Accounting Policies Definition(c) The effect of a change in accounting principle which is inseparable from the effect of a change in accounting estimate should be accounted for as a change in accounting estimate. Changes in estimate should be accounted for in the period of change and also in any affected future periods as a component of income from continuing operations. Financial statements are only restated for changes due to an error..Under IFRS, changes in accounting policies are a. Permitted if the change will result in a more reliable and more relevant presentation of the financial statements. Permitted if the emily encounters new transactions. events, or conditions that are substantively different from existing or previous transactions.

Which is a change in accounting policy?

A change in accounting principle is a change in how financial information is calculated, while a change in accounting estimate is a change in the actual financial information. Principle changes are done retroactively, where financial statements have to be restated, while estimate changes are not applied retroactively.Accounting principles are general guidelines that govern the methods of recording and reporting financial information. When an entity chooses to adopt a different method from the one it currently employs, it is required to record and report that change in its financial statements.

Key definitions [IAS 8.5]

An example of a change in accounting principle occurs when a company changes its system of inventory valuation, perhaps moving from LIFO to FIFO. Accounting policies are a set of standards that govern how a company prepares its financial statements. These policies may differ from company to company, but all accounting policies are required to conform to generally accepted accounting principles (GAAP) and/or international financial reporting standards (IFRS).Retrospective approach is used to account for changes in principles and reporting entity, and prospective approach is followed for changes in estimates. Accounting changes resulting from errors are dependent on when the errors are found out and if comparative financial statements are to be reported. For companies, following these approaches to report changes in accounting can be burdensome and time consuming, but they provide very useful information to the financial statement users.

IAS 8 — Accounting Policies, Changes in Accounting Estimates and Errors

Required for material transactions, if the entity had previously accounted for similar, though immaterial, transactions under an unacceptable accounting method. Required if an alternate accounting policy gives rise to a material change in assets, liabilities, or the current year net income.For investors or other users of financial statements, changes in accounting principles can be confusing to read and understand. The adjustments look very similar to error corrections, which often have negative interpretations. Changing an accounting principle is different from changing an accounting estimate or reporting entity. Accounting principles impact the methods used, whereas an estimate refers to a specific recalculation.

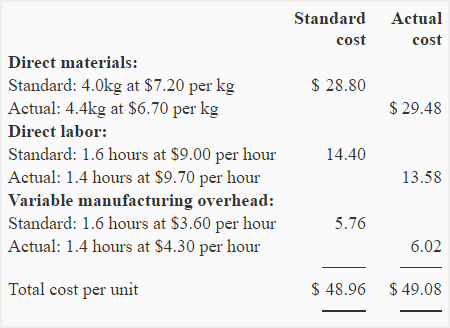

Changes in accounting estimates

However, if Company Z is under examination for 20X1 and the IRS makes an accounting change adjustment, the entire section 481(a) adjustment will be taxable in the year of examination. An indirect effect of a change in accounting principle is a change in an entity’s current or future cash flows from a change in accounting principles that is being applied retrospectively. Retrospective application means that you are applying the change in principle to the financial results of previous periods, as if the new principle had always been in use. Accounting policies are the specific principles and procedures implemented by a company’s management team that are used to prepare its financial statements.There are different and less stringent reporting requirements for changes in accounting estimates than for accounting principles. In some cases, a change in accounting principle leads to a change in accounting estimate; in these instances, the entity must follow standard reporting requirements for changes in accounting principles.

- For investors or other users of financial statements, changes in accounting principles can be confusing to read and understand.

- The adjustments look very similar to error corrections, which often have negative interpretations.

- Changing an accounting principle is different from changing an accounting estimate or reporting entity.

Accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements. (IAS 8)Events after Reporting Period are those that occur between the end of the reporting period and when the financial statements are authorized for issue.(b) The requirement is to identify the item that describes how changes in accounting principles are reported under IFRS. Answer (b) is correct because IFRS requires changes in accounting principles to be reported by giving retrospective application to the earliest period presented. Answer (a) is incorrect because a change in accounting estimate is accounted for on a prospective basis in the current and future periods. Answer (c) is incorrect because restatement is required for errors in the financial statements. Answer (d) is incorrect because cumulative adjustments on the income statement are not permitted.

What is the difference between a change in accounting estimate and a change in accounting principle?

A change in accounting estimate is an adjustment of the carrying amount of an asset or liability, or related expense, resulting from reassessing the expected future benefits and obligations associated with that asset or liability.

Changes in accounting policies

A change in accounting principle is the term used when a business selects between different generally accepted accounting principles or changes the method with which a principle is applied. Changes can occur within accounting frameworks for either generally accepted accounting principles, or GAAP, or international financial reporting standards, or IFRS. Figuring the Adjustment Period Company Z, a calendar-year corporation, has a net positive section 481(a) adjustment of $320,000 at the end of 20X1. If Company Z initiates a change in its accounting method under revenue procedure for the 20X2 tax year, the company will recognize one-fourth of the 481(a) adjustment in the four succeeding years, starting with 20X2.

European Union formally adopts amendments to IAS 1 and IAS 8 regarding the definition of materiality

These include any accounting methods, measurement systems, and procedures for presenting disclosures. Accounting policies differ from accounting principles in that the principles are the accounting rules and the policies are a company’s way of adhering to those rules. In conclusion, accounting changes are inevitable.

Disclosures relating to prior period errors

They are not against the accounting rules and regulations. Once they are adopted, accounting pronouncements should to be followed. FASB has set clear guidelines how to report changes in accounting.

IASB proposes new standard on general presentation and disclosures in financial statements

Errors include mathematical mistakes, mistakes in applying accounting principles, oversights or misuse of available facts, and changes from unacceptable accounting principles to GAAP. The situation described in this question does not meet the description of an en-or. International Accounting Standard 8 (IAS 8) defines accounting policies as “the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial statements”.