Cash receipt — AccountingToolsAn additional posting must be made to balancing the transaction. Therefore, a credit is needed for one or more other accounts that are affected by collecting cash. The cash receipts journal is an important tool to keep track of cash collected by a business. In accounting, journals are used to record similar activities and to keep transactions organized.

How to Account for Cash Receipts

Compare this amount to the sum of the individual customer accounts receivable ledgers. This will help you discover any errors in your customer statements before you mail them out. Your accounting software should notify you of discrepancies automatically. You must maintain an accounts receivable ledger account for each customer you extend credit to. Post your sales invoice charges from the sales and cash receipts journal to the customer ledgers at the end of each day.

Nearby words of

cash receipt

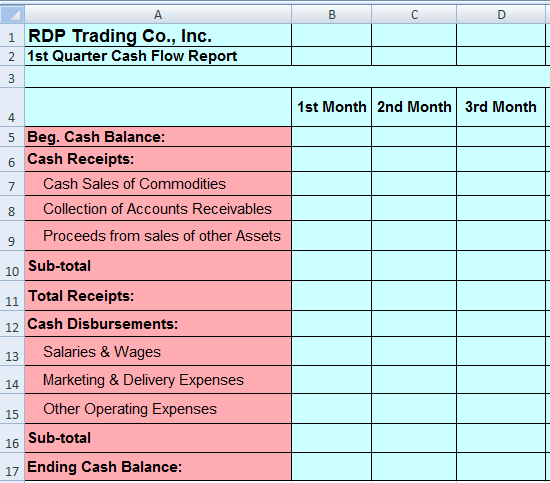

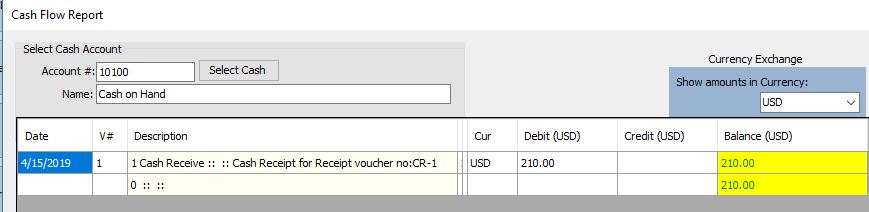

The first column that is posted to the General Ledger is the bank column of the Cash Receipts Journal. Because Cash is an asset, and assets increase on the debit side, you will post the Total Receipts amount to the Bank Account of the General Ledger on the Debit side. Notice how the folio number CRJ1 (Cash Receipt Journal page 1) is entered. This tells the reader where to go to see the details of the Total Receipts for the month. The above image is the Cash Receipts Journal for Johnson Mechanics (an example business).

Cash Receipts

You will notice that I totaled the Bank, Current Income and Sundry Accounts columns. So, the first step is to total the columns of the Cash Receipts Journal. This column is only used to show the amount of cash the business has on hand before it is banked. The beginning accounts receivable total, plus charge sales for the month, minus payments on account for the month, should equal the ending accounts receivable total.

Deposit The Cash

Entries made in the sales and cash receipts journal are also totaled at the end of the month, and the results are posted to the accounts receivable account in your general ledger. If they aren’t the same, you can tell that you made an error somewhere along the line.Referred to as the “one-write” system, this time-saver also reduces the chance of posting errors. Cash, checks, debit cards, credit cards and wire transfers are treated as cash sales. When your customer pays for a purchase in cash or with a check, the sale is complete. You do not have to bill your customer or worry about collecting overdue amounts. If you extend store credit, your customer may drop off a cash payment or send in a check to pay the invoice amount.You typically have many cash receipts during the day for toy, books and candy. You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day. At the close of business today, you are ready to review your day’s business and make the appropriate entries in your accounting records.

Basic Accounting

How do you Journalize a cash receipt?

Cash sales are reported in the sales journal as a credit and the cash receipts journal as a debit.

- Entries made in the sales and cash receipts journal are also totaled at the end of the month, and the results are posted to the accounts receivable account in your general ledger.

- Referred to as the “one-write” system, this time-saver also reduces the chance of posting errors.

- If they aren’t the same, you can tell that you made an error somewhere along the line.

The totals of the Cash Receipts Journal are entered into the General Ledger using the last day of the month. The Sundry Accounts are entered into the General Ledger using the date that the transaction took place.There are numerous reasons why a business might record transactions using a cash book instead of a cash account. Mistakes can be detected easily through verification, and entries are kept up-to-date since the balance is verified daily. With cash accounts, balances are commonly reconciled at the end of the month after the issuance of the monthly bank statement.

Preparing a Bank Reconciliation

For example, a $500 cash sale is a $500 debit in the cash receipts journal and a $500 credit in the sales journal. Sometimes, customers pay with a combination of cash and in-store credit. For example, a customer buys $2,000 of merchandise with a $500 cash payment and uses store credit for the remaining $1,500. You make a $500 debit entry in the cash receipts journal, a $1,500 debit entry in the customer’s accounts receivable account and a $2,000 credit entry to sales.

Are cash receipts debit or credit?

A cash receipt is a printed statement of the amount of cash received in a cash sale transaction. A copy of this receipt is given to the customer, while another copy is retained for accounting purposes. The amount of cash received. The payment method (such as by cash or check)Also, whether you use a cash register or a separate cash receipts book, be sure to post cash receipts on account to the appropriate ledgers at the end of the day. Of course, your software should be able to take care of this automatically. Cash sales are reported in the sales journal as a credit and the cash receipts journal as a debit.Because accounting transactions always need to remain in balance, there must be an opposite transaction when the cash is posted. When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed. Each day, the credit sales recorded in the sales and cash receipts journal are posted to the appropriate customer’s accounts in the accounts receivable ledger. This allows you to know not only the total amount owed to you by all credit customers, but also the total amount owed by eachcustomer.

Make The Sales Entry

You record the cash payment in the cash receipts journal, then enter the cash transaction in the sales journal or in the customer’s accounts receivable ledger account. In a cash receipts journal, there are debit and credit entries.A cash receipts journal is used to record all cash receipts of the business. All cash received by a business should be reported in the accounting records. In a cash receipts journal, a debit is posted to cash in the amount of money received.Let’s say you own a cute little toy store and have many regular customers. In fact, you have a few customers who come in several times a week to buy books or toys from your store. You allow those customers to keep a running tab, and they pay you once a month.