Advance paymentIn addition, you have to carefully monitor the cash value to make sure it doesn’t drop too far, or you may lose your coverage. But if you have a fairly large cash value with consistent returns, you can keep coverage in place for years at little to no additional cost. When you make premium payments on a cash-value life insurance policy, one portion of the payment is allotted to the policy’s death benefit (based on your age, health, and other underwriting factors). The second portion covers the insurance company’s operating costs and profits.Not all insurers offer this option but, with a paid up life insurance policy, the cash value is large enough that you can stop paying premiums out-of-pocket. The downside to paid-up whole life insurance policies is that each premium payment is also deducted from the policy’s death benefit. In addition, you have less cash value available for other purposes, such as a policy loan. Variable and universal life insurance policies are often favored because they allow you to use the policy’s cash value to pay premiums. This strategy will only work for a short period of time if you start while the cash value is too small or if interest rates are low.The cash value behaves like an investment as it grows tax-deferred with interest, as determined by the type of policy, and can be used as collateral for a loan. Dividends aren’t taxable as long as they don’t exceed the premiums you’ve paid in. Alternately, if someone has a life insurance policy they can sometimes sell the policy in what is known as a viatical settlement. A viatical settlement happens when someone sells their policy for more than their current cash value, but less than the death benefit payout. Investors buy groups of life insurance policies for more than their current cash value because with a large enough group of policies, they will make money from the death benefit payouts.

Accessing Cash Surrender Values

That’s why we generally don’t recommend a cash value life insurance policy if you’re fairly advanced in years. The older you are, the more likely that the cost of your premiums will outweigh any eventual benefit you see. If you need a permanent life insurance policy to cover estate taxes or leave an inheritance, guaranteed universal life insurance provides lifelong coverage with little to no cash value component. Universal life (UL) insuranceThis policy lets you vary your premium payments and adjust your death benefit as beneficiaries’ needs change.If you own a term or cash value life insurance policy that you no longer need, you may be wondering if it’s worth continuing to pay the premiums. You have several alternatives to choose from, but the simplest way is to surrender the policy altogether.

Real Business Advice!

The life insurance company generally invests this money in a conservative-yield investment. As you continue to pay premiums on the policy and earn more interest, the cash value grows over the years. Cash surrender value applies to the savings element of whole life insurance policies payable before death. However, during the early years of a whole life insurance policy, the savings portion brings very little return compared to the premiums paid.

Steps to Building a Million-Dollar Business With No Employees

Even a term policy can be sold in a viatical settlement if someone has a terminal illness and the investor wants to take the risk that the person will pass before the term is over. In either case, sufficient cash value must remain inside the policy to support the death benefit. With whole life insurance plans, loans are not considered cash surrenders, so the level of cash value is not affected.In most whole life insurance plans, the cash value is guaranteed, but it can only be surrendered when the policy is canceled. Policyholders may borrow or withdraw a portion of their cash value for current use. A policy’s cash value may be used as collateral for low-interest policy loans. If not repaid, the policy’s death benefit is reduced by the outstanding loan amount.

Exclusive Portfolio and Investment Advice, Banking, Lifestyle and Specials

If cash value growth falls below the minimum level of growth needed to sustain the death benefit, the policyholder is required to put enough money back into the policy to prevent it from lapsing. In most cases, the difference between your policy’s cash value and surrender value are the charges associated with early termination. Since your insurance provider does not want you to stop paying premiums or request an early withdrawal of funds, it often builds different fees and costs into policies to deter you from canceling your policy. Cash value, or account value, is equal to the sum of money that builds inside of a cash value-generating annuity or permanent life insurance policy.

Cash Surrender Value

- A portion of your premiums are paid into the investment account, or the cash value, and this money grows with interest over time.

- If you want to cash in your life insurance early and surrender your coverage to the insurer, you will receive the policy’s cash value minus fees.

- Cash value life insurance policies provide lifelong coverage alongside an investment account.

You have to be aware of how much is in your account and whether you need to make payments in order to keep the policy in force. These policies may offer lower premiums in exchange for a slow accumulation of cash value, if any. It’s an account within your policy that builds up over time, tax-deferred. Your premiums fuela portion of your premiums, as well as interest paid by the insurance company.Variable and universal life insurance policies – A partial withdrawal is similar to receiving a portion of the death benefit early, as the payout to beneficiaries is reduced by the amount you withdraw. So long as you don’t withdraw more money than you’ve paid in premiums, there are no taxes on the partial withdrawal. If you do withdraw more money than you’ve paid, then it will be taxed as income.

If you read the contract for your annuity or permanent life insurance policy, you will encounter insurance industry terms that sound similar, but mean very different things. This list includes terms such as face value, cash value, cash surrender value, surrender cost, and account value. The differences between these concepts are sometimes small, but they can make a large difference if you need to pull money from your policy.Cash value life insurance policies provide lifelong coverage alongside an investment account. A portion of your premiums are paid into the investment account, or the cash value, and this money grows with interest over time. If you want to cash in your life insurance early and surrender your coverage to the insurer, you will receive the policy’s cash value minus fees. However, you can also gain access to your cash value as a policy loan, use the cash value to pay premiums or make a partial withdrawal.

Cash Value vs. Surrender Value: What’s the Difference?

Some life insurance policies, especially variable universal and universal life insurance policies, may have surrender charges for the first years of the policy. A surrender charge is a charge from the cash value imposed by the insurance company for surrendering the contract early or withdrawing money early. Surrender charges can be very significant, especially in the early years of a policy. Always be aware of any possible surrender charges on your life insurance policy before you purchase the policy, and before you withdraw any money or surrender the contract in full.A life insurance policy’s cash value is separate from the death benefit, so your beneficiaries would not receive the cash value if you passed away. Cash value that’s left in your life insurance policy when you die is kept by the insurer. A life insurance policy’s cash value is essentially the amount of money you would receive if you decided to give up the policy to the insurer, or surrender your coverage.

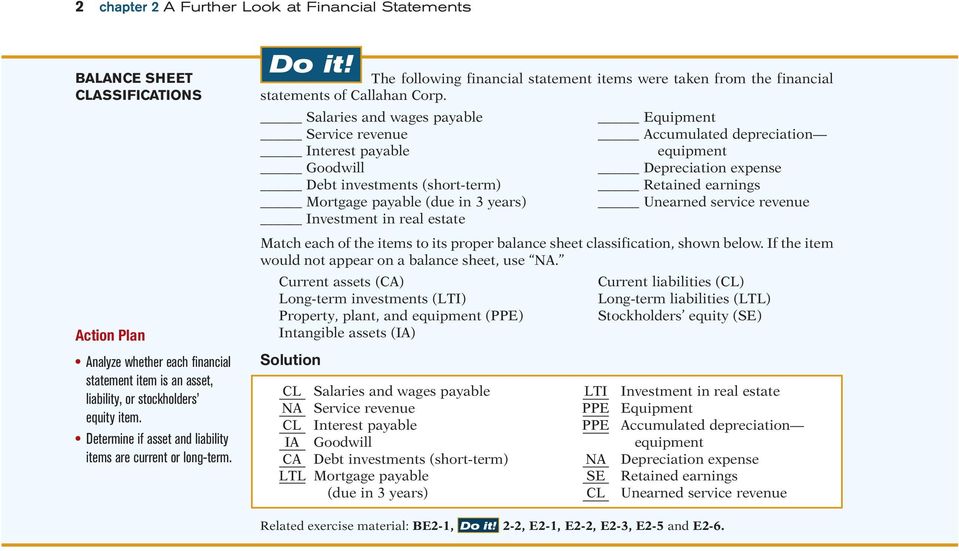

How do you account for cash surrender value of life insurance?

in insurance, the amount the insurer will return to a policyholder on cancellation of the policy. Sometimes abbreviated CSVLI (cash surrender value of life insurance), it shows up as an asset on the balance sheet of a company that has life insurance on its principals, called key man insurance.Your insurance or annuity provider allocates some of the money you pay through premiums toward investments—such as a bond portfolio—and then credits your policy based on the performance of those investments. Similarly, if you have a participating whole life insurance policy from a mutual insurer, you can also use any dividends you receive to purchase paid-up additions. Buying paid-up additions is similar to buying a small single-premium life insurance policy as you increase the policy’s cash value and death benefit but don’t have ongoing payments. The only case in which you’d get cash back from an insurer with a term life insurance policy is if you have a return of premium rider. This rider adds to the cost of your premiums but ensures that you’ll receive a portion or the sum of premiums paid if you live past the term of the policy.

The Complete 35-Step Guide for Entrepreneurs Starting a Business

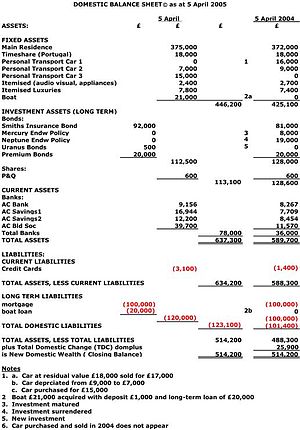

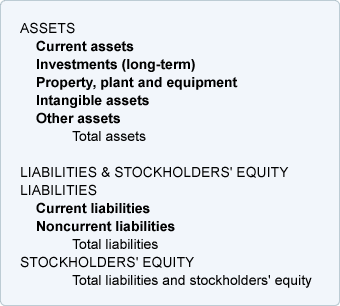

What is cash surrender value of life insurance on the balance sheet?

The cash surrender value of a life insurance policy is an asset a company can control, so it should be recorded on its balance sheet. A future death benefit is an economic benefit—one the company can’t control, so it should not be recorded as an asset.If you want to give up your coverage and cash out your life insurance policy, you should first determine if you can sell it in a life insurance cash settlement. You might want to consider this option if your premiums are quite high and you no longer have dependents, or they’re all financially secure. In a life insurance cash settlement, a company will purchase your life insurance policy for a greater amount than the policy’s cash value but less money than the death benefit. Some companies will even buy term life insurance policies for cash, but only if you’re quite old or sick, so likely to pass away during the policy term. Whole life insurance policies typically won’t let you pay premiums using the policy’s cash value unless you convert to a paid-up policy.