Establishing an allowance for doubtful accounts is super important for your financial stability. The actual payment behavior of customers, or lack thereof, can differ from management estimates, but management’s predictions should improve over time as more data is collected. The allowance for doubtful accounts is then used to approximate the percentage of “uncollectible” accounts receivable (A/R).

- Management may disclose its method of estimating the allowance for doubtful accounts in its notes to the financial statements.

- Also known as “bad debts,” these outstanding accounts typically originate from credit sales that are never settled by customers.

- It can also show you where you may need to make necessary adjustments (e.g., change who you extend credit to).

Say it has $10,000 in unpaid invoices that are 90 days past due—its allowance for doubtful accounts for those invoices would be $2,500, or $10,000 x 25%. It’s important to note that an allowance for doubtful accounts is simply an informed guess and your customers’ payment behaviours may not exactly align. This could mean more customers fail to pay and you wind up with more uncollectible accounts, or you might have overestimated your allowance for doubtful accounts.

Direct Write-Off Method

A company can further adjust the balance by following the entry under the “Adjusting the Allowance” section above. Note that the debit to the allowance for doubtful accounts reduces the balance in this account because contra assets have a natural credit balance. Also, note that when writing off the specific account, no income statement accounts are used. This is because the expense was already taken when creating or adjusting the allowance.

If you use the accrual basis of accounting, you will record doubtful accounts in the same accounting period as the original credit sale. This will help present a more realistic picture of the accounts receivable amounts you expect to collect, versus what goes under the allowance for doubtful accounts. Also known as “bad debts,” these outstanding accounts typically originate from credit sales that are never settled by customers.

How Can Allianz Trade help the number of doubtful accounts?

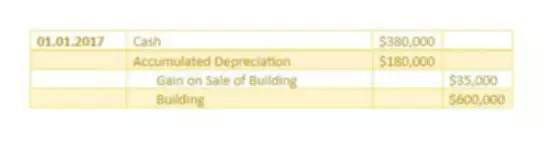

When an invoice is written off, a journal entry must be made, with a debit to bad debt expense and a credit to allowance for doubtful accounts. Then, the company establishes the allowance by crediting an allowance account often called ‘Allowance for Doubtful Accounts’. Though this allowance for doubtful accounts is presented on the balance sheet with other assets, it is a contra asset that reduces the balance of total assets. The accounts receivable aging method is a report that lists unpaid customer invoices by date ranges and applies a rate of default to each date range. Well, rather than waiting for customers to default and hit you with unexpected financial hiccups, businesses prepare in advance.

This amount allows your organization to plan for uncollectible debts that impact your bottom line and budget. The AFDA helps accountants estimate the amount of bad debt that is expected to be uncollectable and adjusts the accounts receivables balance accordingly. This ensures that the company’s financial statement accurately reflects its overall financial health. Use the percentage of bad debts you had in the previous accounting period to help determine your bad debt reserve. Basically, your bad debt is the money you thought you would receive but didn’t.

Learn All About Allowance for Doubtful Accounts (Aka Bad Debt Reserve)

Instead of applying percentages or weights, it may simply aggregate the account balance for all 11 customers and use that figure as the allowance amount. Companies often have a specific method of identifying the companies that it wants to include and the companies it wants to exclude. The allowance can accumulate across accounting periods and may be adjusted based on the balance in the account.

Allowance for doubtful accounts FAQ

They create a cushion known as a “bad debt reserve.” This financial safety net ensures that even if some customers don’t pay up, it won’t disrupt their operations. While collecting all the money you’re owed is the best-case scenario, small business owners know that things don’t always go as planned. Estimating invoices you won’t be able to collect will help you prepare more accurate financial statements and better understand important metrics like cash flow, working capital, and net income. By monitoring customer payment behavior, we can provide insights into customer delinquency trends to help you determine which customers are at greater risk of defaulting on their payments. This, in turn, will allow you to adjust your allowance for doubtful accounts accordingly. If there is a large, unexpected default, you can rest assured that we will pay the claim, effectively eliminating what could have been a devastating bad debt loss.

Your allowance for doubtful accounts estimation for the two aging periods would be $550 ($300 + $250). In the ever-evolving landscape of modern business, agility and efficiency are paramount. Manual processes, while once the norm, can now be a bottleneck leading to missed opportunities and increased risks. This is where automation comes into play, emerging as the ultimate solution to transform your operations and supercharge your collections strategy.

To learn more about how we can help your business grow, contact one of our sales agents by filling out the form below. Access and download collection of free Templates to help power your productivity and performance.