All About Advance Payments In Tally ERP 9Further, if such taxable perquisite value is not reported in the I-T returns, the I-T department may levy penalty ranging from 50% to 200% of the tax payable on the under-reported income,” Gupta further told TOI. An advance payment, or simply an advance, is the part of a contractually due sum that is paid or received in advance for goods or services, while the balance included in the invoice will only follow the delivery.

Tips are payments that customers make without compulsion and with the unrestricted right to determine the amount. For example, suppose you operate a restaurant and include a mandatory gratuity of 17% on the check of parties of eight or more. This isn’t a tip, it’s a service charge and it constitutes taxable wages upon its distribution to the employees.

How to Give a Payroll Advance

Or you may pay one of your computer technicians to set up your personal home computer. Unless certain dollar thresholds are met, your payments to those employees will not constitute taxable wages for payroll tax purposes.Let’s look at some examples that might arise in your business. “Employees must ensure that the employer deducts TDS on the total salary income, which includes the perquisite value of interest-free loans.Most gifts that you give to your employees are presumed to be compensatory in nature. Unless you can show that a gift is connected with an event that’s totally unrelated to your business (for example, an employee’s wedding), gifts to your employees are considered taxable wages for payroll tax purposes. Christmas gifts aren’t considered taxable wages if the gifts are items of property having nominal value (for example, a turkey or a ham). Similarly, when an employee is reimbursed in excess of the actual expenses incurred by the employee, such payments are considered taxable wages for the employee. In such a case, the employer is required to pay payroll tax on these payments (unless the employee returns the excess payment to the employer within a reasonable time).

State law sets the rules for payroll deductions.

Furthermore, noncash payments for casual labor will never be taxable. Payments you make to your employees for services they’ll perform or complete in the future are taxable wages for payroll tax purposes.

Business Owner’s Toolkit

Amounts you pay your employees while they’re serving on jury duty are considered taxable wages for payroll tax purposes, even though the payments may be for periods when the employees are absent from work. However, the taxable amount will differ depending on how you treat your employees’ jury duty pay. If you reduce regular wages by jury duty pay, payroll taxes apply to the reduced wage amount. If you pay the regular wage, but require employees to give jury pay to you, payroll taxes apply to the regular wage amount reduced by the jury duty pay. If you pay the regular wage and allow employees to keep jury pay, payroll taxes apply to only the regular wage amount.

Is advances to employees a financial asset?

Advance to employee or officer (employee advance) represents a cash payment (loan) made by the employer for the business expenses that are anticipated to be incurred by the employee or officer on behalf of the employer; and the employee is obligated to prove business expenses to the employer.The advance repayment amount is essentially a post-tax deduction. An employee payroll advance is not like loaning a few dollars to a friend. Your friend might pay you back sometime in the future when they have the funds, but there is no guaranteed time when you’ll get the loaned money back. Federal and state payroll tax laws generally identify taxable compensation as being an employee’s wages and broadly define “wages” to encompass virtually every payment to an employee for services rendered. Whenever you transfer something of value to an employee as compensation for the employee’s services, you’ve potentially made a taxable wage payment.If TDS is not deducted, the employee faces several consequences. Not only does he or she have to pay income tax on the perquisite value of the loan, but interest will also be payable for late deposit of advance tax.

- In general, “fair market value” is the amount an individual would pay an unrelated third party to obtain comparable benefits and property.

- For noncash payments, the amount of taxable wages is the fair market value of the benefits or property at the time of payment.

- One of the first issues you’ll need to consider if you choose to provide employees with taxable fringe benefits, lodging, equipment, or other noncash items is determining how much you paid.

How to Ask Your Boss for an Advance

Advances aren’t taxable wages if the employees are legally obligated to repay the advanced amounts. Advances to employees to cover expenses they’ll incur in performing services for you aren’t taxable wages if they’re made under an accountable plan. When employees find financial security at a job, they stay longer. This results in measurably reduced turnover cost which allows companies to be more competitive in all areas of their business.Before requesting an advance, consider the possible repercussions carefully. If your boss says no, you will have exposed your financial problems for no reason. If you’re nervous about doing so, exhaust all of your other options before requesting the advance.Furthermore, it shouldn’t be at all surprising that the same rule applies to your payments to employees who don’t take their vacations and instead receive additional amounts for the time they could have taken off. Cash tips that your employees receive from your customers may constitute taxable wages for payroll tax purposes. In contrast, non-cash tips, such as theater tickets, are never considered wages.

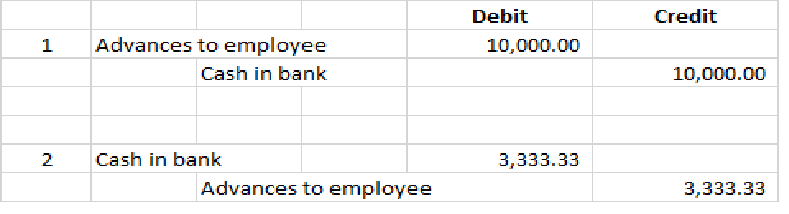

Example of Advance to an Employee

How do you record employee advances?

An advance paid to an employee is recorded as a current asset in the company’s balance sheet. There may not be a separate account in which to store advances, especially if employee advances are infrequent; possible asset accounts in which to store this information are: Employee advances (for high-volume situations)Instead, calculate taxes when you deduct the repayment amounts from the employee’s wages. You should calculate taxes based on the gross payroll amount, then deduct the repayment amount.

Related Questions

However, the law does include a rather lengthy list of fringe benefits that you can provide your employees without incurring any FICA or FUTA tax obligations. For the most part these fringe benefits are also excluded from an employee’s income for income tax purposes. You should assume that all compensation you pay to employees is taxable wages unless you’re aware that the law exempts a given payment from taxation.One of the first issues you’ll need to consider if you choose to provide employees with taxable fringe benefits, lodging, equipment, or other noncash items is determining how much you paid. For noncash payments, the amount of taxable wages is the fair market value of the benefits or property at the time of payment.

Advance payments are recorded as a prepaid expense in accrual accounting for the entity issuing the advance. Advanced payments are recorded as assets on the balance sheet. As these assets are used they are expended and recorded on the income statement for the period in which they are incurred. Insurance is a common prepaid asset, which will only be a prepaid asset because it is a proactive measure to protect business from unforeseen events.

Definition of advances to employees and officers

In general, “fair market value” is the amount an individual would pay an unrelated third party to obtain comparable benefits and property. Occasionally, you may pay workers to do work that doesn’t promote or advance your business. For example, during a slow business period you may pay an employee to do some work around your home.In fact, many people are finding out that their clients tend to be late in paying their invoices. According to Simply Business, small businesses have to wait 72 days on average to get their invoices paid. With DailyPay, employees can pay bills on time and avoid late fees, helping them to reach their financial goals. Companies have reported that DailyPay increases employee engagement and retention and helps to support recruitment. DailyPay is backed by leading venture capital firms and world-class strategic investors.