Tax season is just around the corner. For some reason, most taxpayers consult their tax professionals the week before the due date of tax paying. Try to imagine the usual scenario: last-minute efforts of collecting files, digging pertinent documents, and collating receipts dating back since the latter months of the previous year until you start to rush everything but ending up still trying to figure out what could still be missing. I hope you are not part of this vicious cycle, or if you’ve been for the longest time, it’s time to shift gears and be part of the diligent taxpayers club by preparing for it. As they say, “Failing to plan is planning to fail!”

In this blog, we will get to know everything that we should prepare for this year’s tax season. Particularly, we will discuss significant changes for the 2020 tax season, as well as the holdover principles or laws that will be carried over this year’s tax season. You will also need to take note of the important dates for the filing of taxes for the entire year, plus important considerations and recommendations to get your taxes done right for the year 2020.So take time in reading the next couple of things in this writing and proactively prepare for the taxing job of acing the tax season for this year.

Changes for the 2020 Tax Season

The 2018 Tax Reform Law had a huge impact on the American taxpayers as tax rates and deductions had taken effect, which made these taxpayers pay closer attention to their taxes and details since then. Now, let us look into the significant changes for this year’s tax season:

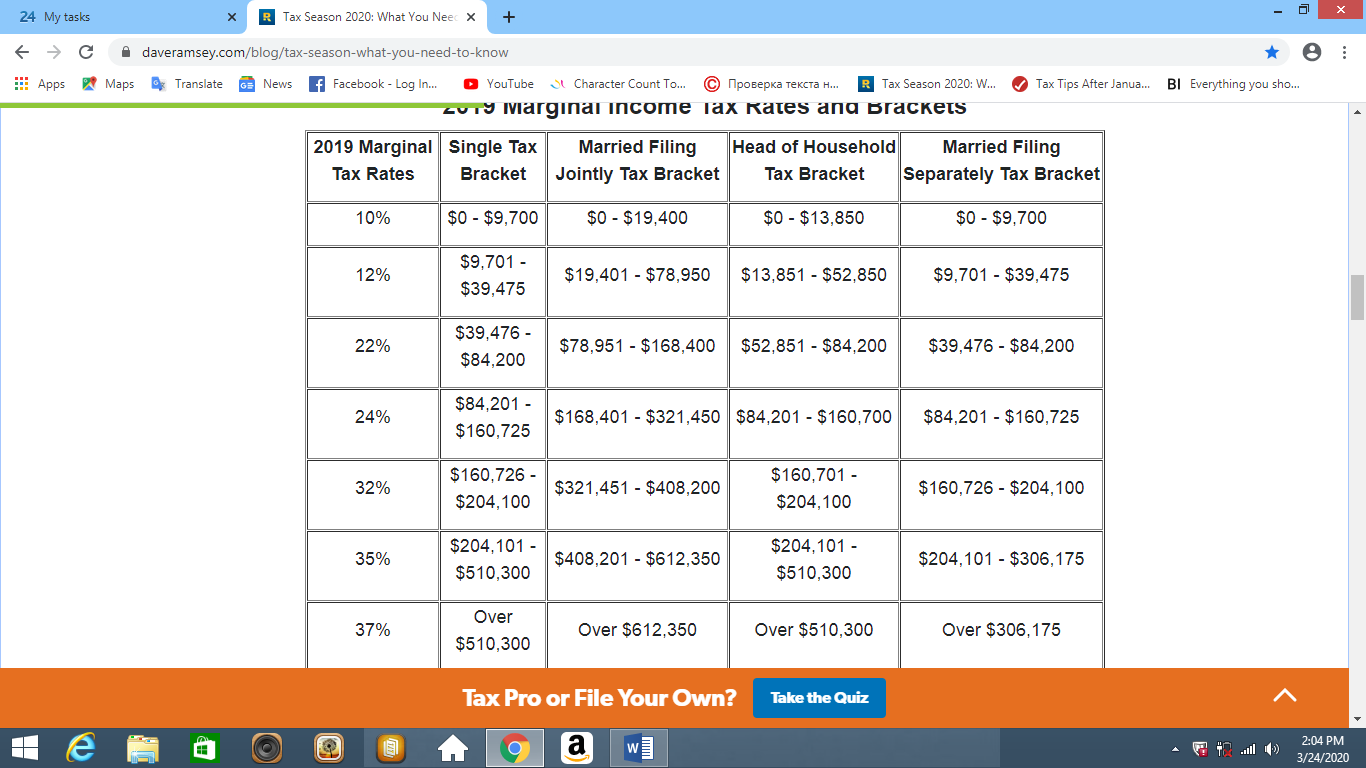

- Increased 2019 income tax brackets, accounting for inflation – let us first discuss how your tax rate is computed. Basically, the tax rate is the percentage of your income that you pay in taxes. Your tax rate determines your tax bracket.

Say, for instance, you are an unmarried individual who is earning $50,000. This means that you belong to the 22% tax bracket. However, it does not equate to your tax rate. Instead, your income is taxed at 10%, and another part at 12% rate. The last part is at 22%. The 2019 tax rates remain the same. However, brackets were slightly altered. The inflation caused the brackets to move by a few hundred dollars from 2018. Check out the illustration below for complete detail of the tax brackets and their corresponding tax rates:

If your civil status and income did not change that much from 2018, the tax bracket would not really move at all as it lurks within the minimal rate changes, unless you got married and you are going for a joint filing of income tax.

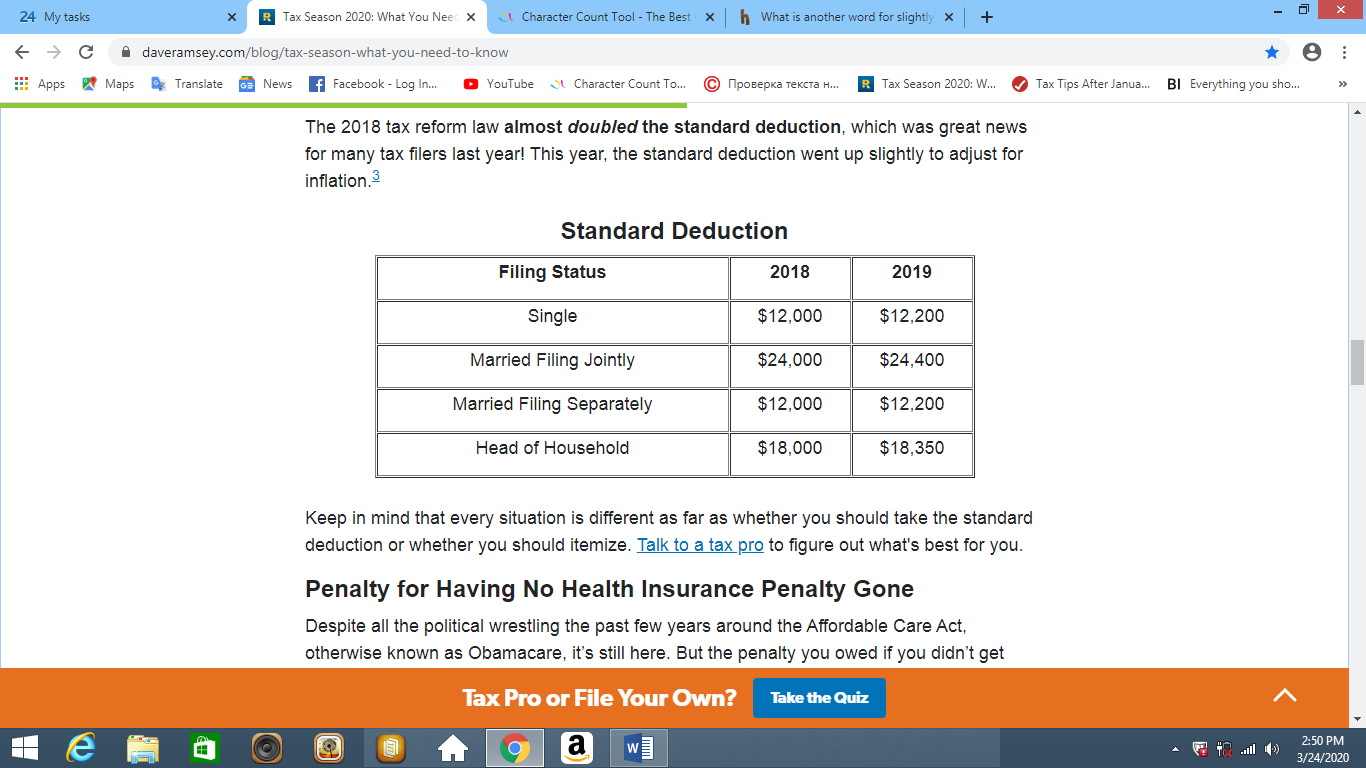

- Higher Standard Deductions in 2019 – Standard deduction is the automatic reduction of your tax from your income. When settling your taxes, you can opt for a standard deduction or have the deductions itemized. Itemizing means are calculating your tax deductions by taking into account each deduction. Apparently, this option of paying tax is more tedious, but it is more accurate and will save you some greenback compared to the standard deduction that sometimes goes higher.

One of the glaring effects of the 2018 Tax Reform Law was doubling the standard deduction. This year, however, the standard deduction partially moved up to make room for inflation adjustments.See the table below for the adjusted Standard Deduction.

- Removal of No Health Insurance Fine – The highly debated Obamacare enactment charged individuals who did not avail health insurance. The 2019 tax season had this penalty lifted, which amounted to $695 back in 2018. The rest of the taxing seasons will be fine-free for taxpayers. But just the same, health insurance remains of high importance and value for all individuals in the U.S.

- The increased threshold level for medical expense deduction – this implies that you can ask for a deduction for the medical expense that was not reimbursed, which should be more than 10% of your adjusted gross income. The adjusted gross income is calculated by subtracting taken deductions from your total income. The mentioned 10% rate as the threshold level is relatively higher than the previous medical expenses deduction threshold level, which was at 7.5% in 2018.

- Modified Estate Tax Exemption – estate tax refers to the wealth in the form of cash or property inherited from your family. Simply put, the $11.2 million worth of inheritance as the threshold amount for estate tax exemption is moved up to $11.4 million.

What is Staying the Same for the 2020 Tax Season

Now that we learned the changes from the tax filing that we need to take note of, let us leaf through the unvaried tax affairs, we need to refresh ourselves with.

- The imposition of Child Tax Credit – Since the 2018 Tax Reform Law took effect, the credit for each qualified child was raised to $2,000. Moreover, the income limits for the credit were also adjusted to 400, 000 for joint filing, while $200,000 for individual filing.

- Reallocating 529 Plans – this was originally intended to be used for college education plan of your children. However, as the resolution was implemented, it still can be used for other education plans besides college (i.e., private school enrollment of primary education and exclusive tutoring programs.) that is granted tax-free.

- Cancellation of Home Equity Debt Deduction – this enactment basically prohibits the taxpayer to deduct interest paid on home equity debt. This was one of the significant developments back then to shun taxpayers away from counterproductive options.

- Implementation of the State and Local Tax (SALT) Deduction – this deduction allows taxpayers to deduct local tax payments. When a taxpayer opts to itemize his taxes, the SALT deduction can still be applied for only up to $10,000 worth of tax.

- Reinforcement of Charitable Donations Deductions – for generous taxpayers who wish to donate to various charitable institutions, they can apply for this deduction scheme, which can take up to 60% of their total income.

- Homeowners Mortgage Deductions – In the 2018 Tax Season, the maximum mortgage deduction imposed was trimmed to $750, 000.

These are the fixtures in the 2020 Tax season that we need to familiarize ourselves with in order to prepare for our tax filing efficiently.

2020 Tax Season — Dates

After getting refreshed with the changes and fixtures for this year’s tax season, it’s time for us to mark our calendars and save important dates for us to remember and ace the tax filing for the year 2020 and enjoy special perks of filing your taxes ahead of time. These are the dates to remember as the tax season unfolds:

- January 2020 – this is the official start of the tax season and what the Internal Revenue Service has accustomed to doing. During the latter days of the month, the IRS begins accepting tax returns.

- January 31, 2020 – By this date, you should have secured a copy of the W-2 Form (the official form employees use to declare their income.) This form can either be accessed online or handed out by the employers. A separate form is used self-employed individuals..

- April 15, 2020 – the official date of the submission of your income tax return. If in case, for some reason, you still can’t submit it on this day, April 15 is also the official last day to request for an extension of filing your ITR. However, the filing is the only thing deferred. The paying party must still be done within the scheduled period of payment. Penalty plus interest rate charges await you if you do not pay your taxes.

- October 15, 2020 – If you filed for a six-month extension for your tax filing, October 15 is your deadliest deadline. Otherwise, you will incur a penalty for late payment and interest rate charges for unpaid and overdue taxes, which we should all avoid at all costs.

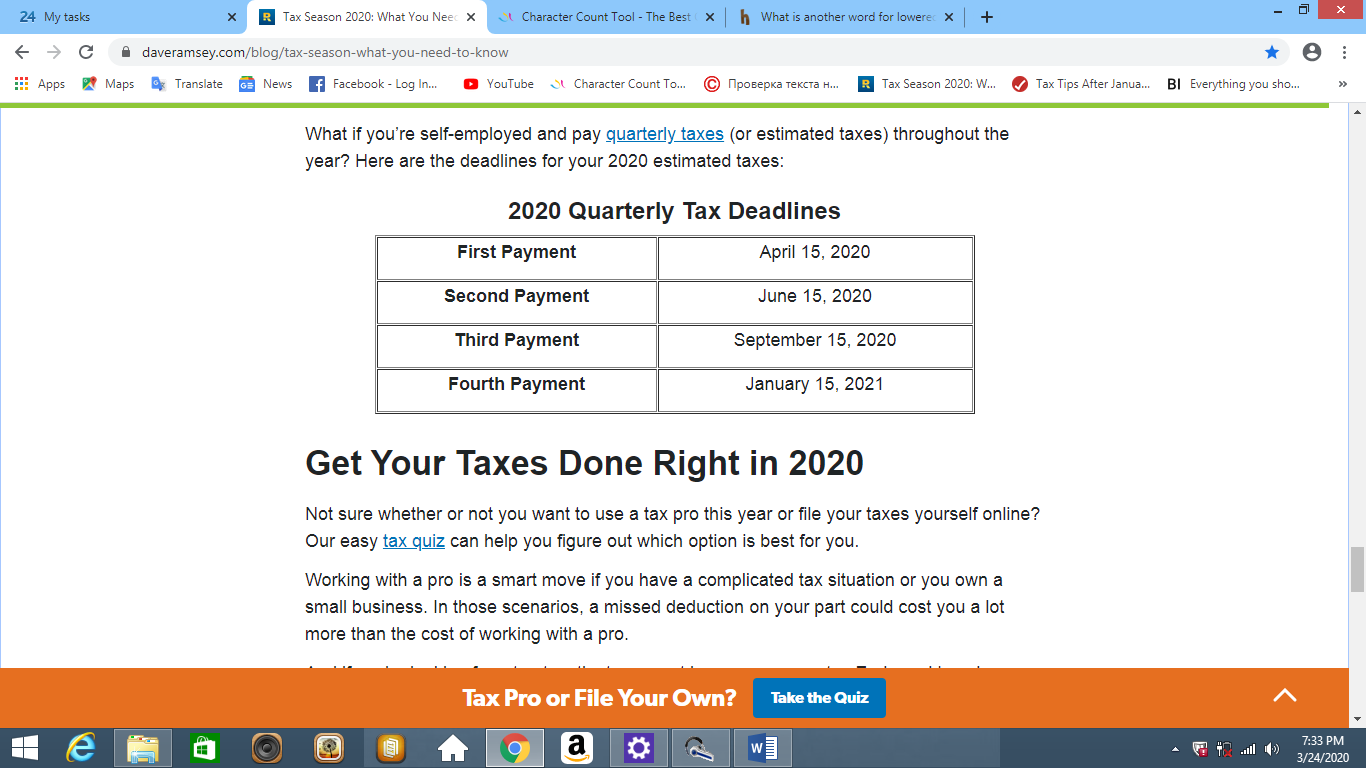

Here is the schedule of tax payment for easy reference:

Special Note: In light of the ongoing pandemic outbreak of COVID-19, the Treasury declared several changes and updates regarding tax filing and payment extensions, which are not stipulated in this article.

Tax Filing 101

At this point, all there’s left to know is the basics of filing your taxes and doing it the right way. Have a quick read of the following must-dos for the tax season.

- Draft your taxes and deductions to estimate your payment – as a taxpayer, and you wouldn’t want to come up short with your payment and incur penalties and interest charges. Draft your tax payment so you would have a good estimate of how much you need to prepare at least close enough to the actual amount of your tax payment. However, when paying, it is better to owe a little amount than pay more than you should as refunds always take longer processes than penalties. Be practical!

- Prepare your tax papers diligently – the scenario pictured out at the beginning of this writing is a classic reminder of why we should be organized in filing our tax papers. Question: What are the things that we should prepare and what to do with them? Here they are:

- A checklist of everything you need to account for, including tax forms, receipts, documents, and so on.

- Documents about tax filing schedules such as mails, sporting documents, etc.

- Organize your documents by clipping similar files or documents together and separating the not-so-important ones.

3. Secure the proper tax forms right on time – most of these forms can be downloaded on the IRS website. 4. Opt to itemize your Taxes – it is no secret that the standard deduction saves us time from dealing with our taxes one by one. However, there’s a prize for those who manually account for their taxes. Self-employed taxpayers are the ideal candidates to itemize taxes, especially when they exceed the standard deduction (amounting to $12,200 for singles and double the amount for joint filing).File your taxes promptly – If you are having a hard time dealing with your tax papers and unsure of beating the deadline, you can file for an extension. But upon doing so, make sure that you were able to secure the extension for filing form until July 15, 2020. Electronic filing of taxes is the way to go if you anticipate a refund. Lastly, seek tax professionals if it deems necessary.