The work of the accounting department of any company is not only limited to storing data about the company’s property and finances. The accounting law requires documentation of each accounting transaction. To comply with the law and generate accounting reports of various complexity as accurately as possible and with minimal costs, more and more entrepreneurs are turning to account programs. For example, it is possible to use Freshbooks.

Freshbooks benefits

First of all, the term online accounting requires some explanation. Now there are almost no accounting programs left in their pure form. The classic accounting system consists of the following components:

- chart of accounts;

- transaction log and order logs;

- general ledger;

- analytical account reports;

- balance sheet and financial reporting forms;

- cash register and bank.

Therefore, as a rule, all accounting programs, including Freshbooks, have additional modules: warehouse, sale of fixed assets, etc. When you enter primary documents in such systems as Freshbooks, most of the accounting operations are generated automatically. These are the benefits.

FreshBooks features

All modern accounting programs, including FreshBooks, are based on creating a document flow of the enterprise. While working with the program, the user enters the primary documents that are processed in the program. The result of this processing is formed business transactions, each of which is a set of accounting transactions. Thus, the main goal of automation of accounting tasks is to provide for the owners of Freshbooks login the following opportunities:

- automatic formation of business operations;

- convenient storage;

- analysis of accounting information.

More and more individual entrepreneurs and organizations prefer so-called online accounting. Unlike old programs, they do not require installation or updates. You can work in such systems from your computer, tablet, or even smartphone. It is enough to have Internet access. Besides, maintaining accounting records and storing data in online systems is not only convenient but also reliable. Anything can happen to your home or work computer, and your colleagues or children may have access to it. And if someone accidentally deletes a file – the entire year’s work can turn into a memory.

FreshBooks: how to login

To log in, you must load the program FreshBooks to your personal computer and then follow the instructions step by step. The process is simple and won’t take much time. Your data will be safely protected. The users of other online programs sometimes complain about the leaks of important information. This cannot happen with FreshBooks online accounting since providers use several server platforms where data is duplicated in real-time. If something happens to one server platform, your data will remain safe on the other, and you will probably not even know about the incident on the first one. Some services allow you to set up authorization by entering a one-time code from a free SMS, similar to Internet banks. Also, each time you log in to the program, you specify a username and password. The largest popularity in the market of online accounting has won the web service FreshBooks for professionals. The developer of this service is a large IT company specializing in creating software solutions for:

- electronic document management;

- accounting automation technologies;

- management of enterprises of all types.

The program allows you to easily and quickly maintain accounting, calculate employee salaries, and submit reports to regulatory authorities. Ideal for entrepreneurs and organizations on the “simplified,” “imputed,” and general taxation system.

Users Reviews on FreshBooks

There are several versions of the program, with different FreshBooks pricing, each designed for a specific user: The light version is suitable for individual entrepreneurs in special modes. It does not require accounting knowledge and allows you to generate and send reports via the Internet without involving an accountant. Besides, using the light version of FreshBooks allows you to manage the entire document flow (primary and incoming documents), work with money (payments for online banking, loading statements from online banking), and keep records of employees, their salaries, and contributions to funds. There are also additional features:

- checking contractors;

- own one-page mini-site on the Internet;

- tax calendar;

- notifications by e-mail and SMS about the need to report to government agencies or pay taxes.

The Pro version of the FreshBooks app is suitable for commercial organizations (LLC, CJSC, JSC) both in special modes and in the general taxation system. It allows you to generate accounting statements (balance sheet, profit, and loss statement), VAT Declaration, and income tax declaration. It contains a block with advanced salary calculation capabilities with employee reporting.

In the Pro version, you can also send prepared reports via the Internet. This version is aimed at accountants and managers who have a basic knowledge of accounting. Just like in the light version, there are useful additions in Freshbooks accounting:

- financial analysis;

- checking contractors;

- tax calendar;

- ready-made accounting policy template (a set of accounting methods accepted in the organization);

- easy transition from other programs (import data on employees, directories of goods (services) and contractors);

- hints with links to regulatory documents;

- reconciliation with the tax and pension Fund.

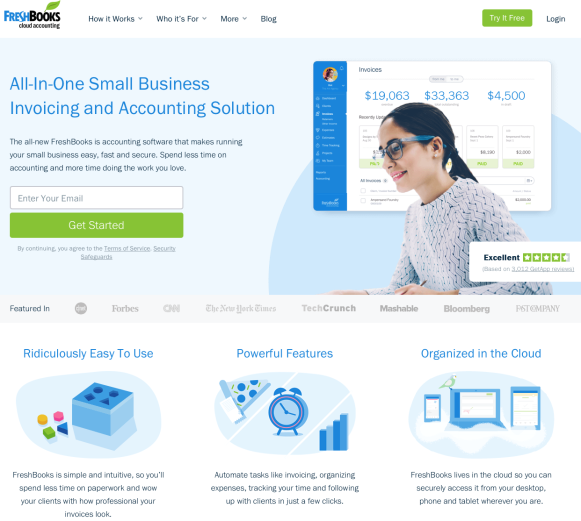

Market experts agree that in the future, the accounting will be conducted entirely using online services. And when choosing programs, users will pay attention to such characteristics as ease of use from the start, additional features, round-the-clock technical support FreshBooks customer service, and quick response to new customer requirements.However, rather than hear it a hundred times, it’s better to try it once! Bookkeeping program FreshBooks cloud accounting (in addition to sending reports) is available to new subscribers for free. To do this, you need to register in the service and get a 30-day trial period.