How To Do Bank ReconciliationSome organizations consider the bank reconciliation to be so important that they conduct one every day, which they accomplish by accessing the latest updates to the bank’s records on the bank’s secure website. This is of particular importance if a company is operating with minimal cash reserves, and needs to ensure that its recorded cash balance is correct. A daily reconciliation may also be necessary if you suspect that someone is fraudulently withdrawing cash from the bank account.

COMPARE THE DEPOSITS

With cash accounts, balances are commonly reconciled at the end of the month after the issuance of the monthly bank statement. Errors or omissions in the cash book can lead to a difference between the balance as per bank statement and the balance as per cash book.

Outstanding Check Definition – What are Outstanding Checks?

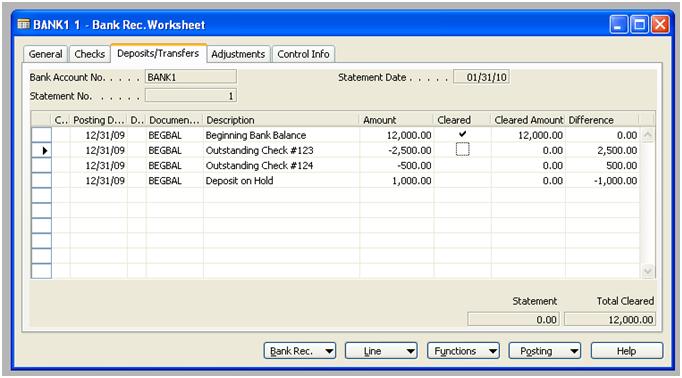

Hence, the credit balance in the bank’s liability account is reduced by a debit. Access the on-line bank statement provided by the bank for the company’s cash account (presumably its checking account). Outstanding checks are those that have been written and recorded in cash account of the business but have not yet cleared the bank account. This often happens when the checks are written in the last few days of the month. Match the deposits in the business records with those in the bank statement.The difference is due to a bank payment of $1000 incorrectly recorded twice by ABC & Co. in its cash book. The difference can be eliminated by adjusting the cash book by a debit entry of $1000. Because the cash book is updated continuously, it will be in chronological order by the transaction. In the description column, the accountant writes a short description or narration of the transaction. In the reference or ledger folio column, the accountant inputs the account number for the related general ledger account.

Bank Rate in India

It is extremely common for there to be differences between the two balances, which you should track down and adjust in your own records. If you were to ignore these differences, there would eventually be substantial variances between the amount of cash that you think you have and the amount the bank says you actually have in an account.

ADJUST THE BANK STATEMENTS

There are numerous reasons why a business might record transactions using a cash book instead of a cash account. Daily cash balances are easy to access and determine. Mistakes can be detected easily through verification, and entries are kept up-to-date since the balance is verified daily.

What is REC in banking?

bank rec definition. A shortened version of the term bank reconciliation or bank statement reconciliation.For instance, an entity may incorrectly record the bank deposits or withdrawals in another accounting ledger or it may record the entry by a wrong amount. Likewise, a bank deposit or withdrawal may be completely omitted from the cash book. Such discrepancies would cause the balance shown in the bank statement to be higher or lower than cash book balance depending on the nature of the error or the omission. The difference needs to be eliminated by adjusting the cash book of the company before the preparation a bank reconciliation.

- There are numerous reasons why a business might record transactions using a cash book instead of a cash account.

- Mistakes can be detected easily through verification, and entries are kept up-to-date since the balance is verified daily.

- Daily cash balances are easy to access and determine.

Businesses control cash receipts by mail by separating the check and the remittance advice in the mail room. The checks are given to the treasurer to deposit in the bank, and the remittance advice is used by the accounting department to record the payment to the customer’s account.Businesses maintain a cash book to record both bank transactions as well as cash transactions. The cash column in the cash book shows the available cash while the bank column shows the cash at the bank. Identify the bank statement balance of the cash account (balance per bank). A cash book is a subsidiary to the general ledger in which all cash transactions during a period are recorded.The amount of the transaction is recorded in the final column. The bank’s use of the term debit memo is logical because the company’s bank account is a liability in the bank’s general ledger. The bank’s liability is reduced when the bank charges the company’s account for a bank fee.

Current Bank Rate

The result could be an overdrawn bank account, bounced checks, and overdraft fees. In some cases, the bank may even elect to shut down your bank account.

Optional cookies and other technologies

Therefore, any outstanding deposits must be subtracted from the balance as per cash book in the bank reconciliation statement. A cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. Entries in the cash book are then posted into the general ledger. A bank reconciliation is used to compare your records to those of your bank, to see if there are any differences between these two sets of records for your cash transactions. The ending balance of your version of the cash records is known as the book balance, while the bank’s version is called the bank balance.

How do you reconcile a bank statement?

The current Bank Rate is 5.65% As of today, i.e. on March 15, 2020, the Policy Rates which include Repo Rate stood at 5.40%, Reverse Repo Rate at 5.15%, Marginal Standing Facility (MSF) Rate at 5.65% and Bank Rate at 5.65%.

bank rec definition

The controller will compare the debit to cash and the bank deposit receipt to ensure they agree. Some companies may also use a lock-box system, where cash receipts are sent directly to a post office box managed by a bank’s employee. DebitBank$1,000CreditReceivable$1,000While preparing a bank reconciliation statement, ABC & Co. finds out that the bank had not credited the cheque in its account until 2nd January 2011. After you’ve checked all the deposits and withdrawals, your business bank balance should match the totals in your business accounts.A cash book and a cash account differ in a few ways. A cash book is a separate ledger in which cash transactions are recorded, whereas a cash account is an account within a general ledger. A cash book serves the purpose of both the journal and ledger, whereas a cash account is structured like a ledger. Details or narration about the source or use of funds are required in a cash book but not in a cash account.Once the bank reconciliation is complete, all items that affect the book side of the reconciliation need to be recorded with journal entries. This ensures the cash balance agrees with the reconciled amount. This also updates the Cash account for unrecorded transactions. ABC & Co.’s bank statement shows a bank balance of $20,000 on 31 December 2010 where as its balance in the cash book at that date is only $19,000.