Is My Car An Asset Or A Liability?

Definition of Balance Sheet Accounts

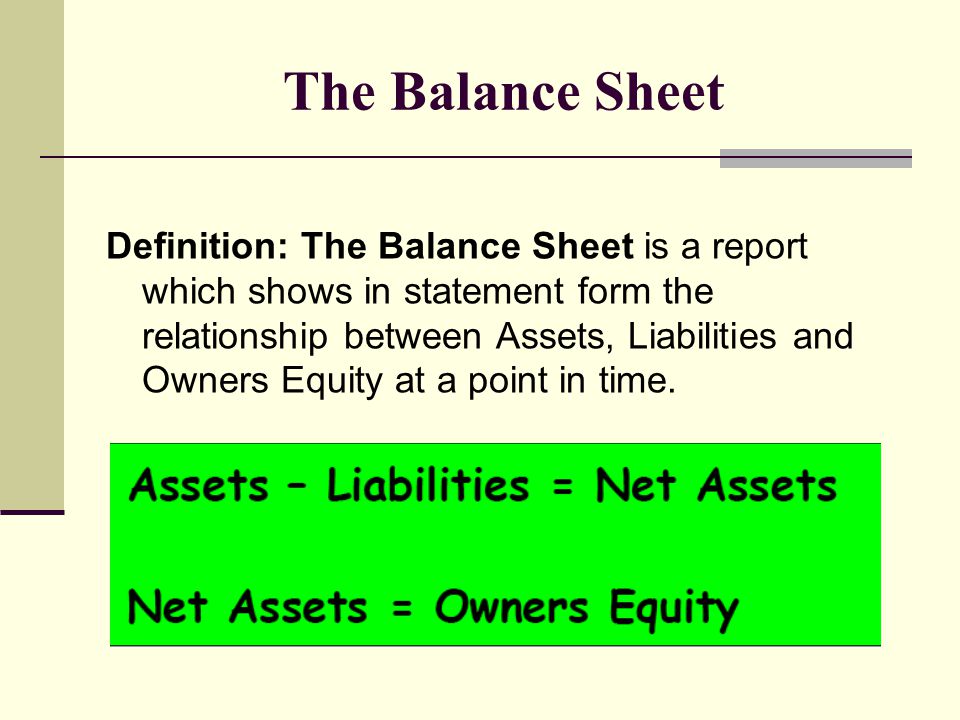

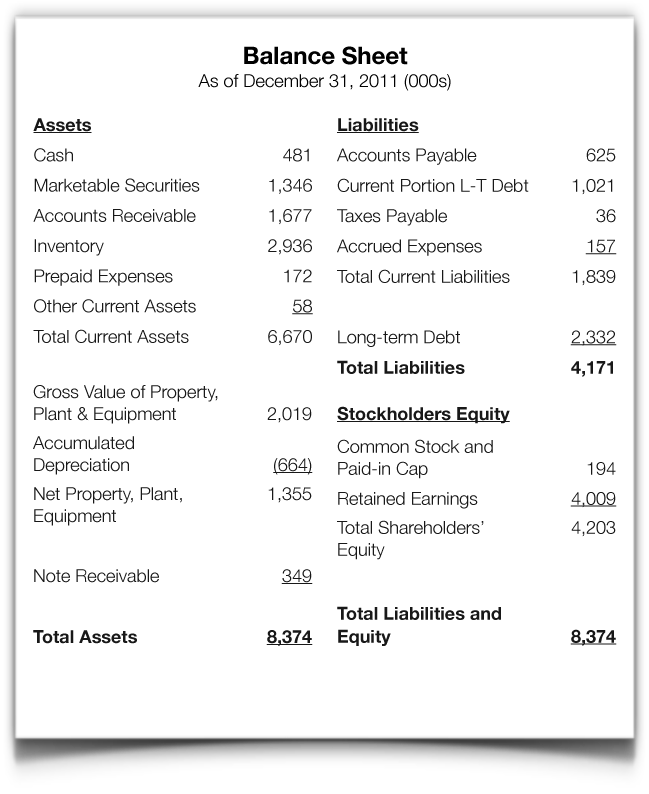

Your balance sheets show the position of the company on a given day, including its total assets, liabilities and equity, which equals its net worth. Lenders commonly use financial statements to assess your company’s creditworthiness.

Balance Sheet vs. Profit and Loss Statement: What’s the Difference?

Balance sheet ratios are financial metrics that determine relationships between different aspects of a company’s financial position i.e. liquidity vs. solvency. They include only balance sheet items i.e. components of assets, liabilities and shareholders equity in their calculation. Non current liabilities are mostly long term debt of the business. If it is very large compared to the total assets of the business its a reason to be concerned.

Spotting Creative Accounting on the Balance Sheet

In summary, the Balance Sheet shows the value of all the capital that a business has built up over the years. The most important numbers in it are cash and liabilities.

Balance Sheet

Review the key financial statements within the context of the relevant accounting standards. In examining balance sheet accounts, issues such as recognition, valuation and classification are keys to proper evaluation. The main question should be whether this balance sheet is a complete representation of the firm’s economic position. When evaluating the income statement, the main point is to properly assess the quality of earnings as a complete representation of the firm’s economic performance. Owners’ equity is mathematically determined to be the difference between your assets and liabilities.

The purpose of the balance sheet

Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. They can also be thought of as a claim against a company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000.The Balance Sheet is a report of the asset and liability accounts. Assets are things you own in your business, like cash, capital equipment, and money that is owed to you for products and services you have delivered to customers. Liabilities are obligations of the business, like bills you have yet to pay, money you have borrowed from a bank or investors.

The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000. The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid.

- The Balance Sheet is a report of the asset and liability accounts.

- Assets are things you own in your business, like cash, capital equipment, and money that is owed to you for products and services you have delivered to customers.

- Liabilities are obligations of the business, like bills you have yet to pay, money you have borrowed from a bank or investors.

Liabilities

In essence, whatever you have left if you were to sell all of your assets and pay off debt is the value of the company at the present time. Equity actually includes a variety of accounts, but most commonly it refers to paid-in capital and retained earnings. Paid-in capital is the par value, or starting price of your shares if you are a public company. The assets section shows items your company owns that have tangible value.

What is a balance sheet used for?

The purpose of the balance sheet is to reveal the financial status of a business as of a specific point in time. The statement shows what an entity owns (assets) and how much it owes (liabilities), as well as the amount invested in the business (equity).I almost never look at a profit and loss statement without also looking at a balance sheet. They really should be considered together as they are two sides of the same coin. Your net worth equals your total liabilities subtracted from your total assets. (For help calculating your net worth, tryPersonal Capital, a free money-management app). Because your car is an asset, include it in your net worth calculation.The balance sheet is an invaluable piece of information for investors and analysts; however, it does have some drawbacks. Since it is just a snapshot in time, it can only use the difference between this point in time and another single point in time in the past.It is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Assets represent items of value that a company owns, has in its possession or is due. Of the various types of items a company owns, receivables, inventory, PP&E, and intangibles are typically the four largest accounts on the asset side of a balance sheet. Therefore, a strong balance sheet is built on the efficient management of these major asset types, and a strong portfolio is built on knowing how to read and analyze financial statements.

What is balance sheet definition and meaning?

A balance sheet is a financial statement that reports a company’s assets, liabilities and shareholders’ equity at a specific point in time, and provides a basis for computing rates of return and evaluating its capital structure.If you have a car loan, include it as a liability in your net worth calculation. Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title.A balance sheet provides a picture of a company’s assets and liabilities, as well as the amount owned by shareholders. A balance sheet can help you determine what a business is really worth. When reviewed with other accounting records and disclosures, it can warn of many potential problems and help you to make sound investment decisions.

Learn More About Balance Sheets

A high debt-to-assets or debt-to-equity ratio is a concern. The basic accounting formula must balance at all times. If not, a journal entry was entered incorrectly, and must be fixed before financial statements can be issued. Balance sheet is the financial statement that provides a picture of a company’s financial position by listing a company’s assets, liabilities and shareholders equity. Income statement and cash flows statement provides information about profitability and cash flows.

But its even more important to dig into the term of the long term debt and find out when it is coming due and other important factors. You’ll need to get the footnotes of the financial statements to do that. Again, we’ll talk more about that in a future post on financial statement analysis. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping. The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Cash Flow Statement, Working Capital and Liquidity, And Payroll Accounting.The purpose of the balance sheet is to reveal the financial status of a business as of a specific point in time. The statement shows what an entity owns (assets) and how much it owes (liabilities), as well as the amount invested in the business (equity). This information is more valuable when the balance sheets for several consecutive periods are grouped together, so that trends in the different line items can be viewed.