Accrued Interest Definition

Accrued Expense vs. Accrued Interest: What’s the Difference?

The use of accruals allows a business to look beyond simple cash flow. In a cash-based accounting approach, a company records only the transactions where cash changes hands.

Difference Between Accrued Expenses and Accounts Payable

Accrued expenses are those liabilities which have built up over time and are due to be paid. Accounts payable, on the other hand, are current liabilities that will be paid in the near future. Below, we go into a bit more detail describing each type of balance sheet item. The most common method of accounting used by businesses is accrual-basis accounting.

Is an accrual a payable?

accrued expenses payable definition. A liability account that reflects the estimated amount a company owes for expenses that occurred, but have not yet been paid nor recorded through a routine transaction.

What is Accounts Payable?

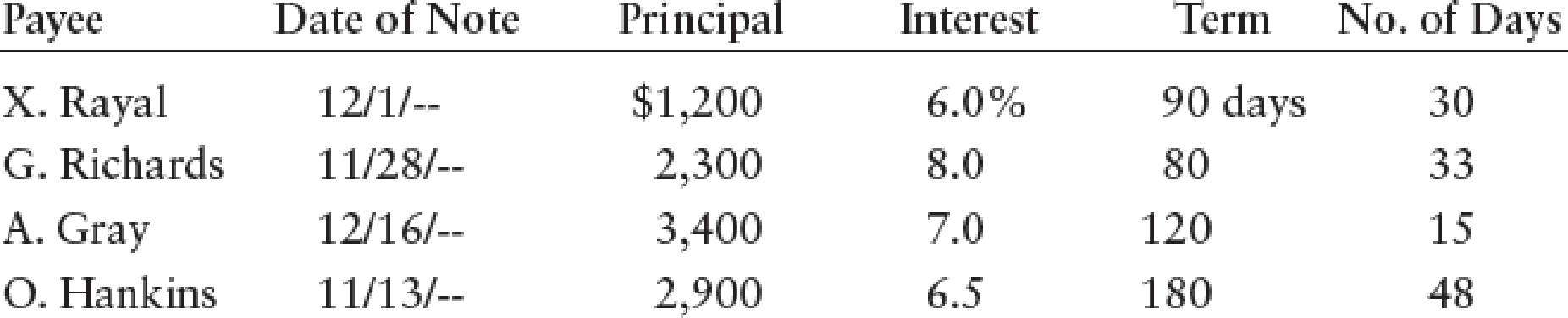

Interest payable is interest expense that has accumulated but not yet been paid. Most of the time, when we think about accounting, we think about the cash-basis method of accounting where revenue is recorded when cash is received and expenses are recorded when bills are paid.

Accrual

Instead, it records transactions only when it either pays out or receives cash. The cash basis yields financial statements that are noticeably different from those created under the accrual basis, since timing delays in the flow of cash can alter reported results.Accounts payable are recognized on the balance sheet when the company buys goods or services on credit. For example, a company delivers a product to a customer who will pay for it 30 days later in the next fiscal year, which starts a week after the delivery. The company recognizes the proceeds as a revenue in its current income statement still for the fiscal year of the delivery, even though it will not get paid until the following accounting period.This isn’t the only method of accounting, and most certainly not the one most businesses use. If a business records its transactions under the cash basis of accounting, then it does not use accruals.These types of accounts include, among others, accounts payable, accounts receivable, goodwill, deferred tax liability and future interest expense. Under the accrual accounting method, when a company incurs an expense, the transaction is recorded as an accounts payable liability on the balance sheet and as an expense on the income statement. As a result, if anyone looks at the balance in the accounts payable category, they will see the total amount the business owes all of its vendors and short-term lenders. When the expense is paid, the account payable liability account decreases and the asset used to pay for the liability also decreases.Accrued revenues are revenues that are earned in one accounting period, but cash is not received until another accounting period. Accrued expenses are expenses that have been incurred in one accounting period but won’t be paid until another accounting period. Accrual (accumulation) of something is, in finance, the adding together of interest or different investments over a period of time. It holds specific meanings in accounting, where it can refer to accounts on a balance sheet that represent liabilities and non-cash-based assets used in accrual-based accounting.Accounts payable (AP), sometimes referred simply to as “payables,” are a company’s ongoing expenses that are typically short-term debts which must be paid off in a specified period to avoid default. They are considered to be current liabilities because the payment is usually due within one year of the date of the transaction.

- In a cash-based accounting approach, a company records only the transactions where cash changes hands.

- The use of accruals allows a business to look beyond simple cash flow.

- Accruals form the base for accrual accounting and incorporate all transactions, including accounts receivable, accounts payable, employee salaries, etc.

accrued expenses payable definition

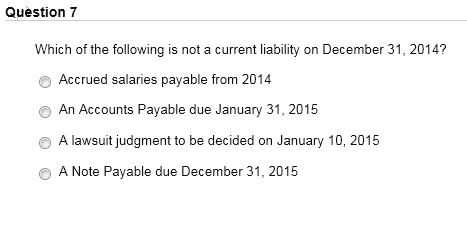

Two important parts of this method of accounting are accrued expenses and accrued revenues. Accrued expenses are expenses that are incurred in one accounting period but won’t be paid until another. Primary examples of accrued expenses are salaries payable and interest payable. Salaries payable are wages earned by employees in one accounting period but not paid until the next, while interest payable is interest expense that has been incurred but not yet paid. There are two key components of the accrual method of accounting.The proceeds are also an accrued income (asset) on the balance sheet for the delivery fiscal year, but not for the next fiscal year when cash is received. There are a few common types of accrued expenses and accrued revenues.

AccountingTools

The key difference between these terms is that accrued expense is recognized in the accounting books for the period it is incurred in whether cash is paid or not. Accounts payable is the payment to creditors who have made sales to the company on credit. Companies must account for expenses they have incurred in the past, or which will come due in the future. Accrual accounting is a method of tracking such accumulated payments, either as accrued expenses or accounts payable.

Where does accrued expense payable?

Accrual and account payable refer to accounting entries in the books of a company or business. Accruals refer to earned revenues and incurred expenses that have not actually been realized. Accounts payable are short-term debts, representing goods or services a company has received but not yet paid for.

What is accrual accounting in Oracle Apps?

Accruals form the base for accrual accounting and incorporate all transactions, including accounts receivable, accounts payable, employee salaries, etc. Recording an amount as an accrual provides a company with a more comprehensive look at its financial situation. It provides an overview of cash owed and credit given, and allows a business to view upcoming income and expenses in the following fiscal period.Falling under the accrued expenses category are salaries payable and interest payable. Salaries payable are wages earned by employees in one accounting period but not paid until another accounting period.Accrued revenues are revenues earned in one accounting period but not received until another. The most common forms of accrued revenues recorded on financial statements are interest revenue and accounts receivable. Interest revenue is money earned from investments, while accounts receivable is money owed to a business for goods or services that haven’t been paid for yet. Accrued revenues and accrued expenses are both integral to financial statement reporting because they help give the most accurate financial picture of a business. Accrued expenses and accounts payable are two important terms recorded in the balance sheet of organizations.