Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. There is no definitive answer to this question as the ideal debt to asset ratio varies depending on the industry a company is in. Debt to asset is a crucial tool to assess how much leverage the company has. This translates to how possibly a company can company survive and thrive for years to come. A highly leveraged company may suffer during financial difficulties such as recession or interest rates sudden rise.

- The debt to asset ratio indicates how much a company is leveraged and how likely it is to be able to repay its debts in the future.

- This often gives a company more flexibility, as companies can increase, decrease, pause, or cancel future dividend plans to shareholders.

- Its debt-to-equity ratio would therefore be $1.2 million divided by $800,000, or 1.5.

- The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022.

- Its goal is to calculate the total debt as a given percentage of the total amount of assets.

In addition, the debt ratio depends on accounting information which may construe or manipulate account balances as required for external reports. It’s also important to understand the size, industry, and goals of each company to interpret their total-debt-to-total-assets. Google is no longer a technology start-up; it is an established company with proven revenue models that is easier to attract investors.

Step 2. Debt to Asset Ratio Calculation Example

Acquisitions, sales, or changes in asset prices are just a few of the variables that might quickly affect the debt ratio. As a result, drawing conclusions purely based on historical debt ratios without taking into account future predictions may mislead analysts. As noted above, a company’s debt ratio is a measure of the extent of its financial leverage.

Investors and creditors are generally looking for companies that have less than 0.5 of the debt to asset ratio. To get a more comprehensive result, you can also compare the ratio in multiple periods to check for stability. Apple has a debt to asset ratio of 31.43, compared to an 11.47% for Microsoft, and a 2.57% for Tesla. All three of these ratios would generally be seen as low, leaving all three companies with ample room to increase their leverage in the future if they wish to do so.

It indicates how much debt is used to carry a firm’s assets, and how those assets might be used to service debt. As with most measurements, the debt to asset ratio is not without limitations. The most obvious flaw is that intangible assets aren’t included in the total assets. For example, intellectual property usually won’t appear (or will be improperly presented) on the balance sheet since it has no defined value.

How to Calculate Debt to Asset Ratio?

We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA). The key is to understand those limitations ahead of time, and do your own investigation so you know how best to interpret the ratio for the particular company you are analyzing. For example, a company might determine that ceasing to offer a particular product or service would be in their best long-term interest. The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022. Nevertheless, this particular financial comparison represents a global measurement that aims to assess a company as a whole.

It’s great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors. The financial health of a firm may not be accurately represented by comparing debt ratios across industries. Bear in mind how certain industries may necessitate higher debt ratios due to the initial investment needed. A debt ratio greater than 1.0 (100%) tells you that a company has more debt than assets. Meanwhile, a debt ratio of less than 100% indicates that a company has more assets than debt. Used in conjunction with other measures of financial health, the debt ratio can help investors determine a company’s risk level.

Essentially, it points out the way in which a company has grown and developed over time when it comes to acquiring assets. The results of the ratio directly correlate with the degree of risk the company is taking on. Among the company’s assets, if most of them are in the form of debts, it means that the company will most likely struggle to pay its debt off in time. This results from higher debts rather than equity, which is assets that a company truly owns.

Defining the debt to asset ratio

If the calculation yields a result greater than 1, this means the company is technically insolvent as it has more liabilities than all of its assets combined. A calculation of 0.5 (or 50%) means that 50% of the company’s assets are financed using debt (with the other half being financed through equity). The debt to asset ratio is calculated by dividing a company’s total debts by its total assets.

Total-Debt-to-Total-Assets Ratio: Meaning, Formula, and What’s Good

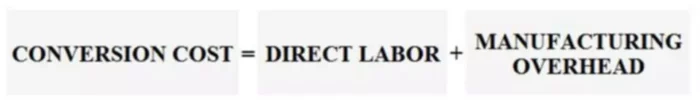

This ratio is sometimes expressed as a percentage (so multiplied by 100). The debt to asset ratio is a financial metric used to help understand the degree to which a company’s operations are funded by debt. It is one of many leverage ratios that may be used to understand a company’s capital structure.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. All else being equal, the lower the debt ratio, the more likely the company will continue operating and remain solvent. Let’s look at a few examples from different industries to contextualize the debt ratio.

What Happens if a Ratio is Too High, or Too Low?

Common debt ratios include debt-to-equity, debt-to-assets, long-term debt-to-assets, and leverage and gearing ratios. In the consumer lending and mortgage business, two common debt ratios used to assess a borrower’s ability to repay a loan or mortgage are the gross debt service ratio and the total debt service ratio. A debt ratio of 30% may be too high for an industry with volatile cash flows, in which most businesses take on little debt. A company with a high debt ratio relative to its peers would probably find it expensive to borrow and could find itself in a crunch if circumstances change. Conversely, a debt level of 40% may be easily manageable for a company in a sector such as utilities, where cash flows are stable and higher debt ratios are the norm.