How to write down inventory — AccountingTools

Release of the Allowance for Obsolete Inventory

How do you calculate inventory reserves?

In our example on inventory write downs, an allowance for obsolete inventory account is created when the value of inventory has to be reduced due to obsolescence. It is maintained as a contra asset account, so that the original cost of the inventory can be held on the Inventory account until disposed of.In some cases, inventory may become obsolete, spoil, become damaged, or be stolen or lost. When these situations occur, a company must write the inventory off. An inventory write-off is an accounting term for the formal recognition of a portion of a company’s inventory that no longer has value.As a small business owner, you may know the definition of cost of goods sold (COGS). But do you know how to record a cost of goods sold journal entry in your books? Learn more about COGS accounting, including the steps on how to record COGS journal entries, below.

Double Entry Bookkeeping

Inventory refers to the goods and materials in a company’s possession that are ready to be sold. It is one of the most important assets of a business operation, as it accounts for a huge percentage of a sales company’s revenues.

Obsolete Inventory

Obsolete inventory is inventory that a company still has on hand after it should have been sold. When inventory can’t be sold in the markets, it declines significantly in value and could be deemed useless to the company.

What is inventory obsolescence allowance?

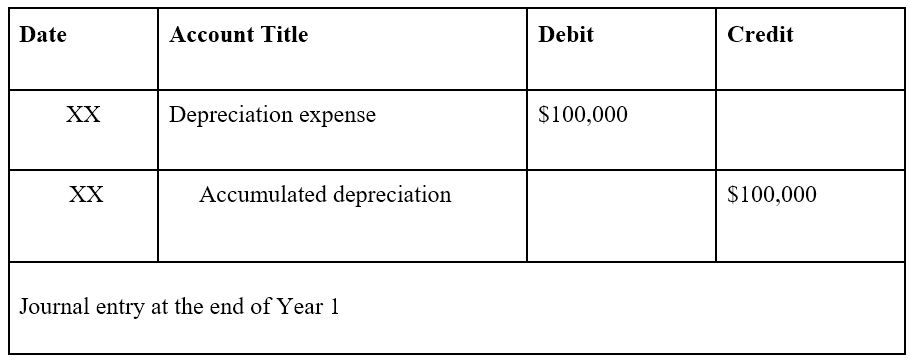

allowance to reduce inventory to net realizable value definition. This is a valuation account for the asset Inventory. A credit balance should be reported in this account for the amount that the net realizable value of inventory is less than the cost reported in the Inventory account.It may be expensed directly to the cost of goods sold or it may offset the inventory asset account in a contra asset account, commonly referred to as the allowance for obsolete inventory or inventory reserve. Examples of expense accounts include cost of goods sold, inventory obsolescence accounts, and loss on inventory write-down. A contra asset account may include allowance for obsolete inventory and obsolete inventory reserve.When the inventory write-down is small, companies typically charge the cost of goods sold account. However, when the write-down is large, it is better to charge the expense to an alternate account. The debit to the income statement reduces the net income which in turn reduces the retained earnings and therefore the owners equity in the business. The following Cost of Goods Sold journal entries provides an outline of the most common COGS.

Popular Double Entry Bookkeeping Examples

- The allowance method may be more appropriate when inventory can reasonably be estimated to have lost value, but the inventory has not yet been disposed.

- When the asset is actually disposed, the inventory account will be credited and the inventory reserve account will be debited to reduce both.

- Using the allowance method, a business will record a journal entry with a credit to a contra asset account, such as inventory reserve or the allowance for obsolete inventory.

The allowance method may be more appropriate when inventory can reasonably be estimated to have lost value, but the inventory has not yet been disposed. Using the allowance method, a business will record a journal entry with a credit to a contra asset account, such as inventory reserve or the allowance for obsolete inventory. When the asset is actually disposed, the inventory account will be credited and the inventory reserve account will be debited to reduce both. This is useful in preserving the historical cost in the original inventory account.Generally accepted accounting principles in the U.S. allow businesses to use one of several inventory accounting methods. FIFO (first-in, first-out), LIFO (last-in, first-out) and average cost are the three most commonly used inventory systems. When inventory costs are not uniform due to price fluctuations, the choice of inventory method can result to an increase or decrease in cost of goods sold.

Balance Sheet

To increase the value of your inventory, you debit it, and to reduce its value, you credit it. An inventory reserve is also a balance sheet account, but since it is a contra asset account, or one that reduces asset value, you credit it to increase it and debit it to reduce it. When you sell items, you credit inventory and debit a cost of goods sold expense account.To recognize the fall in value, obsolete inventory must be written down or written off in the financial statements in accordance withGenerally Accepted Accounting Principles (GAAP). A write-down occurs if the market value of the inventory falls below the cost reported on the financial statements. A write-off involves completely taking the inventory off the books when it is identified to have no value and, thus, cannot be sold. Inventory is an asset, and as such, it is a balance sheet account.

When you establish an inventory reserve, you have already charged your expense account. Therefore, as long as your inventory reserve is sufficient, your entry would be a credit to the specific inventory account and a debit to the inventory reserve account to reduce the balances in each account.Generally Accepted Accounting Principles (GAAP) require that any item that represents a future economic value to a company be defined as an asset. Since inventory meets the requirements of an asset, it is reported at cost on a company’s balance sheet under the section for current assets.

Recording Obsolete Inventory

If the reserve balance is insufficient, you would credit inventory for the full adjustment, debit inventory reserve for its full balance and debit cost of goods sold for the difference. Inventory items at any of the three production stages can change in value.Inventory is goods that are ready for sale and is shown as Assets in the Balance Sheet. When that inventory is sold, it becomes an Expense and we call that expense as Cost of goods sold. Inventory is the cost of goods which we have purchased for resale, once this inventory is sold it becomes the cost of goods sold and the Cost of goods sold is an Expense.

When Should a Company Use Last in, First Out (LIFO)?

If the inventory is held for too long, the goods may reach the end of their product life and become obsolete. Inventory refers to assets owned by a business to be sold for revenue or converted into goods to be sold for revenue.