22.04.2020 by Harry Vance

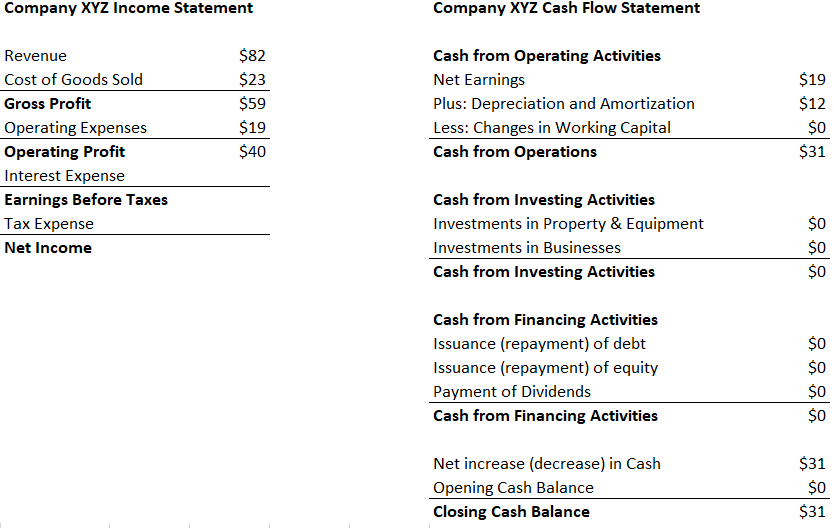

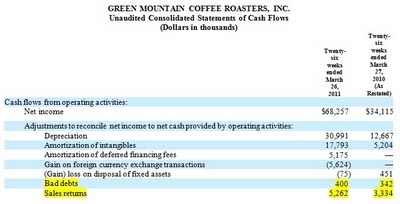

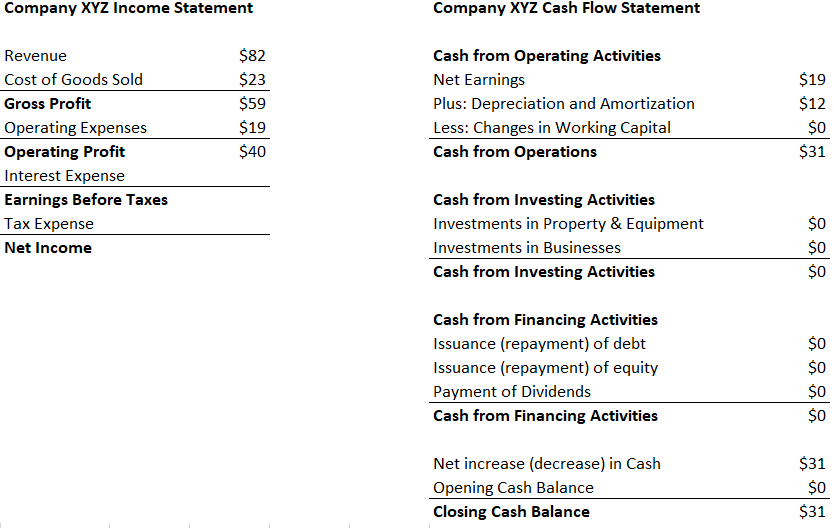

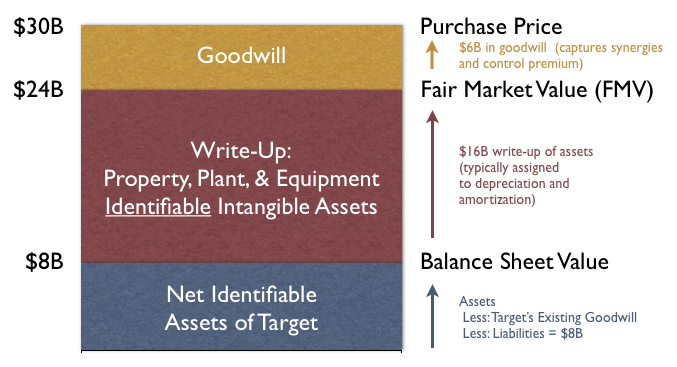

How Does Amortization Impact Interest Rates?Amortization expense is an income statement account affecting profit and loss. The offsetting entry is a balance sheet account, accumulated amortization, which is a contra account that nets against the amor... Read more

22.04.2020 by Harry Vance

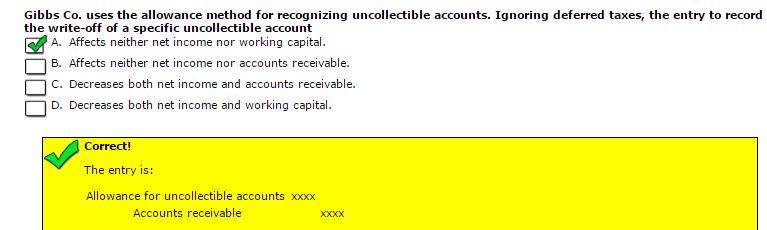

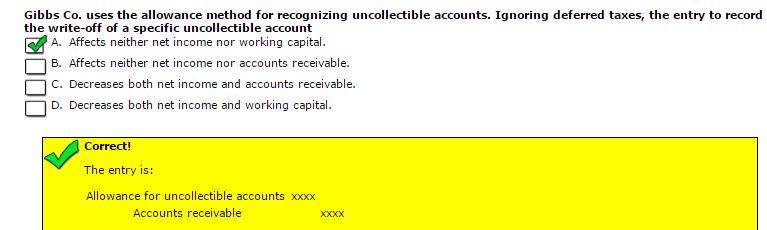

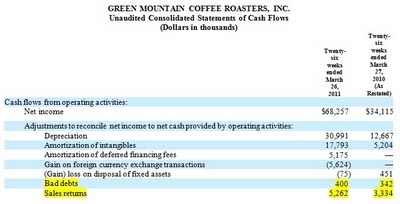

Allowance For Doubtful Accounts DefinitionRegardless of which percentage is used, either percentage would probably result in a reasonable estimate of uncollectible accounts receivable. Using the 1.70% estimate, the Nicholas Corporation would prepare... Read more

21.04.2020 by Harry Vance

allowance for doubtful accounts definition and meaningUnderstanding the Allowance For Doubtful AccountsWhen we look at the account's receivable, we meet the final two criteria pretty easily. There was a past transaction, there was a sale and it is un... Read more

21.04.2020 by Harry Vance

The Difference Between Contingent and Primary BeneficiariesYou can name more than one primary beneficiary and more than one contingent beneficiary—you're not limited to one of each. You can allocate percentages for each beneficiary, specifying what p... Read more

21.04.2020 by Harry Vance

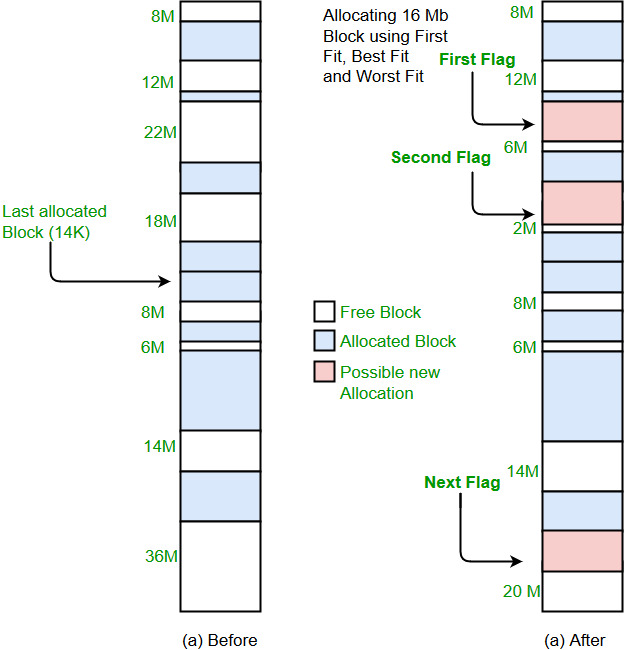

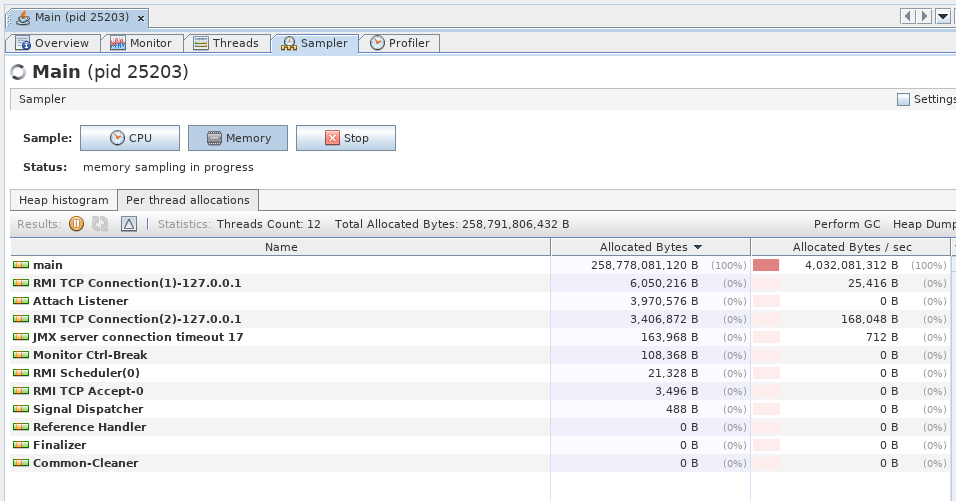

Direct allocation method — AccountingToolsOne of the most commonly tracked allocation rates is the allocation rate paid to a 401(k)from an employee’s paycheck. In many employee benefit plans, the employer will match the employee’s allocation rate up... Read more

21.04.2020 by Harry Vance

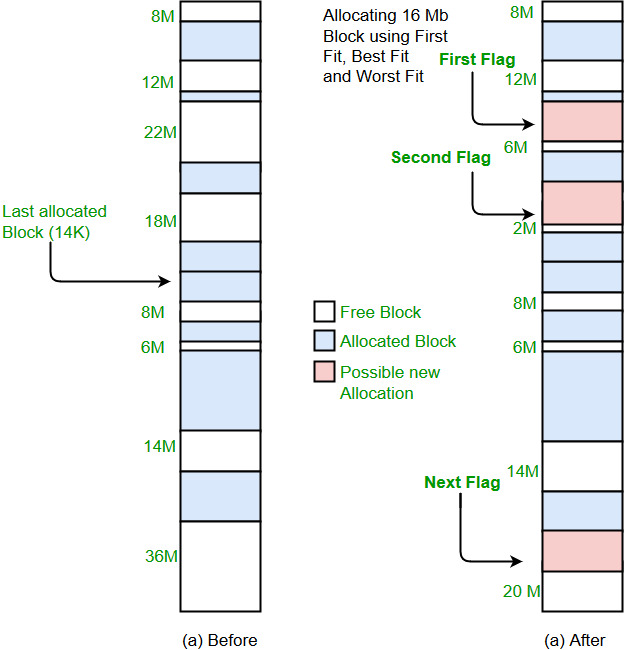

AllocateMeaning of allocate in EnglishMost basic administrative paperwork and errands fit into this category. You can see where your resources are allocated across a calendar that is color-coded to note whether they’re on- or off-task, on vacation or... Read more

20.04.2020 by Harry Vance

Frequently Asked Questions About the AICPACareer GuidanceThe CPA designation is granted by individual state boards, not the American Institute of Certified Public Accountants (AICPA). To become a full member of AICPA, the applicant must hold a valid... Read more

20.04.2020 by Harry Vance

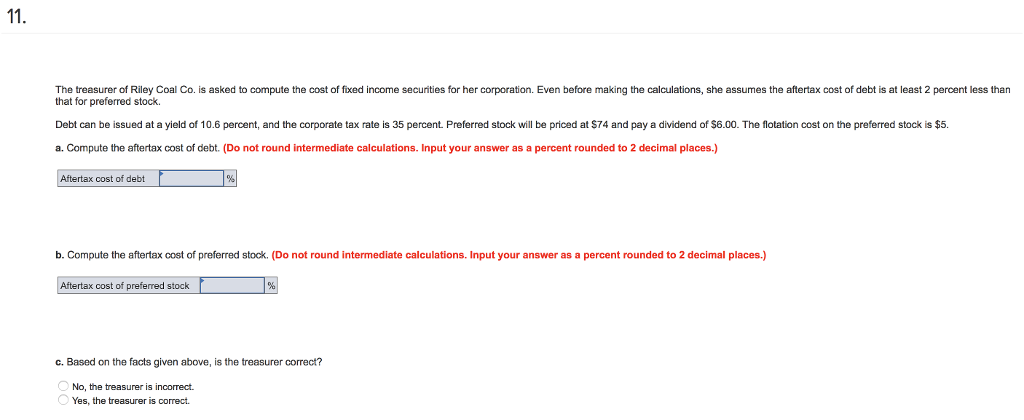

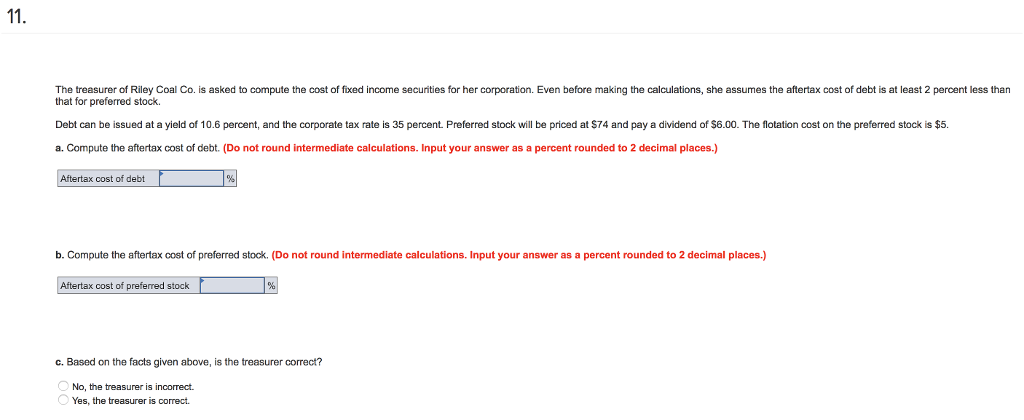

Cost of DebtA company's cost of debt is the effective interest rate a company pays on its debt obligations, including bonds, mortgages, and any other forms of debt the company may have. Because interest expense is deductible, it's generally more usef... Read more

20.04.2020 by Harry Vance

Solved: Should I 0 or 1 on a Form W4 for Tax Withholding AHow to Calculate Your Investment ReturnThe after-tax real rate of return is the actual financial benefit of an investment after accounting for the effects of inflation and taxes. It is a more... Read more

17.04.2020 by Harry Vance

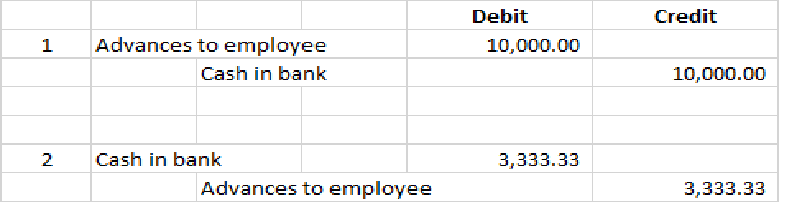

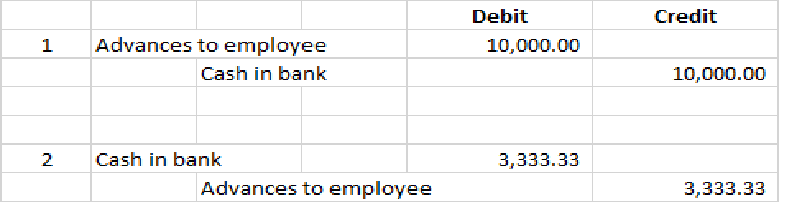

All About Advance Payments In Tally ERP 9Further, if such taxable perquisite value is not reported in the I-T returns, the I-T department may levy penalty ranging from 50% to 200% of the tax payable on the under-reported income,” Gupta further told T... Read more