Accelerated Depreciation Definition & ExampleOur Advantages and disadvantages of straight line method homework help article will provide a decent review over the methods including the musts and don’ts of this method. Some businesses, though, prefer an accelerated depreciation method that means paying higher expenses early on and lower expenses toward the end of the asset’s lifespan.The total depreciation amount remains the same as straight line, however, the depreciation expense is greater up front. There are many different ways to calculate accelerated depreciation, such as 125 percent declining balance, 150 percent declining balance and 200 percent declining balance, also known as double declining. One of the more common ways is to construct a table of declining yearly values. You can calculate straight-line depreciation by subtracting the asset’s salvage value from the original purchase price and then dividing it by the total number of years it is expected to be useful for the company.

MANAGE YOUR BUSINESS

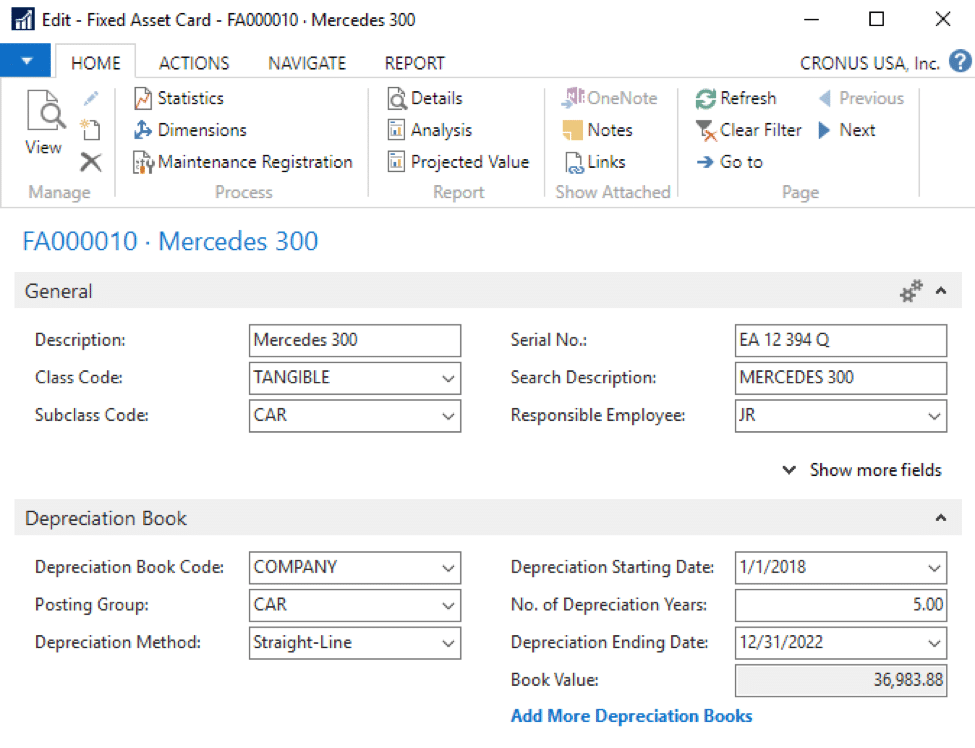

An asset can be depreciated under straight-line or accelerated depreciation. Straight-line, the more liberal method, recognizes an equal amount of depreciation expense over the useful life of the asset. Accelerated depreciation recognizes a greater amount of depreciation in earlier periods and a smaller amount in later periods. Therefore, accelerated depreciation is considered more conservative because it recognizes more expense sooner and lowers earnings in the current period. Straight-line depreciation is an accounting method that is most useful for getting a more realistic view of your profit margins in businesses primarily using long-term assets.

accelerated depreciation definition

For example, if your business requires machinery to function, you can allocate the cost of this equipment over a period of time to the expenses on your balance sheet, so that your profits will not be affected all at once. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. The allocation of the cost of a plant asset to expense in an accelerated manner. This means that the amount of depreciation in the earlier years of an asset’s life is greater than the straight-line amount, but will be less in the later years.

How does proration affect asset depreciation?

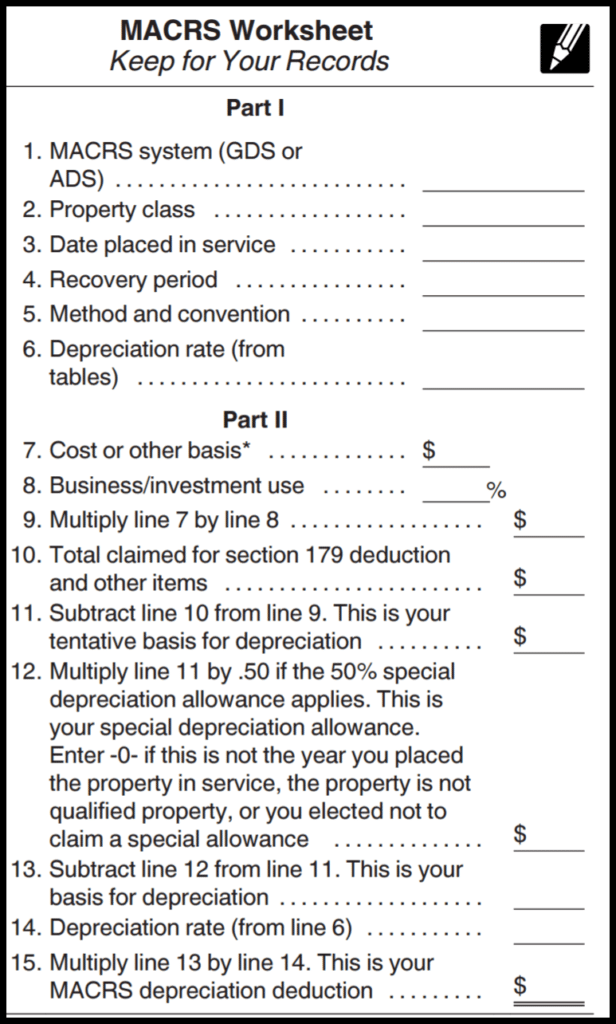

For tax purposes, accelerated depreciation provides a way of deferring corporate income taxes by reducing taxable income in current years, in exchange for increased taxable income in future years. This is a valuable tax incentive that encourages businesses to purchase new assets. In straight-line depreciation method, cost of a fixed asset is reduced uniformly over the useful life of the asset. Since the depreciation expense charged to income statement in each period is the same, the carrying amount of the asset on balance sheet declines in a straight line.MACRS allows for greater accelerated depreciation over longer time periods. This is beneficial since faster acceleration allows individuals and businesses to deduct greater amounts during the first few years of an asset’s life, and relatively less later.

BUSINESS PLAN

The straight-line depreciation method results in equal depreciation expenses spread evenly over the course of the asset’s useful life. Due to its simplicity, the straight-line method of depreciation is the most common depreciation method. Generally-accepted accounting principles (GAAP) require companies to depreciate its fixed assets using method that best reflects the pattern in which the assets are expected to generate economic benefits.

Accelerated Depreciation

Of course, depreciation methods for financial reporting are largely arbitrary cost allocation methods not related to the actual value of the asset. But GAAP separates depreciation methods permitted for financial reporting from tax depreciation, which includes accelerated depreciation rates such as double declining depreciation and sum of the years’ digits. Accelerated depreciation methods assume that the greatest wear and use of the asset occurs in the early years of the asset’s life, thereby “accelerating” depreciation in the early years. The IRS permitted accelerated depreciation methods for financial reporting in 1954. As many companies adopted them for tax purposes, the same depreciation methods were also used for financial reporting to avoid keeping separate records.

- In straight-line depreciation method, cost of a fixed asset is reduced uniformly over the useful life of the asset.

- This is a valuable tax incentive that encourages businesses to purchase new assets.

- For tax purposes, accelerated depreciation provides a way of deferring corporate income taxes by reducing taxable income in current years, in exchange for increased taxable income in future years.

The most common reason for using accelerated depreciation is to lessen net income. Straight-line depreciation is easier to calculate and looks better for a company’s financial statements. This is because accelerated depreciation shows less profit in the early years of asset acquisition. Most companies use straight-line depreciation for financial statements and accelerated depreciation for income tax returns. In the accelerated depreciation model, assets depreciate at a faster rate during the beginning of their lifetime and slow down near the end of the asset’s life.

Do companies prefer straight line or accelerated depreciation?

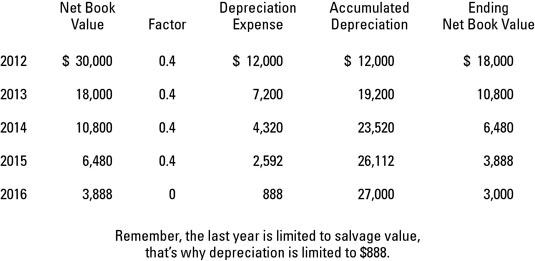

The difference between accelerated and straight-line is the timing of the depreciation. For profitable companies, the use of accelerated depreciation on the income tax return will mean smaller cash payments for income taxes in the earlier years and higher cash payments for income taxes in later years.For example, an asset with a useful life of five years would have a reciprocal value of 1/5 or 20%. Double the rate, or 40%, is applied to the asset’s current book value for depreciation. Although the rate remains constant, the dollar value will decrease over time because the rate is multiplied by a smaller depreciable base each period. Depreciation is how the costs of tangible and intangible assets are allocated over time and use. Both public and private companies use depreciation methods according to generally accepted accounting principles, or GAAP, to expense their assets.While the straight-line method is appropriate in most cases, some fixed assets lose more value in initial years. This is one of the two common methods a company uses to account for the expenses of a fixed asset.Depreciation is a useful tool for business, because it allows you to purchase needed equipment and supplies for your company without drastically affecting your profits all at once. One of the simplest and most common methods used by businesses for their assets is straight-line depreciation. This accounting method allocates the cost of a long-term asset over a period of time, which affects your profits at an equal and predictable amount per year. Accelerated depreciation helps companies shield income from taxes — after all, the higher the depreciation expense, the lower the net income.These types of assets include office buildings, manufacturing equipment, computers, office furniture and vehicles. These are considered long-term assets, because they will last for more than one year and are necessary to run the business on a day-to-day basis. By dividing out the cost of these assets, you are giving yourself and your investors a complete view of your profit margins, because the equipment is fueling the business. Rather than taking a financial accounting hit immediately and then later seeing seemingly inflated profits, you even out your profits and expenses at an equal rate, using the straight-line depreciation method.

What is the difference between straight line and accelerated depreciation?

While the straight-line depreciation method spreads the cost evenly over the life of an asset, an accelerated depreciation method allows the deduction of higher expenses in the first years after purchase and lower expenses as the depreciated item ages.In total the amount of depreciation over the life of the asset will be the same as straight-line depreciation. The difference between accelerated and straight-line is the timing of the depreciation. For profitable companies, the use of accelerated depreciation on the income tax return will mean smaller cash payments for income taxes in the earlier years and higher cash payments for income taxes in later years. The double declining balance (DDB) method is an accelerated depreciation method. After taking the reciprocal of the useful life of the asset and doubling it, this rate is applied to the depreciable base, book value, for the remainder of the asset’s expected life.

TAXES

Depreciation using MACRS can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and so on. When you purchase assets for your company, the purpose of these assets is to increase the profitability of the business. Unfortunately, their purchase can negatively affect your profits in the immediate term for accounting purposes. Using a depreciation method, you can spread out the cost of your assets over several years, so that they won’t negatively affect your profits during the year they are purchased. This allows you to better see how your profits have gone up or down with their use.

How Do I Calculate Fixed Asset Depreciation Using Excel?

In business there are many assets that are considered in the depreciable category after the accounting is done over them. Straight line method or also called as straight line depreciation method is one of the ways to gradually lessen the carrying amount of a fixed asset all over its useful span. Right from the purchase of the asset, this method separates each and every cost that asset has faced all over its useful life. The simplicity of operation of straight line method makes it more understanding and most used method in accountancy.High depreciation expenses recorded now, however, mean less depreciation expenses recorded later — thus higher net income and taxes at the end of the asset’s useful life. Essentially, this means that accelerated depreciation defers taxes for companies rather than helps companies avoid taxes. When a company uses an accelerated depreciation method, it lowers the value of its total assets on its balance sheet earlier in the life of those assets. Many companies employ accelerated depreciation methods when they have assets that they expect to be more productive in their early years. However, if Company XYZ uses an accelerated depreciation method, it might expense far more of the asset’s cost in the first few years and expense less cost in the later years.Why would a business willingly choose costlier early expenses on the asset? Accelerated depreciation is any method of depreciation used for accounting or income tax purposes that allows greater deductions in the earlier years of the life of an asset. This is known as depreciation, and there are several different depreciation methods, which allow businesses to determine the projected loss of value of certain assets over time or based on actual physical usage. This allows for an effective allocation of costs throughout the useful life of the asset in the correct period. The modified accelerated cost recovery system (MACRS) is the proper depreciation method for most assets.