discussed revenue recognition and how to handle that from an accountant standpoint. In this video, we’re going to talk about a related item, which is accounts receivable. You often receive accounts receivable in return for whatever it is you’ve given up to create revenue. Now, before we get into the details of accounts receivable, it’s probably worthwhile to review our definition of an asset from quite a few videos ago. The first is a probable future economic benefit, under my control and it comes from a past transaction.

How should investors interpret accounts receivable information on a company’s balance sheet?

The remaining accounts, most of them are only 1 to 30 days past due, which is not all that uncommon that people don’t quite pay an invoice on time, but we do have about $10,000 that’s over 90 days late. You’d go through all of these accounts, and you’d look at not only how far past due they are, but what do I know about them?We already have our accounts receivable on our T account, and now we’ve created this contra asset. We call it a contra asset because it offsets the asset off accounts receivable. We’re going to call this contra asset our allowance for uncollectible accounts. That’s that $15,000 that represents our estimate that of the $900,000 there’s about $15,000 we’re not going to be able to collect in the long run.We’ll try to combine these more general terms along with our specific knowledge to come up with some estimate of amounts we’re not going to collect. We don’t know exactly which of those people won’t pay us, but our estimate is that some portion of them won’t.

Learn About Allowance for Doubtful Accounts to Improve Revenue Predictions

When we add all of this up, we’ve now increased our allowance for doubtful accounts to $21,000. So when we put that amount up to $21,000, we know that we’re going to have to credit our contra asset allowance for uncollectible accounts for $6,000. Well, just like last time, our income statement reflects the fact that we’ve now lost $6,000 more value in expectation. Again, notice that we got our balance sheet right, and our income statement was just whatever it needed to be. So this is really taken this balance sheet sort of perspective of let’s get that probable future economic benefit that meets the definition of an asset right.

What is allowance for doubtful accounts?

And then what’s the reflected bad debit expense that we’re going to have to incur in order to get us to that balance? Now, we’re just going to do the same process we did before, we’re going to go ahead and age the accounts. We have new information now, though, we might know something specifically about some of the customers.