Book of prime entry

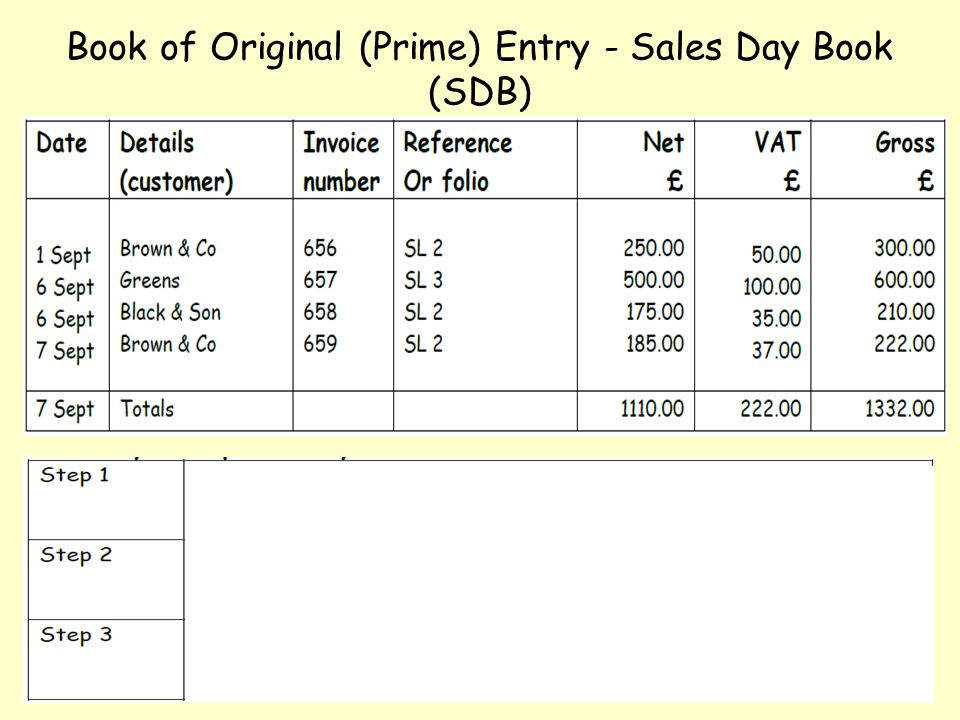

Books of original entry

Which is the book of original entry in accounting?

Books of original entry refers to the accounting journals in which business transactions are initially recorded. The information in these books is then summarized and posted into a general ledger, from which financial statements are produced.Because the business has accumulated more assets, a debit to the asset account for the cost of the purchase ($250,000) will be made. To account for the credit purchase, a credit entry of $250,000 will be made to notes payable. The debit entry increases the asset balance and the credit entry increases the notes payable liability balance by the same amount. For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets and the loan liability will also rise by an equivalent amount. If a business buys raw material by paying cash, it will lead to an increase in the inventory (asset) while reducing cash capital (another asset).

Which of the followings is not a book of original entry?

Credits do the opposite — decrease assets and expenses and increase liability and equity. Cash needs to be increased by $450 and accounts receivable needs to be reduced by $450.The correcting entry journal entry will debit cash by $450 and credit accounts receivable by $450 (debits increase amounts, credits reduce them). A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. In this system, only a single notation is made of a transaction; it is usually an entry in a check book or cash journal, indicating the receipt or expenditure of cash.A single entry system is only designed to produce an income statement. The total amount of debits must equal the total amount of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software. Hence, a ledger is known as the book of secondary entry or final entry, as they are posted from the Journal and the balances of these accounts are used to prepare the financial statements of the business.

Accounting Notes

If you find you have an unbalanced trial balance, in other words, the debits don’t equal the credits; then you have an error in the accounting process. List every open ledger account on your chart of accounts by account number. The account number should be the four-digit number assigned to the account when you set up the chart of accounts.

Commerce-Reliable Series-11th-Book-keeping & Accountancy-Chp 6

You should also remember that they have to balance, meaning that if a debit is added to an account, then a credit is added to another account. To keep debits and credits in balance, keep a ledger with credits on one side and debits on the other. Then, use the ledger to calculate the ending balance and update your balance sheet. Debits increase asset or expense accounts and decrease liability or equity.There is no upper limit to the number of accounts involved in a transaction – but the minimum is no less than two accounts. Thus, the use of debits and credits in a two-column transaction recording format is the most essential of all controls over accounting accuracy. If you fail to make a journal entry or record a financial transaction in an incorrect account, it will not show up as an error in the trial balance. Numbers transposed in the debit column instead of in the credit column, also will not show up in the trial balance.

Accounting Errors and Corrections

Equity is what’s left after subtracting all assets, and liability is how much is owed to other parties. Understanding debits and credits is essential for bookkeeping and analysis of balance sheets. Whenever an accounting transaction happens, a minimum of two accounts is always impacted, with a debit entry being recorded against one account and a credit entry being recorded against another account. There is no upper limit to the number of accounts involved in a transaction but the minimum cannot be less than two accounts. The net effect of these accounting entries is the same in terms of quantity.

- If the debits and credits do not equal, then there is an error in the general ledger accounts.

- For each open ledger account, total your debits and credits for the accounting period for which you are running the trial balance.

- Record the totals for each account in the appropriate column.

For each open ledger account, total your debits and credits for the accounting period for which you are running the trial balance. Record the totals for each account in the appropriate column. If the debits and credits do not equal, then there is an error in the general ledger accounts. Run a trial balance on a regular basis, at least monthly; it helps you identify any problems quickly and fix them as soon as they arise. Preparing the trial balance should be tied to the billing cycle of the company.Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. Business transactions are events that have a monetary impact on the financial statements of an organization. When accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right. To understand debits and credits, know that debits are expenses and losses and that credits are incomes and gains.There are other standard techniques to track down an error in a trial balance. If the debits and credits do not equal, see if the number 2 divides equally into the difference. If it does, look for an account, look for an account incorrectly in the column with the larger total that equals half the difference.

How do you make a book of original entry?

Cash transactions are recorded in cash book with brief narration and not in journal, because cash book is also considered as a book of original entry. The transactions appearing in the cash book are directly posted to their relevant ledger accounts.

Book of original entries is also known as ______.

Further, any failure to post an accounting journal entry to the journal ledger will not show up. The trial balance is the next step in the accounting cycle. It is the first step in the “end of the accounting period” process. Debits and credits are essential to the double entry system. In accounting, a debit refers to an entry on the left side of an account ledger, and credit refers to an entry on the right side of an account ledger.

Errors Which do not Affect the Trial Balance

Generally speaking, debit means “increase,” so a non-failing business should have a positive cash account (or debit). If a cash account is credited to the point of becoming negative, this means the account is overdrawn. A general ledger is a standard way of recording debits and credits for a particular account. Equity and liability are two other essential terms to know for understanding debits and credits.

List your total debits and credits from each general ledger account. The columns should be the account number, account name, debit, and credit. To account for the credit purchase, entries must be made in their respective accounting ledgers.To be in balance, the total of debits and credits for a transaction must be equal. Debits do not always equate to increases and credits do not always equate to decreases. Bank cash book is a multi-column ledger prepared by operating level offices of the government of Nepal to maintain the record of cash & banking transaction under AGF No. 5. It is a statement, which keeps the record of cash receipts and payments made through the bank.A trial balance is prepared to ascertain whether the posting made in the bank cash book is correct or not. The totals of the debits and credits for any transaction must always equal each other so that an accounting transaction is always said to be in balance. Thus, the use of debits and credits in a two column transaction recording format is the most essential of all controls over accounting accuracy.In the double-entry system, transactions are recorded in terms of debits and credits. Since a debit in one account offsets a credit in another, the sum of all debits must equal the sum of all credits. The double-entry system of bookkeeping or accounting makes it easier to prepare accurate financial statements and detect errors. Whenever an accounting transaction is created, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry being recorded against the other account.It is a book prepared by operating level offices for recording their banking transactions. It maintains the record of cash receipt and cash payment which are made either in cash or through cheque. The bank cash book is based on the principle of the double-entry system. It keeps the record of every financial transaction affecting its debit and credit account.