Preparing Financial Statements and Auditors’ IndependenceAlmost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud. As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls.

How to Prepare Financial Statements

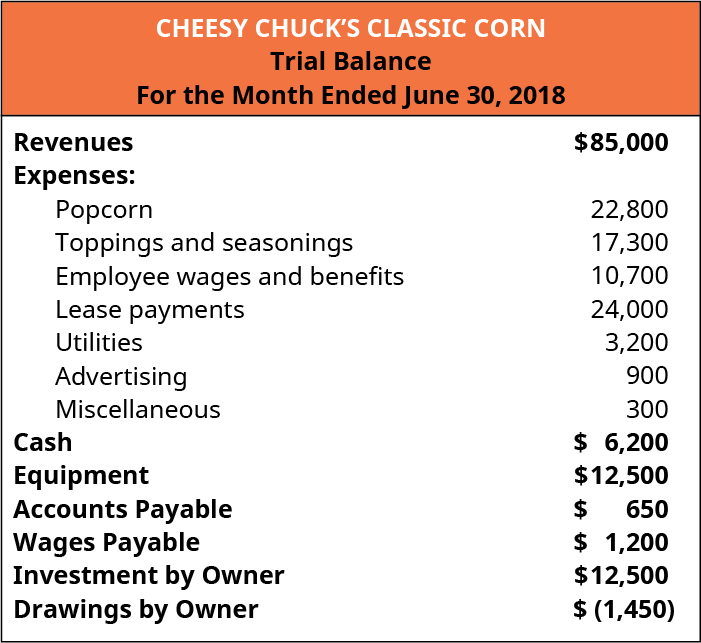

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials.A compilation does not include performing inquiries of management or performing any analytical or other procedures ordinarily performed in a Review or Audit. Compiled financial statements generally range in costs from $800 – $3,500 based on the size and complexity of your company and can take 1-2 weeks to complete.First, the company will record the transaction in the general ledger with journal entries. The journal entries are then broken down into T-accounts, which show the balance of each account. From there, an accountant can start to compile his income statement and balance sheet. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

Examples of Certified Financial Statements

You can do this by bringing in a different accountant every now and then to check your books and observe your recordkeeping. Such an accountant can interview your staff to ensure they follow the guidelines on billing and educate them where necessary.Certified financial statements are required for publicly-traded companies as they play an important role in the financial markets. Companies may employ internal auditors to review financial statements, but they can only be certified by an external auditor, who is usually a certified public accountant (CPA). An auditor is an independent certified public accountant who examines the financial statements that a company’s management has prepared. Many of these financial statements – including those in the company’s annual report and those provided to shareholders in connection with the solicitation of proxies for annual meetings – must be examined and reported on by an independent auditor. A certified financial statement is one that has been reviewed and approved by a certified, independent auditor.When possible, business owners should always try to certified financial statements from an independent auditor. However, many small, privately held businesses cannot justify the expense of an independent audit. That doesn’t mean you can’t get an occasional second opinion on your financial statements and health.

How much do compiled financial statements Cost?

Illustrative Guidance – Disclosures Compiled financial statements often include notes on long-term debt, capital assets, or related party transactions that disclose breakdowns of items presented on the balance sheet or income statement.

What Accountants Do

A company’s outside, independent auditor examines the company’s financial statements and provides a written report that contains an opinion as to whether the financial statements are fairly stated and comply in all material respects with GAAP. In addition, some companies also use internal auditors to review the financial reporting processes and internal accounting controls to assure that the company’s systems are appropriately designed and operating effectively. Standards for external audits performed in the United States, called the generally accepted auditing standards (GAAS), are set out by Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA). Additional rules for the audits of publicly traded companies are made by the Public Company Accounting Oversight Board (PCAOB), which was established as a result of SOX in 2002. A separate set of international standards, called the International Standards on Auditing (ISA), were set up by the International Auditing and Assurance Standards Board (IAASB).

Do compiled financial statements include notes?

compiled financial statements definition. Financial statements prepared by an accountant based on the amounts provided by a client. The accountant does not review or audit the amounts provided and therefore does not provide any assurances regarding the validity of the amounts.

What could compiled financial statements look like?

A financial audit is an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of the transactions they claim to represent. The audit can be conducted internally by employees of the organization or externally by an outside Certified Public Accountant (CPA) firm.

- An auditor is an independent certified public accountant who examines the financial statements that a company’s management has prepared.

- Companies may employ internal auditors to review financial statements, but they can only be certified by an external auditor, who is usually a certified public accountant (CPA).

- Certified financial statements are required for publicly-traded companies as they play an important role in the financial markets.

Certified Financial Statement

If a preliminary check reveals too many errors, it might be worth considering a change in accounting personnel. They can (but usually don’t) perform bookkeeping functions, but usually, they prepare detailed financial statements, perform audits of the books of public companies, and they may prepare reports for tax purposes. But an accountant is classified by the IRS as an “unenrolled preparer,” which means they have no standing with the IRS in the matter of signing tax returns or representing clients during tax audits and other matters before the IRS. Only CPAs, tax attorneys, and Enrolled Agents are able to represent a taxpayer before the IRS. Compiled financial statements represent the most basic level of service offered by a Certified Public Accountant with respect to financial statements.

Preparing Financial Statements and Auditors’ Independence

A company’s financial statements can be examined and approved in a process called an audit by Certified Public Accountants, or CPAs. These independent experts apply the guidelines and principles set forth by the American Institute of Certified Public Accountants. CPAs must pass various exams before they get certified and must attend periodic training sessions to retain their certifications. CPAs will often spend days or even weeks in a client’s office to perform the audit, and are given wide access to financial and other records. An audit may be required by a third-party user of your company’s financial statements, such as a lender, investor (or other funding source) or government regulator.

Audited financial statements can cost you anywhere from $6,000 and can go up dramatically depending on the size and complexity of your company’s operations. Compiled financial statements and Reviewed financial statements offer much more cost effective solutions and shorter time frames to complete. Accountants with businesses big and small normally compile financial statements each quarter.In addition to preparing and reviewing financial statements, CPAs also prepare tax returns for businesses and individuals, sign tax returns, and represent taxpayers before the IRS for audits and other matters. The American Institute of Certified Public Accountants (AICPA) is the national professional association for CPAs.Public companies are required to provide audited financial statements to their shareholders and file them with the Security and Exchange Commission. Even if not required, many companies choose to have audits performed anyway because they can yield valuable benefits. For example, an audit can help a company ensure the accuracy of its financial information, and can help identify weaknesses in internal controls and ways to improve internal controls. The best way to identify the auditor of a publicly traded company is to check the company’s most recent filings using our EDGAR database of corporate filings. Be sure to check any Form 8-K filings submitted after the company’s most recent annual report to find out whether the company subsequently hired a new auditor.Such statements are considered more reliable than unaudited statements and are mandatory for publicly traded companies. However, financial statements that have not been audited by external, independent audit professionals are not considered certified. The Sarbanes-Oxley Act of 2002 sets standards for external, independent auditors and requires that they submit an Internal Controls Report with certified financial statements. A CPA is an accountant who has passed certain examinations and met all other statutory and licensing requirements of a state to be certified by that state.Once an auditor has reviewed the details of a financial statement following GAAP guidelines and is confident the numbers are accurate, they certify the documents. The third and most complex service and level of assurance offered by a CPA are Audited financial statements. Audited financial statements are much more complex and in-depth and require a substantially larger scope of work than Compiled financial statements and Reviewed financial statements. Audited financial statements provide you, the company, with an opinion letter from the CPA, as to whether or not your financial statements are presented fairly, in all material respects, under U.S. generally accepted accounting principles. An audit requires the CPA to obtain an understanding of your company’s internal controls and to assess your potential fraud risk.

Responses to Guide to Financial Statement Services

The three most common certified financial statements are the balance sheet, the income statement, and the statement of cash flows. The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s financial position as of a specific date, usually on December 31. Certified financial statements are financial statements audited and certified by external, independent accountants. A certified financial statement is a financial document, such as an income statement, cash flow statement, or balance sheet that has been audited and signed-off by an accountant.