Chief Executive Officer

CEO Salary

The board establishes corporate management policies and decides on big-picture corporate issues. Because the board is in charge of executive functions, and the CEO is responsible for integrating company policy into day-to-day operations, the CEO often fills the role of chairman of the board. Chief executive officers, or CEOs, lead and oversee their organization. CEO requirements include formal training and work experience, as well as important skills in areas like time-management, communication, problem-solving, and leadership.The CEO generally reports to the company’s board of directors, while the CFO reports to the CEO. As the chief financial officer, the CFO puts together the annual budgets of the company, analyzes financial data, and tracks expenses and revenues.

A CFO may be needed:

He holds the highest rank in the company and only reports to the board of directors. On the other hand, the CFO assumes the highest-ranked financial position in the company. The main focus of a CFO is the financial management of the business. The CEO is in charge of looking at the company’s “big picture” — overseeing all departments, from administration to sales. The CEO’s principal focus points include staying within the overall company budget, maintaining a strong position in the market and implementing decisions made by the company’s board of directors.

What is the difference between CEO and CFO?

Usually this degree is in a field related to business and leadership, such as business administration, management, or public administration. Bachelor’s degrees in business management usually take 4 years to complete, but some accelerated programs are available. The top of most management teams has at least a Chief Executive Officer (CEO), a Chief Financial Officer (CFO), and a Chief Operations Officer (COO). ne of the most important things a finance professional needs to know is what the company’s senior leadership expects from them. In this Q&A, we posed questions on this subject to Ravi Venkatesan, a well-known business leader in India and a UNICEF special representative for young people and innovation.

Is CEO higher than CFO?

The chief executive officer is the highest-ranking overall position in the entire company, while the chief financial officer is the highest-ranking financial position. While both essential positions in any company, there are major differences in the roles each one plays. The CFO reports directly to the CEO.

What is a CFO?

You also supervise cash management activities, execute capital-raising strategies to support a firm’s expansion, and deal with mergers and acquisitions. Most CFOs are also responsible for managing the corporate investments and will sit on the board. A CFO also serves as the company’s liaison between banks, investors, lenders and other financial institutions.

A chief executive officer (CEO) is the highest-ranking executive of a firm. CEOs act as the company’s public face and make major corporate decisions.In small businesses, the president might also be the owner of the company. In an organization or company where a CEO is already in charge, the president is the second in command. In general, the chief executive officer (CEO) is considered the highest ranking officer in a company, and the president is second in charge. However, in corporate governance and structure, many permutations can take place, so the roles of both CEO and president may be different, depending on the company. If you’re wondering what degree you need to be a CEO, chief executive officer education typically entails earning at least a bachelor’s degree.The number of years of management experience you will need depends on the size of the company and the extent of the duties involved. Many Chief Financial Officers have an MBA, a Masters or another type of advanced degree. Another position that will give you a real advantage at getting a CFO position later in life is working in the Corporate Treasury.In some corporations and organizations, the president is the leader of the company’s executive group. In the corporate world, however, the president often refers to someone who is the leader of a segment or critical part of the overall company, rather than the leader of the overall company.

- A CFO is a corporate executive job that’s responsible for the financial planning and record keeping of a company, as well as managing the financial risk.

- In general, businesses with less than $10 Million in yearly revenue do not have a real need for a CFO role.

- The CFO reports to the company’s higher management which usually includes the Chief Executive Officer (CEO).

The CFO may also sit on the board of directors, just like the CEO. The CEO assumes the main role of overseeing the operations of the entire company, from sales to administration.

CFO Job Description Template

At the top of the proverbial food chain, in the corporate world, is the chief executive officer (CEO). The CFO generally reports directly to the CEO and the board of directors. While CEOs manage general operations, CFOs focus specifically on financial matters. A CFO analyzes a company’s financial strengths and makes recommendations to improve financial weaknesses. The CFO also tracks cash flow and oversees a company’s financial planning, such as investments and capital structures.A CFO is a corporate executive job that’s responsible for the financial planning and record keeping of a company, as well as managing the financial risk. The CFO reports to the company’s higher management which usually includes the Chief Executive Officer (CEO). In general, businesses with less than $10 Million in yearly revenue do not have a real need for a CFO role.The treasurer of a company is responsible for cash management, managing interest and commodity risks as well as financial investments and banking contacts. These types of roles will only be present in the largest companies and will give you exposure to higher level financial interactions.

What is a CEO?

Having solid financial experience makes you more apt to make these judgments. Sometimes, especially at small companies, the same person serves as chief executive officer and chief financial officer, making this financial expertise even more crucial. Many CFOs begin their careers as finance professionals, accountants or managers of small divisions, and work their way up to senior positions within a company. The Chief Financial Officer directs a company’s financial goals, objectives, and budgets. If you work as a CFO, you oversee the investment of funds held by the company and assess and manage associated risks.Tasks for this job include reporting, accounting, budgeting and compliance. Getting a job in this type of position is a great option for preparing your career for a job as CFO.

CFO Requirements:

What is the difference between CEO and CFO?

There are significant differences between the roles of the chief executive officer (CEO) and the chief financial officer (CFO), which are as follows: The CEO is responsible for all activities within an organization, while the CFO is responsible solely for the financial side of the business. Reporting relationships.

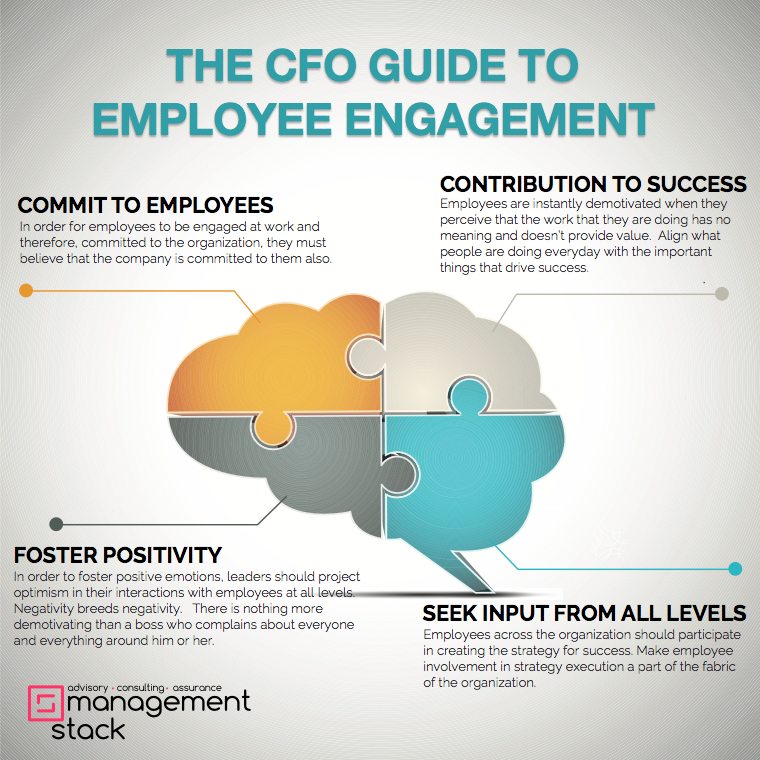

The CFO’s main responsibility is maintaining and improving a company’s financial health, and she works closely with the CEO to achieve this. A company’s controller is the chief accounting officer that heads up the accounting department. This is the stepping stone position above accountant or CPA that leads to becoming a CFO. This role requires a balance between managing a team of other people and understanding the financial details of the company.For a company to require a CFO they will usually be much larger and more well established. As a CFO, your job will be to ensure that the CEO and board’s decisions are financially sound, both in regard to resources available and regulatory compliance.