Good Debt vs. Bad Debt: Know the Difference

allowance method for bad debts expense definition

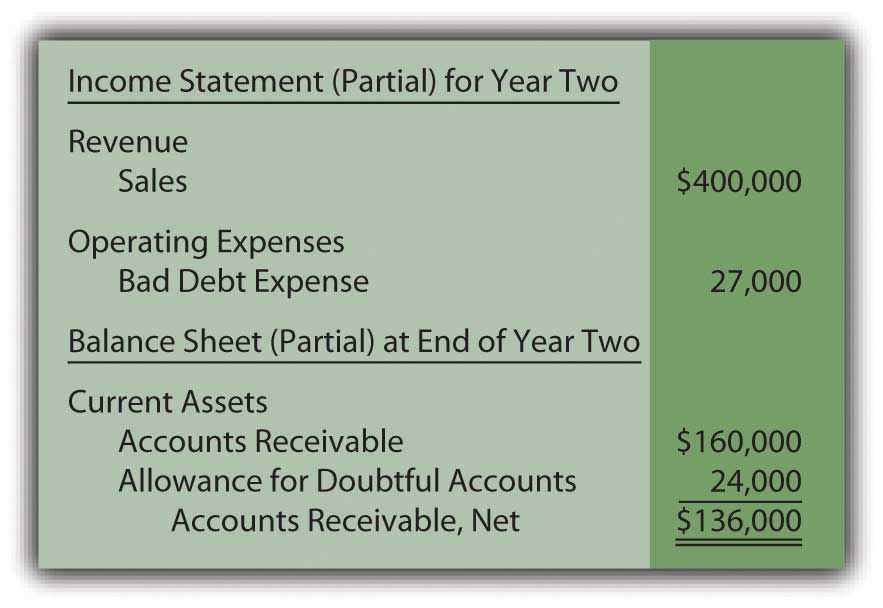

Companies that extend credit to their customers report bad debts as an allowance for doubtful accounts on the balance sheet, which is also known as a provision for credit losses. Let’s say your business brought in $100,000 worth of sales in an accounting period. Based on past trends, you predict that 3% of your sales will be bad debts. You must record $3,000 as a debit in your bad debts expense account and a matching $3,000 as a credit in your allowance for doubtful accounts. An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (it either has a credit balance or a balance of zero) that decreases your accounts receivable.By creating an allowance for doubtful accounts entry, you are estimating that some customers won’t pay you the money they owe. For example, let’s say a company estimates that 5 percent of accounts receivables are deemed uncollectible and the accounts receivables balance is $100,000. By following this method, the balance of allowance for doubtful accounts should be $5,000. The amount you wrote off in past months for doubtful accounts is probably a good predictor of what you might write off in the future. DateAccountDebitCredit3/31/20XXBad Debts Expense$2,000Allowance for Doubtful Accounts$2,000This method is sometimes referred to as the income statement approach.

MANAGE YOUR BUSINESS

How do you calculate allowances?

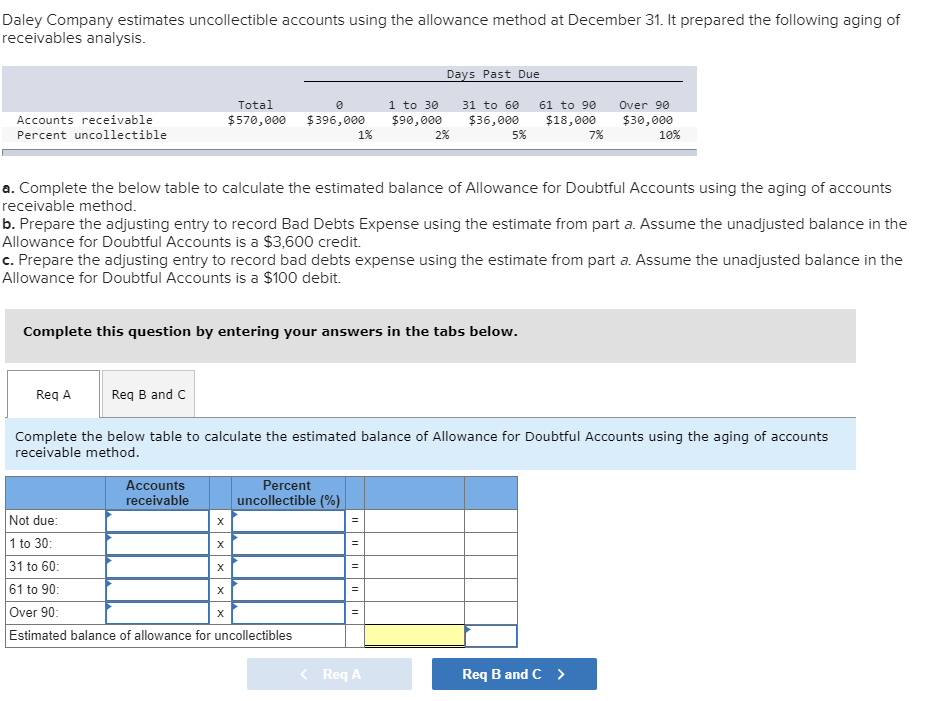

Definition. The financial accounting term allowance method refers to an uncollectible accounts receivable process that records an estimate of bad debt expense in the same accounting period as the sale. The allowance method is used to adjust accounts receivable appearing on the balance sheet.The first journal entries under the allowance method include a debit to bad debt expense and a credit to allowance for doubtful accounts. When the company considers an account to be completely uncollectible, it makes a debit to allowance for doubtful accounts and a credit to accounts receivable. The sales method applies a flat percentage to the total dollar amount of sales for the period. For example, based on previous experience, a company may expect that 3% of net sales are not collectible.The statistical calculations can utilize historical data from the business as well as from the industry as a whole. The specific percentage will typically increase as the age of the receivable increases, to reflect increasing default risk and decreasing collectibility. To predict your company’s bad debts, you must create an allowance for doubtful accounts entry. You must also use another entry, bad debts expense, to balance your books.

Estimating Bad Debts—Allowance Method

The journal entry is a debit to the allowance for doubtful accounts and a credit to the accounts receivable account. Again, it may be necessary to debit the sales taxes payable account if sales taxes were charged on the original invoice.Increase your bad debts expense by debiting the account, and decrease your ADA account by crediting it. Estimated uncollectibles are recorded as an increase to Bad Debts Expense and an increase to Allowance for Doubtful Accounts (a contra asset account) through an adjusting entry at the end of each period. Companies only have to make two transactions for the amount of the customer’s bad debt.

Accounting Topics

As a result, its November income statement will be matching $2,400 of bad debts expense with the credit sales of $800,000. If the balance in Accounts Receivable is $800,000 as of November 30, the corporation will report Accounts Receivable (net) of $797,600. Under the allowance method, a company records an adjusting entry at the end of each accounting period for the amount of the losses it anticipates as the result of extending credit to its customers. The entry will involve the operating expense account Bad Debts Expense and the contra-asset account Allowance for Doubtful Accounts.

BUSINESS IDEAS

- The estimate could be based on a percentage of sales or it could be based on the age of its accounts receivables.

- Prior to specifically identifying an account receivable as uncollectible, a company debits Bad Debts Expense and credits Allowance for Doubtful Accounts for an estimated amount.

- Under this method of recognizing losses on credit sales, a contra asset account Allowance for Doubtful Accounts is reported on the balance sheet.

What is the allowance method?

Definition: The allowance method is a system that estimates uncollectable receivables and bad debts by reporting accounts receivable at its realizable value. In other words, it’s a method that management uses to estimate the amount of cash credit customers will actually pay.The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. It may also be necessary to reverse any related sales tax that was charged on the original invoice, which requires a debit to the sales taxes payable account. Two primary methods exist for estimating the dollar amount of accounts receivables not expected to be collected. Bad debt expense can be estimated using statistical modeling such as default probability to determine its expected losses to delinquent and bad debt.Instead of directly writing off the customer balances in the account receivable account, bad debt expense is recorded by crediting the allowance account. This account is a contra asset account that is used to reduce the total outstanding receivables reported on the balance sheet. A bad debt expense is recognized when a receivable is no longer collectible because a customer is unable to fulfill their obligation to pay an outstanding debt due to bankruptcy or other financial problems.Later, when a specific account receivable is actually written off as uncollectible, the company debits Allowance for Doubtful Accounts and credits Accounts Receivable. One way companies derive an estimate for the value of bad debts under the allowance method is to calculate bad debts as a percentage of the accounts receivable balance. The financial accounting term allowance method refers to an uncollectible accounts receivable process that records an estimate of bad debt expense in the same accounting period as the sale. The allowance method is used to adjust accounts receivable appearing on the balance sheet. The allowance method works by using theallowance for doubtful accountsaccount to estimate the amount of receivables that are going to be uncollected in the future.If the total net sales for the period is $100,000, the company establishes an allowance for doubtful accounts for $3,000 while simultaneously reporting $3,000 in bad debt expense. If the following accounting period results in net sales of $80,000, an additional $2,400 is reported in the allowance for doubtful accounts, and $2,400 is recorded in the second period in bad debt expense. The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400. A company will debit bad debts expense and credit this allowance account. The allowance for doubtful accounts is a contra-asset account that nets against accounts receivable, which means that it reduces the total value of receivables when both balances are listed on the balance sheet.This means that investors and creditors will be able to see how much cash management is expecting to collect from its current customers on account. The seller can charge the amount of the invoice to the allowance for doubtful accounts.Under this method of recognizing losses on credit sales, a contra asset account Allowance for Doubtful Accounts is reported on the balance sheet. Prior to specifically identifying an account receivable as uncollectible, a company debits Bad Debts Expense and credits Allowance for Doubtful Accounts for an estimated amount. The estimate could be based on a percentage of sales or it could be based on the age of its accounts receivables. Management uses the allowance for doubtful accounts method to estimate credit accounts that customers will not pay. Instead, management uses past financial information to estimate bad debt amounts.

ACCOUNTING

Let’s say you have a total of $50,000 in accounts receivable ($50,000 X 2%). The percentage of credit sales approach focuses on the income statement and the matching principle. Sales revenues of $500,000 are immediately matched with $1,500 of bad debts expense. The balance in the account Allowance for Doubtful Accounts is ignored at the time of the weekly entries. However, at some later date, the balance in the allowance account must be reviewed and perhaps further adjusted, so that the balance sheet will report the correct net realizable value.The allowance method has two distinct advantages over thedirect write-off methodfor estimating bad debt expense. First, the allowance method agrees with thematching principleby recording an estimatedbad debt expensein the period in which the related sale takes place. Second, it reports accounts receivable on the balance sheet at its realizable value.

Determine the Allowance Account

This allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. Use the percentage of bad debts you had in the previous accounting period and apply it to your estimate. For example, if 2% of your sales were uncollectible, you could set aside 2% of your sales in your ADA account.If the seller is a new company, it might calculate its bad debts expense by using an industry average until it develops its own experience rate. Percentage of Sales –This method estimates the amount of bad debt expense a company will incur based on the amount of sales it receives. For example, if a business makes $100,000 in sales and estimates that 5 percent of sales is bad debts, then this would mean that approximately $5,000 should be added to the allowance for doubtful accounts. Essentially, this is the average amount of money that is written off at the end of the year. Next, let’s assume that the corporation focuses on the bad debts expense.