Solved: Should I 0 or 1 on a Form W4 for Tax Withholding A

How to Calculate Your Investment Return

The after-tax real rate of return is the actual financial benefit of an investment after accounting for the effects of inflation and taxes. It is a more accurate measure of an investor’s net earnings after income taxes have been paid and the rate of inflation has been adjusted for. Both of these factors will impact the gains an investor receives, and so must be accounted for. This can be contrasted with the gross rate of return and the nominal rate of return of an investment.

What Is the Rate of Return I Can Expect on a Savings Account?

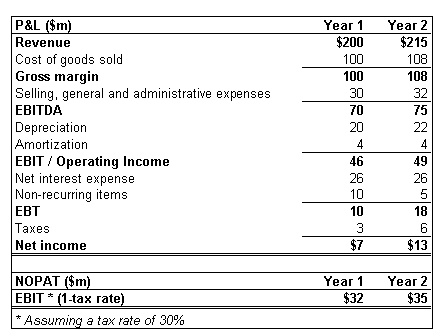

UGMA accounts are custodial accounts where a parent, guardian, or appointed financial institution will manage the assets on behalf of the child until they come of age. At this point, the child can legally take control of the assets within the UGMA account and use them at his or her discretion for any purpose. This can be problematic in some situations, such as drug abuse, credit risks, or impaired judgment. Also, an asset in a UGMA account does not have the same kind of protections from creditors that other accounts might offer. Anyone thinking of using a UGMA account should carefully consider their other financial goals and the income tax bracket implications.However, you can change the beneficiary of a 529 plan if the intended recipient decides not to go to college. For example, you can transfer the beneficiary to yourself or to another dependent if desired. A company’s pretax earnings provides insight into its financial performance before the impact of tax is employed. Pretax earnings is calculated by subtracting a firm’s operating expenses from its gross margin or revenue. Operating expenses include items such as depreciation, insurance, interest, and regulatory fines.

Example of the After-Tax Real Rate of Return

What does after tax money mean?

After-tax income is the net income after the deduction of all federal, state, and withholding taxes. After-tax income, also called income after taxes, represents the amount of disposable income that a consumer or firm has available to spend.You may be wondering how investments are taxed in a UTMA or UGMA account. Any profits or income realized is reported on the beneficiary’s tax return, which typically offers lower tax rates.

Here Are the Deductions You Lost Due to Tax Law Changes

Your after-tax 401(k) contributions will be included within your regular 401(k) plan, and will earn investment income on a tax-deferred basis. The real benefit, of course, will take place once you leave your employer. You can roll over the after-tax contributions into a Roth IRA, where the investment earnings will be tax-free.This category could include contributions to a 401(k) retirement plan, health insurance, life insurance, or a flexible spending account for medical expenses. It also may include union dues or any other garnishments that are taken from your wages. It helps to categorize these according to pre-tax and after-tax contributions, to deduct them from either your gross salary or after-tax calculation.

What Is After-Tax Income?

In some situations, the custodian may report the account on their tax return. Consider your investment objectives and the benefits of other options for tax free investments, such as tax-free income funds, money markets, or municipal bonds offered by local governments. There are certain tax penalties that a financial professional can help you reduce or avoid. A professional advisor can also offer services for business owners and real estate investors, such as structuring a business or help you update articles of your organization.

- Tax-free investments can minimize your tax liability and let you keep more of the money you earn.

- If you are considering tax-free investing, be sure to research your options carefully or speak to a tax professional.

- Financial investing carries both risks and rewards, and it’s important to determine the best or most efficient investing strategy for your specific needs.

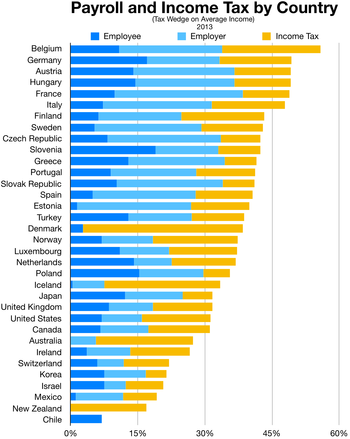

However, income limits and company retirement plans can impact eligibility and the deductions available. High-income earners can still utilize the benefits of these options with a little more work. Traditional IRAs allow pre-tax money to be invested tax-free and withdrawn in a lower tax rate at retirement. However, traditional IRAs also come with drawbacks such as mandatory disbursements after a certain age and other issues.Tax-free investments can minimize your tax liability and let you keep more of the money you earn. Financial investing carries both risks and rewards, and it’s important to determine the best or most efficient investing strategy for your specific needs.

In contrast, a Roth IRA uses after-tax money and is tax-free at retirement but has income eligibility requirements. Consult with a financial advisor today if you have any questions about IRA investments. Most companies do not offer this option, nor are they required to by law, but it’s certainly worth investigating. If it is permitted, you can begin taking advantage of tax-free investment earnings in your Roth IRA rollover account immediately, rather than waiting until you leave the company.

After-Tax and Pretax Retirement Contributions

For a wage earner, gross income is the amount of salary or wages paid to the individual by an employer, before any deductions are taken. For a wage earner, net income is the residual amount of earnings after all deductions have been taken from gross pay, such as payroll taxes, garnishments, and retirement plan contributions. The Roth is a retirement account that allows the money you contribute to grow completely free of taxation so long as you make no unqualified withdrawals. There are no age contribution limitations with a Roth, so if you’re 75 and you want to keep adding, you’re free to do so. There are also no minimum required distributions, allowing you complete flexibility in how you withdraw your money during retirement.If you are considering tax-free investing, be sure to research your options carefully or speak to a tax professional. There are many tax-free investment options available to investors that use proper tax planning strategies. Some of these options provide better benefits and more comprehensive tax advantages than others. In some cases, it may be worthwhile to consider a 529 education plan for yourself or qualified dependent.For example, a manufacturer with revenues of $100 million in a fiscal year may have $90 million in total operating expenses (including depreciation and interest expenses), excluding taxes. The after-tax earnings figure, or net income, is computed by deducting corporate income taxes from pretax earnings of $10 million.Contributing to a 401K planoffered by your employer is a great way to shield income from taxes and build up savings for the future. You don’t pay taxes on that money and it comes out of and reduces your taxable income. Making contributions to an individual retirement account (IRA) works, too. You can’t usually use pre-tax dollars for an IRA, but you can deduct your contributions from your taxes.In addition, distributions for eligible college or higher education costs may be tax-free at the federal level but only tax-free in some states. Before starting a 529, you should consider the benefits based on your location and planned usage. Spending money on non-qualified expenses is subject to income tax, plus a penalty on earnings. Money invested into a 529 is not as liquid as other investments without facing those penalties.

b) vs. Roth IRA: What’s the Difference?

Also, U.S. Series I savings bonds, charitable donations, and 1031 exchanges all provide some form of tax incentive. Be sure to consider the alternative minimum tax (AMT) which can impact your taxes greatly, if applicable. An Individual Retirement Account (IRA) should also be considered for tax-conscious investors as these plans offer tax-free growth. Both traditional and Roth IRAs allow annual contributions up to $5,500 (under 50) and $6,500 (over 50).This allows you to set money aside for school tuition and higher education. Contributions are after-tax and not deductible, but some accumulated tax is deferred.

What is after tax rate?

The after-tax real rate of return is the actual financial benefit of an investment after accounting for the effects of inflation and taxes. It is a more accurate measure of an investor’s net earnings after income taxes have been paid and the rate of inflation has been adjusted for.