Cash Basis Accounting: Explain Examples, Contrast With AccrualThe cash method is simple in that the business’s books are kept based on the actual flow of cash in and out of the business. Income is recorded when it’s received, and expenses are reported when they’re actually paid. The cash method is used by many sole proprietors and businesses with no inventory. From a tax standpoint, it’s sometimes advantageous for a new business to use the cash method of accounting.If a business chose to track purchases and sales using cash basis accounting, it would lead to huge gaps between inventory accounting and the reported revenues and expense. Generally, a small business can use either the overall cash method of accounting or an overall accrual method of accounting. Under the cash method (which is typically simpler than the accrual method), a taxpayer can defer income until cash is received; conversely, it must wait to deduct expenses until the amounts are paid.

What does cash mean in accounting?

cash definition. A current asset account which includes currency, coins, checking accounts, and undeposited checks received from customers. The amounts must be unrestricted. (Restricted cash should be recorded in a different account.)

Cash Accounting

Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned, regardless of when the money is actually received or paid. For example, you would record revenue when a project is complete, rather than when you get paid.However, you only record income and expenses when money is received and paid, like in cash-basis accounting. Accrual basis accounting applies the matching principle – matching revenue with expenses in the time period in which the revenue was earned and the expenses actually occurred. This is more complex than cash basis accounting but provides a significantly better view of what is going on in your company. There are also tax consequences for businesses that adopt the cash accounting method of recognizing cash inflows and outflows.

The difference between cash and accrual

One can choose to use either the accrual basis or cash basis of accounting when initially setting up the accounting system for an LLC. Under the accrual basis, revenue is recognized when earned and expenses when incurred. Under the cash basis, revenue is recognized when cash is received and expenses when bills are paid. The accrual basis involves more complex accounting, but results in more accurate financial statements.

Cash accounting

Each offers different viewpoints into your company’s financial wellbeing. Accrual basis accounting achieves a more accurate measurement of a business’s periodic net income because it attempts to match revenues and expenses related to the same accounting period.If a business has inventory, the IRS usually requires the accrual basis accounting for recording it. There are, however, certain exceptions when businesses with inventory can used cash basis accounting. EXECUTIVE SUMMARY THE IRS RELEASED REVENUE PROCEDURE and revenue procedure to give small businesses some much needed guidance on choosing or changing their accounting method for tax purposes. REVENUE PROCEDURE ALLOWS ANY COMPANY —sole proprietorship, partnership, S or C corporation—that meets the sales test to use the cash method of accounting for tax purposes. If a company’s average revenue for the last three years is less than $1 million, the cash method is allowed but not required.

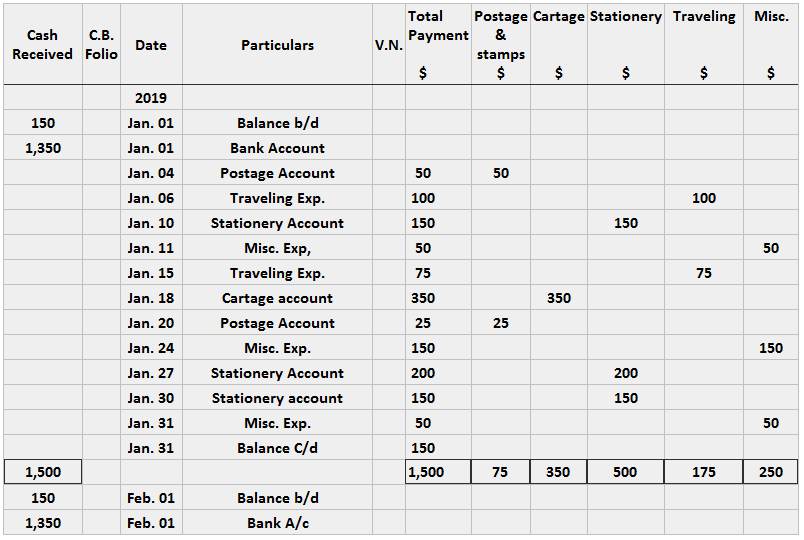

Imagine you perform the following transactions in a month of business:

- The cash method is used by many sole proprietors and businesses with no inventory.

- Income is recorded when it’s received, and expenses are reported when they’re actually paid.

- The cash method is simple in that the business’s books are kept based on the actual flow of cash in and out of the business.

The overall cash method of accounting is available for S corporations, partnerships that do not have a C corporation as a partner, and personal service corporations (PSCs). C corporations and partnerships with a C corporation as a partner can use the cash method if their average annual gross receipts for the prior three tax years are less than $5 million. For a group of C corporations that files a consolidated return, the gross receipts of all the corporations in the group are aggregated for the $5 million test.

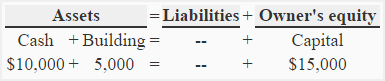

What Are the Objectives of Financial Accounting?

That way, recording income can be put off until the next tax year, while expenses are counted right away. At the start and end of every tax year, businesses have to account for inventory.In general, businesses can only deduct expenses that are recognized within the tax year. The choice of revenue/expense recognition method can determine which year a business can deduct its expenses. Likewise, a company that receives payment from a client in 2018 for services rendered in 2017 will only be allowed to include the revenue in its financial statements for 2018. The disadvantage of the cash basis accounting is that it can paint an inaccurate picture of the business’s financial health and growth. This is because the related expenses may be recognized in a different period than the revenues.The cash basis is relatively easy to use, and so is preferred when the accounting staff is small and less well trained. Modified cash-basis accounting is a hybrid between accrual and cash-basis accounting. It has more accounts than the cash-basis method because it uses the accounts used in accrual.

What is an example of cash accounting?

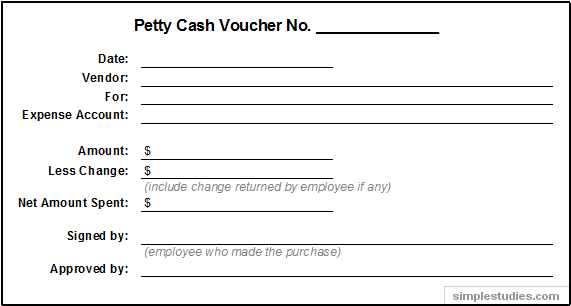

Cash accounting. May 07, 2018. Cash accounting is an accounting methodology under which revenue is recognized when cash is received, and expenses are recognized when cash is paid. For example, a company bills a customer $10,000 for services rendered on October 15, and receives payment on November 15.Cash-basis accounting is the simplest accounting method available. In cash-basis accounting, you record income when you physically receive it and expenses when you physically pay it. You only use cash accounts, meaning you do not deal with accounts like Accounts Receivable, Accounts Payable, or any long-term liability accounts. Deciding between cash basis accounting and accrual basis accounting can be a difficult decision when you are first starting your business.

Analyze Cash Flow the Easy Way

Cash accounting is an accounting method in which payment receipts are recorded during the period they are received, and expenses are recorded in the period in which they are actually paid. In other words, revenues and expenses are recorded when cash is received and paid, respectively. Like other areas of tax, accounting methods can be complex and burdensome for many small business taxpayers. Fortunately, there are several simplifying conventions and accounting methods tailored to smaller business entities, including C corporations, partnerships, and S corporations. Using these simplified methods can sometimes result in tax savings and streamline the tax return preparation process and recordkeeping requirements.From 6 April 2017, the cash basis also becomes the default accounting basis for unincorporated businesses with rental income of £150,000 or less. Such businesses can still use the accrual basis if they prefer – but will need to elect to do so. You also can’t use cash-basis accounting if you report inventory on hand at the end of the year. Some exceptions are made for sole proprietors and very small businesses. The IRS regulates accounting methods to prevent falsely represented income on business tax returns.

Limitations of Cash Accounting

The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid. This method does not recognize accounts receivable or accounts payable. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your accounts. Cash accounting recognizes revenue and expenses only when money changes hands, but accrual accounting recognizes revenue when it’s earned, and expenses when they’re billed (but not paid).