Amortization schedule — AccountingTools

Amortization in Action

Each time you make a payment on a loan you pay some interest along with a part of the principal. The principal is the original loan amount, or the balance that you must pay off. By making regular periodic payments, the principal gradually decreases, and when it reaches zero, you’ve completely paid off your debt.For example, after exactly 30 years (or 360 monthly payments) you’ll pay off a 30-year mortgage. The function helps calculate the total payment (principal and interest) required to settle a loan or an investment with a fixed interest rate over a specific time period. The payment scheme of a fixed-interest mortgage is determined on the day that the loan terms are finalized. The interest rate is applied, the amount of interest applicable is added to the amount of the loan and a total balance is noted. With this information, a loan officer can give you a table listing every payment due over the life of the loan, including interest and principal amounts.

Amortization schedule

Credit cards, on the other hand, are generally not amortized. They are an example of revolving debt, where the outstanding balance can be carried month-to-month, and the amount repaid each month can be varied.Examples of other loans that aren’t amortized include interest-only loans and balloon loans. The former includes an interest-only period of payment and the latter has a large principal payment at loan maturity. Other types of loans—specificallyvariable rate loansandlines of credit—are harder to calculate with an amortization table. Amortized loans are designed to completely pay off the loan balance over a set amount of time. Your last loan payment will pay off the final amount remaining on your debt.Loan amortization provides borrowers with a clear and consistent picture of how much they will be repaying during each repayment cycle. Borrowers will have a fixed repayment schedule over the repayment period of the loan. Payments will be made in regular installments in a set amount that consists of both principal and interest.

Using Amortization Tables

For example, the payment on the above scenario will remain $733.76 regardless of whether the outstanding (unpaid) principal balance is $100,000 or $50,000. Besides considering the monthly payment, you should consider the term of the loan (the number of years required to pay it off if you make regular payments). The longer you stretch out the loan, the more interest you’ll end up paying in the end. Usually you must make a trade-off between the monthly payment and the total amount of interest.

Loans That Don’t Get Amortized

What are two types of amortization?

Amortization = (Bond Issue Price – Face Value) / Bond Term Simply divide the $3,000 discount by the number of reporting periods. For an annual reporting of a five-year bond, this would be five. If you calculate it monthly, divide the discount by 60 months. The amortized cost would be $600 per year, or $50 per month.If a loan is amortized over a period of time on an installment plan, the rates are fixed each month so it may only make a difference in the interest paid if you pay off the loan early. The early payoff will eliminate future interest charges that would have been incurred on the unpaid balance. You have to know what the interest rate is, how long the loan term is for, and the amount being borrowed.A portion of each payment is for interest while the remaining amount is applied towards the principal balance. The percentage of interest versus principal in each payment is determined in an amortization schedule. The schedule differentiates the portion of payment that belongs to interest expense from the portion used to close the gap of a discount or premium from the principal after each payment. The formulas used for amortization calculation can be kind of confusing. So, let’s first start by describing amortization, in simple terms, as the process of reducing the value of an asset or the balance of a loan by a periodic amount .

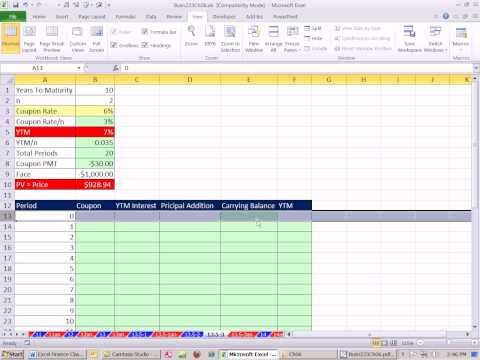

How do you calculate an amortization table?

Most types of installment loans are amortizing loans. For example, auto loans, home equity loans, personal loans, and traditional fixed-rate mortgages are all amortizing loans. Interest-only loans, loans with a balloon payment, and loans that permit negative amortization are not amortizing loans.

- Unamortized loans are more straight-forward since you know each monthly payment is only going towards interest.

- This makes it easier to calculate the actual cost of the loan.

- The trade-off for lower interest-only payments is that towards the end of the repayment period, you will have a balloon payment that will go towards principal.

Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance, which varies for each pay period. An amortization schedule helps indicate the specific amount that will be paid towards each, along with the interest and principal paid to date, and the remaining principal balance after each pay period. Amortization is the process of spreading out a loan into a series of fixed payments over time. You’ll be paying off the loan’s interest and principal in different amounts each month, although your total payment remains equal each period.This most commonly happens with monthly loan payments, but amortization is an accounting term that can apply to other types of balances, such as allocating certain costs over the lifetime of an intangible asset. Amortization also refers to the repayment of a loan principal over the loan period. In this case, amortization means dividing the loan amount into payments until it is paid off. You record each payment as an expense, not the entire cost of the loan at once.

Paying Off a Loan Over Time

In the example below, payment 1 allocates about 80-90% of the total payment towards interest and only $67.09 (or 10-20%) toward the principal balance. The exact percentage allocated towards payment of the principal depends on the interest rate. Not until payment 257 or over two thirds through the term does the payment allocation towards principal and interest even out and subsequently tip the majority toward the former.Unamortized loans are more straight-forward since you know each monthly payment is only going towards interest. This makes it easier to calculate the actual cost of the loan. The trade-off for lower interest-only payments is that towards the end of the repayment period, you will have a balloon payment that will go towards principal.

Sample Amortization Schedule

An amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator. Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments.

Types of Amortizing Loans

Make sure to use the monthly interest rate when calculating. Using the formula above, put in the amount being borrowed in the P variable, the monthly interest rate in the r variable, and the amount of total months the loan will be amortized for in the n variable. This schedule is quite useful for properly recording the interest and principal components of a loan payment. An amortization schedule (sometimes called amortization table) is a table detailing each periodic payment on an amortizing loan.Planning ahead is crucial to ensure that you don’t become delinquent given the change in payment amount. One thing to be aware of is that the amount of your monthly payments can be quite high because you will be paying both principal and interest. Another drawback to amortized loans is that many consumers aren’t aware of the true cost of the loan. While the monthly payment of a loan may seem to fit in your budget, you should always calculate the total amount in interest that you will pay to determine the actual cost of taking out the loan.Common examples of amortized loans include student loans, car loans and home mortgages. There are a few crucial points worth noting when mortgaging a home with an amortized loan. First, there is substantial disparate allocation of the monthly payments toward the interest, especially during the first 18 years of a 30-year mortgage.