change in net assets definition and meaningNonprofits are required to report expenses by functional classification – program, management and general, and fundraising. In addition, health and welfare organizations are required to include a statement of functional expenses as part of their financial statements. Functional reporting provides a tool used to determine if the nonprofit is using its resources efficiently. This should make that method more appealing because it reduces the complexity in preparing the statement, as well as its overall length.The change in net assets results from revenues, expenses, and the release of assets from restrictions. It is computed for an organization’s three classes of net assets as well as for total net assets during the period appearing in the heading of the statement of activities. While the basic information contained in each type of entity’s financial statements is the same, the terminology used is different.

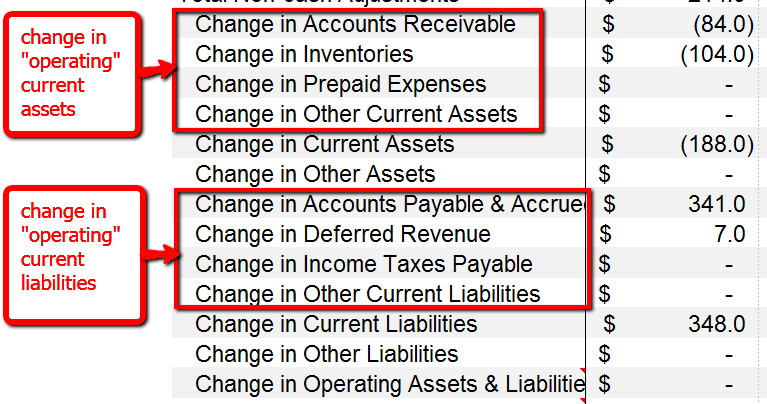

Calculating the change in assets of a company

Universities, museums, and religious organizations had previously reported by fund types, whereas hospitals and trade associations had focused on the consolidated entity. The newly released not-for-profit reporting standard retains the current approach, focusing on the organization as a whole and providing a uniform reporting format across varying industries in the nonprofit sector. Unrestricted net assets, also known as the operating reserve, represent the cumulative earnings over the life of the organization. A positive operating reserve allows an organization to pay its current obligations and fund future programs or projects through use of unrestricted net assets.A nonprofit statement of financial position shows assets, liabilities and net assets. A for profit income statement shows revenues less expenses, which equals net income (or loss).

New Classes Simplify Reporting

Cash received on investments would be displayed among investing activities and cash paid for interest among financing. This would improve comparability with public-sector nonprofits, such as government hospitals and public universities, whose cash flows are similarly classified.Whatever their source, they contribute to the overall financial health of the organization as part of its unrestricted net assets. Many associate nonprofits with not making a profit, but in fact it is important that organizations have a positive change in net assets, more specifically a positive change in unrestricted net assets. This, combined with two key financial ratios, help determine the financial health of any nonprofit organization.Nonprofit organizations use finances to communicate with donors, creditors and their boards of directors. Financial reporting shares information regarding the firm’s ability to manage its funds and use the money to support the organization’s mission. Donors want to see that the organization uses its money to plan activities that benefit the recipients. The board of directors wants to see that the organization’s leaders are managing their resources.

Investment Return and Change in Net Assets

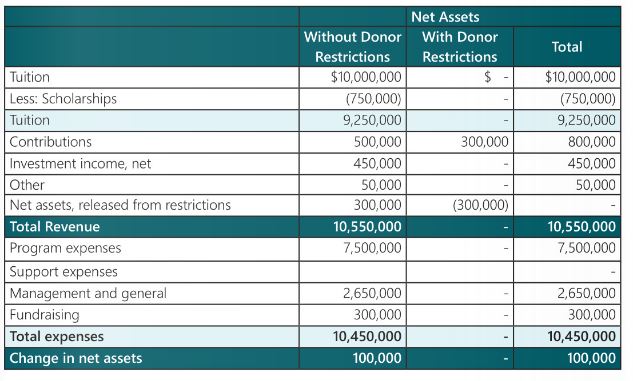

Changes in net assets without donor restrictions shows whether an organization operated with a gain or a loss. Which items from the original exposure draft were left out of ASU , potentially to come in the future? The exposure draft called for requiring the direct method of reporting cash flows from operations and eliminating the reconciliation of cash flows from operating activities with the statement of activity. The recently issued standard still permits the indirect method, though it did eliminate the reconciliation when the direct method is used.The Statement of Activities and Changes in Net Assets shares information regarding the organization’s revenues, expenses and net assets. The changes required in ASU , on the other hand, simplify financial statements and improve disclosures, particularly in the area of liquidity management. In implementing the new requirements, not-for-profit management should review expense allocation practices and review or, if necessary, adopt liquidity management policies. Auditors can help by providing recommendations that will facilitate the implementation process. Note that there is only a single restricted column in the statement of activities (Exhibit 1).

Nonprofit Net Assets and Balance Sheet Explained

- Donors want to see that the organization uses its money to plan activities that benefit the recipients.

- Financial reporting shares information regarding the firm’s ability to manage its funds and use the money to support the organization’s mission.

- Nonprofit organizations use finances to communicate with donors, creditors and their boards of directors.

Charities and other nonprofit organizations are known best for the charitable causes they serve, but increasingly, they are using strategies and techniques borrowed from the for-profit business world. It has become extremely important for charities to account for their assets and income in a way that their stakeholders can understand, and what’s known as the statement of activities and changes in net assets provides vital financial information. Below, you’ll learn more about this statement, and how you can use it to calculate the net assets that a nonprofit holds.Under current practice, resources may appear to be available for short-term cash needs, but in fact are not available to the organization because of donor-imposed limitations on their use. This requirement to disclose the not-for-profit’s liquidity management policy could provide the necessary incentive for some organizations to articulate and adopt such policies. After evaluating their needs, not-for-profit organizations might wish to take other actions, such as negotiating a line of credit as part of this liquidity management policy. (In most cases, this option is no longer permitted.) Contributions received for fixed-asset acquisitions will be recorded as net assets with donor restrictions.The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) , Presentation of Financial Statements of Not-for-Profit Entities on August 18, 2016. This new accounting standard is effective for fiscal years beginning after December 15, 2017. There are several financial reporting changes under this new accounting standard, but the one that I want to talk to you about and focus on is net asset classifications.Organizations may still choose to use the indirect or direct method of reporting cash flows, but if using the direct method, they are no longer required to reconcile the change in net assets to cash used in operating activities. For many companies, pension funds represent large, long-term liabilities and require complicated accrual accounting. Several common factors play into the complications of pension fund accounting, all of which will impact the Statement of Changes in Net Assets. These factors include the need to make estimates of the size of payments to future retirees and the value of investment returns from year to year.

Change in net assets

All expenses continue to be reported as unrestricted (without donor restrictions), and amounts are reported as net assets released from restriction as donor-imposed restrictions are satisfied. In addition, no distinction is made with respect to the permanence of donor-imposed restrictions in the net assets accounts on the statement of financial position (Exhibit 2). Previous FASB standards required nonprofits to separately report investment expenses; they can now report investment returns net of investment-related expenses. This change should make it easier for not-for-profits to report investment activities and provide greater comparability among organizations using internal and external investment managers. Recognizing net assets with donor restrictions on financial statements help decision makers be aware of obligations in the future.A nonprofit statement of activities shows revenues less expenses, which equals the change in net assets. The disclosures related to liquidity should particularly assist creditors, donors, and other users in assessing the near-term availability of (and requirements for) cash.

How to Calculate Net Assets in a Statement of Activities and Changes in Net Assets

Many organizations receive their unrestricted revenue through fee-for-service, ticket sales or membership income. Other sources of revenue include unrestricted grants/contributions and the release of temporarily restricted net assets through the satisfaction of donor or time restrictions.

GAAP For Non-Profits › General Reporting Matters

A bigger change would be in the reporting of cash flows from the purchase and sale of fixed assets; under the exposure draft, these would be reported as operating, rather than investing, activities. The change in net assets without donor restrictions indicates if an organization operated the most recent fiscal period at a financial gain or loss. This line is a direct connection with and should be equal to the bottom line of an organization’s income statement (also called a Statement of Activities or profit/loss statement). Let’s face it, not many people like change – especially when it comes to their daily routines and their jobs. I want to take a little time to discuss one of the changes that has affected nonprofit organizations recently.