What is Inventory? Meaning Definition Examples

Inventory to Working Capital Explanation

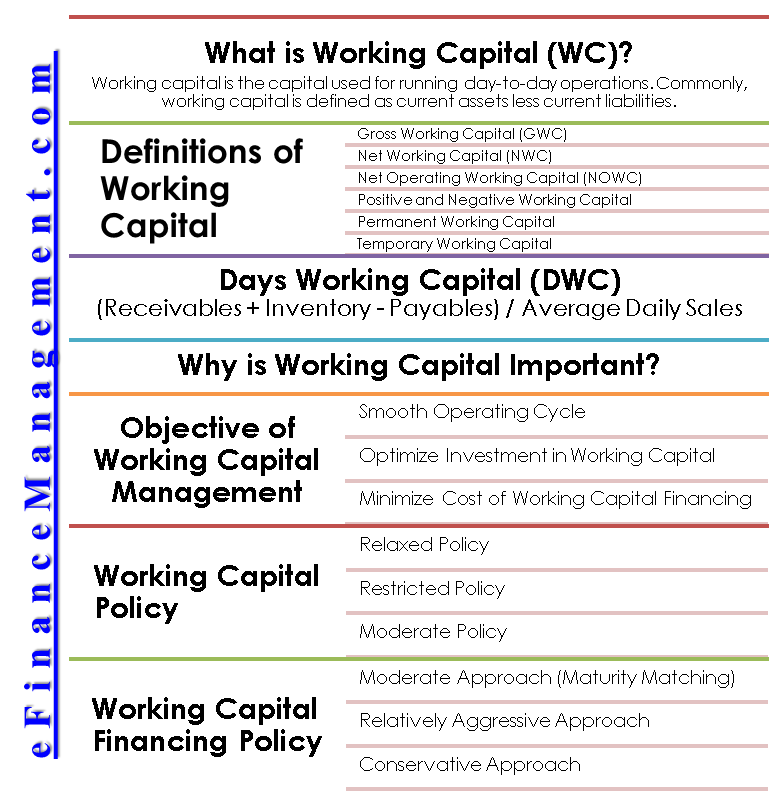

The working capital ratio remains an important basic measure of the current relationship between assets and liabilities. To calculate the working capital, compare a company’s current assets to its current liabilities.These include the selling of long-term assets for cash, increasing inventory turnover, and refinancing short-term debts with long-term debts. The net working capital (NWC) ratio measures the percentage of a company’s current assets to its short-term liabilities. Similar to net working capital, the NWC ratio can be used to determine whether or not you have enough current assets to cover your current liabilities. Current liabilities are short-term financial obligations due in 1 year or less. Current liabilities usually include short-term loans, lines of credit, accounts payable, accrued liabilities, and other debts such as credit cards, trade debts, and vendor notes.

What Is Inventory, Is It Working Capital?

In many cases these calculations are the same and are derived from company cash plus accounts receivable plus inventories, less accounts payable and less accrued expenses. The optimal ratio is to have between 1.2 – 2 times the amount of current assets to current liabilities. Anything higher could indicate that a company isn’t making good use of its current assets.Current portions of long-term debt like commercial real estate loans and small business loans are also considered current liabilities. Trade working capital is the difference between current assets and current liabilities directly associated with everyday business operations. A company’s liabilities are any financial debt or obligations that a company is responsible for due to its business operations.

Inventory

Assets are considered current assets when they are expected to be liquidated into cash or be used within one year. Working capital is calculated as the difference between a company’s current assets and current liabilities. Inventory is classified as part of the current assets, or short-term assets, since there is an expectation that this asset is going to be consumed and produce economic benefits within a year. Working capital is calculated by deducting the company’s current liabilities from its current assets.Liabilities often include “payable” in their account title on the balance sheet. Examples of liabilities are notes payable, accounts payable, salaries payable, wages payable and income taxes payable. Liabilities are considered current liabilities if the debts or obligations are due within one year. A company’s assets are any items of economic value that a company owns or controls. Examples of assets are cash, accounts receivable, inventory, supplies, land, buildings and equipment.Because excessive inventories can place a heavy burden on the cash resources of a company, it is not favorable for management. A key issue for a company to improve its operation efficiency is to identify the optimum inventory levels and thus minimize the cost tied up in inventories. Net working capital measures a company’s ability to meet its current financial obligations. When a company has a positive net working capital, it means that it has enough short-term assets to finance to pay its short-term debts and even invest in its growth. Companies can increase their net working capital by increasing their current assets and decreasing their short-term liabilities.

What is an example of inventory?

Inventory to working capital ratio is defined as a method to show what portion of a company’s inventories is financed from its available cash. This is essential to businesses which hold inventory and survive on cash supplies. In general, the lower the ratio, the higher the liquidity of a company is.Current liabilities are considered to be the debts of the business that are to be settled in cash within the fiscal year. Current assets are assets which are expected to be sold or otherwise used within one fiscal year. Typically, current assets include cash, cash-equivalents, accounts receivable, inventory, and prepaid accounts which will be used within a year, and short-term investments. Net working capital is a key indicator of your business’s short-term liquidity.

How to Analyze a Company’s Inventory

The management of working capital involves managing inventories, accounts receivable and payable, and cash. Working capital (abbreviated WC) is a financial metric which represents operating liquidity available to a business, organization, or other entity, including governmental entities. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. If current assets are less than current liabilities, an entity has a working capital deficiency, also called a working capital deficit.

Benefits of Inventory Management

- Working capital is the difference between a business’ current assets and current liabilities or debts.

- Working capital serves as a metric for how efficiently a company is operating and how financially stable it is in the short-term.

- The working capital ratio, which divides current assets by current liabilities, indicates whether a company has adequate cash flow to cover short-term debts and expenses.

Liquidity measures such as the quick ratio and the working capital ratio can help a company with its short-term asset management. A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other. Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses. Working capital is a measure of a company’s liquidity, operational efficiency and its short-term financial health.It demonstrates whether or not your company has enough working capital to both meet its current financial obligations as well as invest in its growth. However, an increasing or decreasing net working capital isn’t necessarily bad or good. Sometimes strategic business decisions call for an increase in short-term liabilities in the near-term.Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory and other assets that are expected to be liquidated or turned into cash in less than one year. Current liabilities include accounts payable, wages, taxes payable, and the current portion of long-term debt. A company with positive working capital (more assets than liabilities) is seen as being in good short-term financial health. Even with a significant amount of positive working capital, however, a company can experience a cash shortage if its current assets are unable to be liquidated quickly. The amount of time it takes to turn current assets and current liabilities into cash is referred to as the working capital cycle.

Working capital is the difference between a business’ current assets and current liabilities or debts. Working capital serves as a metric for how efficiently a company is operating and how financially stable it is in the short-term. The working capital ratio, which divides current assets by current liabilities, indicates whether a company has adequate cash flow to cover short-term debts and expenses. Net operating working capital is a measure of a company’s liquidity and refers to the difference between operating current assets and operating current liabilities.

A positive working capital means that the company can pay off its short-term liabilities comfortably, while a negative figure obviously means that the company’s liabilities are high. But one of the measures shortcomings is that current assets often cannot be liquidated in the short term. High working capital positions often indicate that there is too much money tied up in accounts receivable or inventory, rather than short-term liquidity. In those cases, it is best to work to collect payments from your customers and sell down inventory to increase your working capital.A company can be endowed with assets and profitability but may fall short of liquidity if its assets cannot be readily converted into cash. Positive working capital is required to ensure that a firm is able to continue its operations and that it has sufficient funds to satisfy both maturing short-term debt and upcoming operational expenses.

Why Working Capital Management Matters

Ideally, you’d like to have positive net working capital and a working capital ratio between 1.2 and 2.0. This likely represents a healthy business that has enough short-term or current assets to fully secure its immediate debt. To better explain inventory to working capital,it is an important indicator of a company’s operation efficiency. Note that a low value of 1 or less of inventory to working capital means that a company has high liquidity of current asset. While it may also mean insufficient inventories, high value inventory to working capital ratio means that a company is carrying too much inventory in stock.

Is working capital an inventory?

Inventory is generally categorized as raw materials, work-in-progress, and finished goods. Retailers typically refer to this inventory as “merchandise.” Common examples of merchandise include electronics, clothes, and cars held by retailers.

Inventory to Working Capital Example

If a company has substantial positive working capital, then it should have the potential to invest and grow. If a company’s current assets do not exceed its current liabilities, then it may have trouble growing or paying back creditors, or even go bankrupt. A buyer usually considers negative working capital in a target as detrimental because it signifies additional capital that will be required to run the business after closing. A buyer actually prefers to see a working capital ratio of 1 to 1.5 times, which means there is at least one dollar of current assets for every dollar of current liabilities. This assures the buyer that the company can generate sufficient cash over the short term to cover supplier and payroll obligations.