ARB definition and meaningRecommendations by the American Institute of Certified Public Accountants on how accountants ought to treat certain facts or items. While Accounting Research Bulletins are not authoritative in themselves, the SEC often makes them so by adopting them. Accounting research bulletin is a publication containing accounting practices recommended by the American Institute of Certified Public Accountants.

ARB definition

The Accounting Research Bulletins were discontinued after 1959 as the Committee of Accounting Procedure was dissolved under a recommendation from the Special Committee on Research Program. Accounting Principles Board replaced the Committee of Accounting Procedures and in later years it got replaced by the Financial Accounting Standards Board (FASB). Accounting Research Bulletins are the documents issued Committee on Accounting Procedure (CAP), which was part of the American Institute of Certified Public Accountants (AICPA). These documents were issued between 1938 and 1959 in an effort to rationalize the general accounting practice.The CAP issued three ARBs in 1939, the first of which included rules that had been recommended in 1933 to the New York Stock Exchange. The CAP would issue 51 ARBs during its existence, several of which survive in today’s FASB’s Codification, and four Accounting Terminology Bulletins. FASB issued Statement no. 151 , Inventory Costs ( /st/index.shtml ), an amendment of Accounting Research Bulletin (ARB) no. 43, chapter 4.The Committee on Accounting Procedure was the first private sector organization tasked with setting accounting standards in the United States. It was run by the American Institute of Accountants, now known as the American Institute of Certified Public Accountants. The Accounting Research Bulletins were not binding rules in themselves; they were more like explanations of the existing rules.

Accounting Research Bulletin (ARB) definition

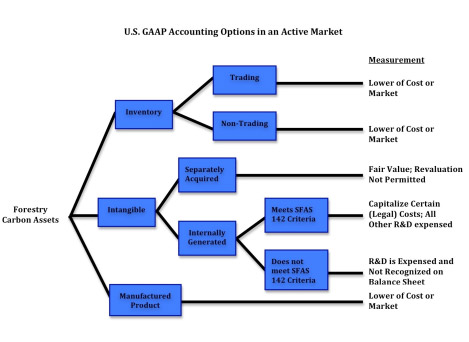

They were and are part of the generally accepted accounting principles unless superseded by pronouncements of the APB or FASB. International Accounting Standards are an older set of standards that were replaced by International Financial Reporting Standards (IFRS) in 2001. Statements of Financial Accounting Standards were published by the Financial Accounting Standards Board to provide guidance on specific accounting topics. FASB Accounting Standards Codification governs the preparation of corporate financial reports and is recognized as authoritative by the Securities and Exchange Commission (SEC), which regulates American stock exchanges.

The Common Concepts and Techniques of Managerial Accounting Defined

Although the Bulletins were not binding on American Institute of CPAs members, the Securities and Exchange Commission typically required their use by corporations under their jurisdiction. The Bulletins were issued by the committee on accounting procedure of the AICPA. The Committee was replaced by the accounting principles board (APB) in 1959.They can be found in the Accounting Standards Codification, which became effective after September 2009, and which is the single source of U.S. Another influential publication was An Introduction to Corporate Accounting Standards, published in 1940 by the American Accounting Association. That work enshrined the concepts of matching costs and revenues, and that accounting is not a process of valuing assets and liabilities, but the allocation of historical costs and revenues to periods. That was music to the SEC’s ears, which had struggled with asset appraisal write-ups. However, cost-based accounting would wane decades later when mark-to-market valuations gained favor.

Accounting Research Bulletin (ARB)

- It was run by the American Institute of Accountants, now known as the American Institute of Certified Public Accountants.

- The Accounting Research Bulletins were not binding rules in themselves; they were more like explanations of the existing rules.

- The Committee on Accounting Procedure was the first private sector organization tasked with setting accounting standards in the United States.

The CAP was replaced by the Accounting Principles Board, which in turn was later replaced by the Financial Accounting Standards Board. All of the accounting positions in the bulletins have since been superseded, but some of the text in the bulletins has been integrated into the successor accounting standards, which are part of Generally Accepted Accounting Principles (GAAP). The best known of the accounting research bulletins was ARB No. 43, which aggregated the information found in the earlier bulletins. Accounting Research Bulletins were documents issued by the Committee on Accounting Procedure between 1938 and 1959 on various accounting problems.They were discontinued with the dissolution of the Committee in 1959 under a recommendation from the Special Committee on Research Program. In all, 17 bulletins were issued; however, the lack of binding authority over AICPA’s membership reduced the influence of, and compliance with the content of the bulletins. The Accounting Research Bulletins have all been superseded by the Accounting Standards Codification (ASC). These pronouncements were issued by the Committee on Accounting Procedures of the American Institute of Certified Public Accountants during the years 1953 to 1959.

Understanding Accounting Research Bulletins (ARB)

The guidance is effective for inventory costs incurred during fiscal years beginning after June 15, 2005, but earlier application is permitted for costs incurred during fiscal years beginning after November 23, 2004. Today in the United States, the corporate financial reports are required to follow the rules of Accounting Standards Codification. This codification is recognized by the Securities and Exchange Commission (SEC) as authoritative guidelines. The Accounting Research Bulletins were superseded by the Accounting Standards Codification (ASC) which became effective after September 2009. However, some of its points have been integrated into Generally Accepted Accounting Principles (GAAP).

Grasp the Accounting of Private Equity Funds

The AIA’s 1938 Statement of Accounting Principles, authored by three academicians, was intended to be a survey and statement of best practices. Thomas Sanders, one of its authors, would become part-time research director for the CAP.In 1949, the CAP reconsidered developing a framework but instead codified and updated its first 42 ARBs. The CAP was criticized for its piecemeal, “firefighting” approach to setting standards and its failure to reduce the number of alternative accounting procedures. A two-thirds majority vote by the CAP was necessary to issue an Accounting Research Bulletin (ARB).While the Bulletins were not binding on American Institute of CPAs members, the Securities and Exchange Commission (SEC) typically required their use by corporations under their jurisdiction. The CAP decided early on that formulating a statement of broad principles would take too long and instead approached issues on a case-by-case basis. Without a framework and often without adequate research, the CAP relied on the members’ collective experience for agreement on member-suggested solutions.

What Are the Objectives of Financial Accounting?

Several relatively contemporaneous publications would aid and influence both the CAP and the SEC. The first was an American Institute of Accountants (AIA) 1936 statement Examination of Financial Statements by Independent Public Accountants, dealing with some accounting principles, though oriented primarily to auditing.Accounting Research Bulletins are issuances of the Committee on Accounting Procedure (CAP), which was part of the American Institute of Certified Public Accountants (AICPA). The bulletins were issued during the 1953 to 1959 time period, and were an early effort to rationalize the general practice of accounting as it existed at that time. The Statement of Financial Accounting Concepts is issued by the Financial Accounting Standards Board (FASB) and covers financial reporting concepts.