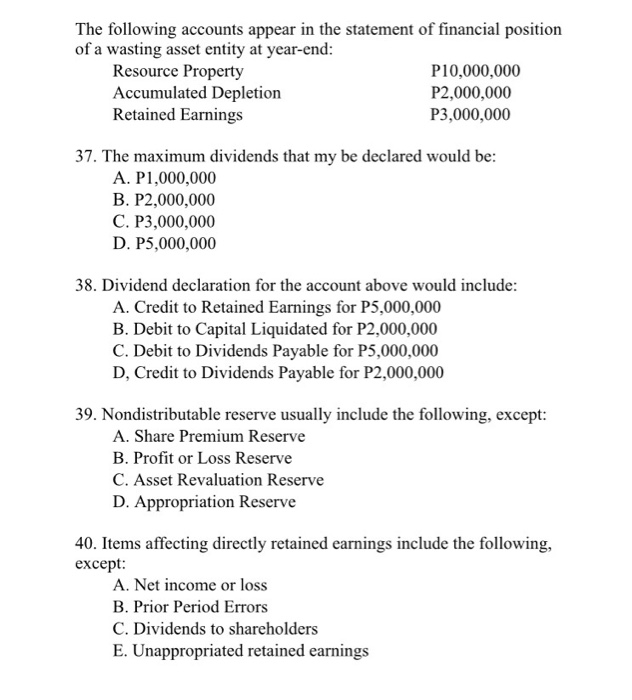

Accounting for Natural Resource Assets & Depletion

Accounting for Depletion

Thus, we could expense all, some, or none of the depletion and removal costs recognized in an accounting period, depending on the portion sold. If all of the resource is sold, we expense all of the depletion and removal costs. Nearly all fixed assets have a useful life, after which they no longer contribute to the operations of a company or they stop generating revenue. During this useful life, they are depreciated, which reduces their cost to what they are supposed to be worth at the end of their useful lives (which is known as salvage value).

Natural Resource Assets

What type of account is accumulated depletion?

The accumulated depletion account is. reported on the balance sheet as a deduction from the cost of the mineral deposit. The process of transferring the cost of metal ores and other minerals removed from the earth to an expense account is called. depletion.

Depreciation is the accounting term used for assets such as buildings, furniture and fittings, equipment etc. Companies use this to record the diminishing value of their assets as they are used in the business from the time of purchase of such assets. Hence cost is allocated periodically as value lost due to usage (as expense affecting the business’s net income) and the declining value of assets is recorded (affecting the value of business). Different methods exist in calculating the depreciation amount and these are different depending on the asset type. The depreciation is calculated from the time an asset is used / placed for service and the depreciation is recorded periodically.

Is accumulated depletion an asset?

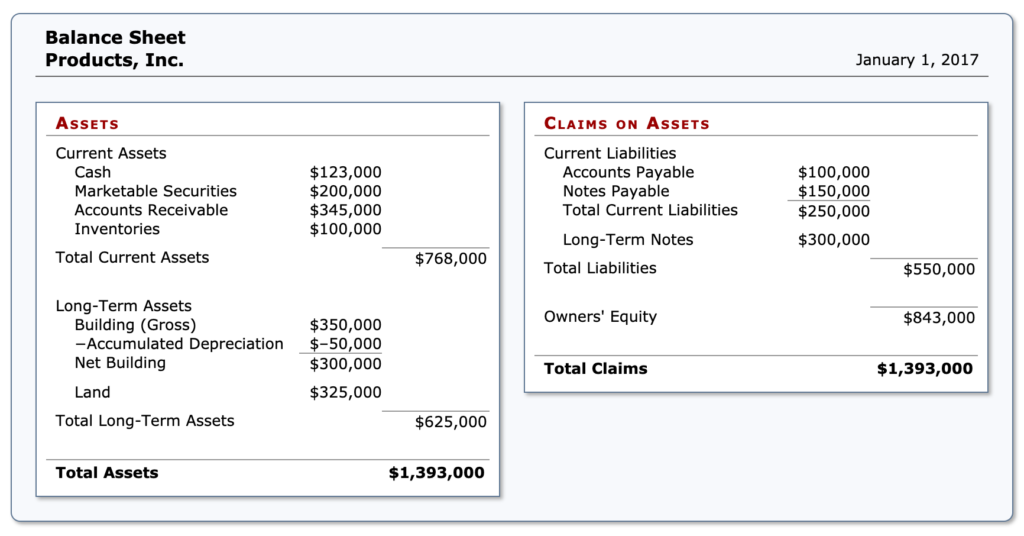

Accumulated depletion is the amount of depletion expense that has built up over time in relation to the use of a natural resource. This amount is paired with the natural resource asset on the balance sheet as a contra account.Depletion differs from depreciation in that it is not linked to any length of time and changes based on the amount of resources removed. You should be familiar with the definition of an asset in a company and how to account for them on the balance sheet. However, you may not know how an asset such as land with minerals is handled in accounting. Depending on the company and its resource / asset in use, these methods reduce the value of the asset / resource which is taken into account.Typically, we record natural resources at their cost of acquisition plus exploration and development costs; on the balance sheet, we report them at total cost less accumulated depletion. How does a company account for the value of the land as those assets are removed? Depreciation is the deduction of the asset value due to aging, whereas depletion is the actual physical reduction of the company’s natural resources (accounting for consumption).Land, however, has no definitive useful life, so there is no way to depreciate it. Instead, in the absence of natural resources that are to be extracted (see below), land is considered to have an unlimited life span.

AccountingTools

The yearly depletion cost is based on the units extracted or used for a given time period. Plant assets and natural resources are tangible assets used by a company to produce revenues. On the income statement, depreciation expense is recorded for plant assets and depletion expense is recorded for natural resources. On the balance sheet, accumulated depreciation appears with the related plant asset account and accumulated depletion appears with the related natural resource account. By crediting the Accumulated Depletion account instead of the asset account, we continue to report the original cost of the entire natural resource on the financial statements.

Example

Different accounting standards are in place to guide companies in accounting for both depreciation and depletion. E.g. computer equipment in a company would be considered for depreciation from the point of time of it in use. Whereas in the oil company, its resource will have depletion amount being calculated as it is used.

- Depreciation is the accounting term used for assets such as buildings, furniture and fittings, equipment etc.

- Companies use this to record the diminishing value of their assets as they are used in the business from the time of purchase of such assets.

- Hence cost is allocated periodically as value lost due to usage (as expense affecting the business’s net income) and the declining value of assets is recorded (affecting the value of business).

Unit 11: Plant Assets and Intangible Assets

Depreciation is calculated taking the cost of the asset, the expected useful life of the asset, residual value of the asset and percentage where necessary. Depreciation is not taken into account once the full cost of the asset is recovered / the asset is no longer in the company’s possession (i.e. sold, stolen and fully depreciated).Depletion is also different because it does not depend on any length of time but is directly related to the amount of resources removed. Depletion would be used when resources such as coal, precious metals, timber, or petroleum are to be extracted.Further, due to the scarcity of land, its value tends to increase over time, as opposed to the decline in value of most other types of fixed assets. On the balance sheet, we classify natural resources as a separate group among noncurrent assets under headings such as “Timber stands” and “Oil reserves”.

Example of Accumulated Depreciation

Depletion is an accrual accounting method used to allocate the cost of extracting natural resources such as timber, minerals, and oil from the earth. Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. The reason for using depreciation to gradually reduce the recorded cost of a fixed asset is to recognize a portion of the asset’s expense at the same time that the company records the revenue that was generated by the fixed asset.

Thus, statement users can see the percentage of the resource that has been removed. To determine the total cost of the resource available, we combine this depletion cost with other extraction, mining, or removal costs. We can assign this total cost to either the cost of natural resources sold or the inventory of the natural resource still on hand.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Cost depletion is typically part of the “DD&A” (depletion, depreciation, and amortization) line of a natural resource company’s income statement. Depletion is similar to depreciation, which is used to allocate the cost of tangible assets like factories and equipment over their useful lives. Depletion is used for natural resources, which can include minerals, ore, oil, gas, and timber. In particular, a company that extracts resources will use depletion to account for the use of these assets. Cost depletion is one of two accounting methods used to allocate the costs of extracting natural resources, such as timber, minerals, and oil, and to record those costs as operating expenses to reduce pretax income.

Hence, these methods help the company to record the asset / resource’s value as it reduces due to the usage, and hence, help to understand its value at a given time. Depletion expense is commonly used by miners, loggers, oil and gas drillers, and other companies engaged in natural resource extraction. Enterprises with an economic interest in mineral property or standing timber may recognize depletion expenses against those assets as they are used. Depletion can be calculated on a cost or percentage basis, and businesses generally must use whichever provides the larger deduction for tax purposes.The cumulative amount of depletion expense pertaining to the natural resources shown on the balance sheet. The account has a credit balance and will be reported on the balance sheet as a contra asset. Your company may purchase long-lived assets such as property, plant and equipment that you depreciate over their useful lives. Depreciation is how the Internal Revenue Service allows you to expense part of an asset’s cost over a number of years.Depreciation, depletion, and amortization (DD&A) is an accounting technique that enables companies to gradually expense various different resources of economic value over time in order to match costs to revenues. Depletion can only be used for natural resources, while depreciation is allowed for all tangible assets. Unlike depreciation, cost depletion is based on usage and must be calculated every period. Cost depletion is one of the two accounting methods used to allocate the costs of extracting natural resources. Depletion is the process of adjusting the value of a natural resource asset so that it accounts for the removal of the natural resources during the asset’s life.