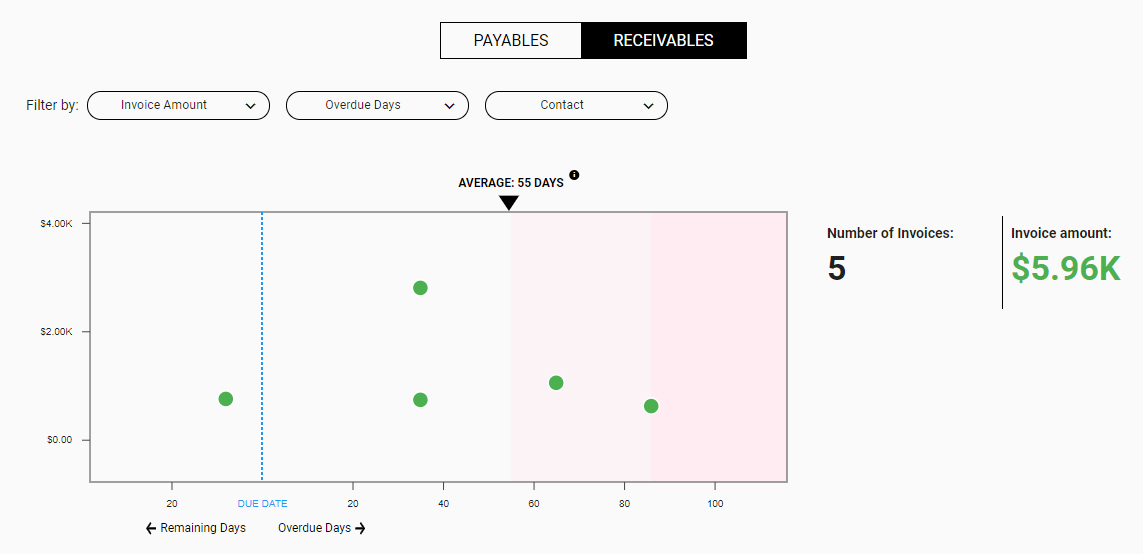

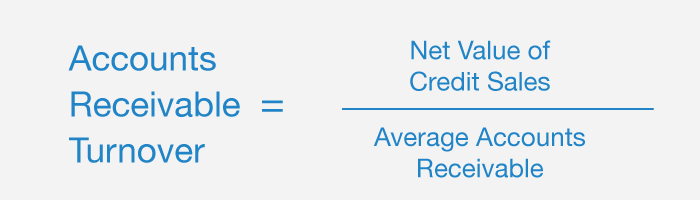

average payment periodThe accounts turnover ratio is calculated by dividing total net sales by the average accounts receivable balance. As a reminder, this ratio helps you look at the effectiveness of your credit, as your net credit sales value does not include cash since cash doesn’t create receivables. In other words, if an investor chooses a starting and ending point for calculating the receivables turnover ratio arbitrarily, the ratio may not reflect the company’s effectiveness of issuing and collecting credit. As such, the beginning and ending values selected when calculating the average accounts receivable should be carefully chosen so to accurately reflect the company’s performance. Investors could take an average of accounts receivable from each month during a 12-month period to help smooth out any seasonal gaps.

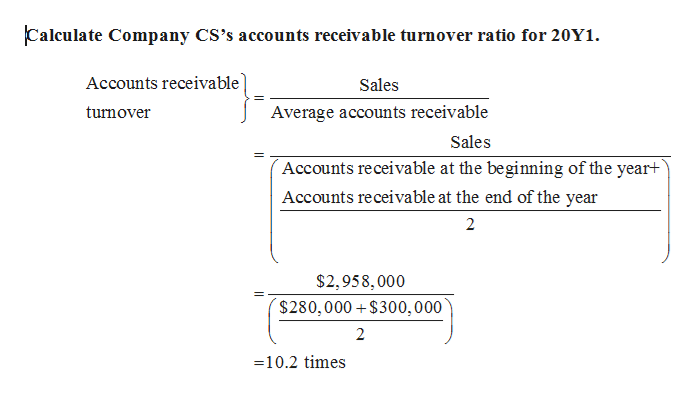

Accounts receivable turnover example

When companies fail to satisfy customers through shipping errors or products that malfunction and need to be replaced, your company’s turnover may slow. When it comes to business accounting, there are many formulas and calculations that, although seemingly complex, can nevertheless provide valuable insight into your business operations and financials.

Accounts receivable turnover

Not only is this important information for creditors, but it also helps the business more accurately plan its cash flow needs. It also allows the business to examine whether or not their credit policies are too restrictive or too generous. The debt to equity ratio is a measure of a company’s financial leverage, and it represents the amount of debt and equity being used to finance a company’s assets. It’s calculated by dividing a firm’s total liabilities by total shareholders’ equity. Furthermore, a low accounts receivable turnover rate could indicate additional problems in your business—ones that are not due to credit or collections processes.The ratio also measures how many times a company’s receivables are converted to cash in a period. The receivables turnover ratio could be calculated on an annual, quarterly, or monthly basis. The accounts receivable turnover ratio is an accounting measure used to quantify a company’s effectiveness in collecting its receivables or money owed by clients. The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is collected or is paid. The receivables turnover ratio is also called the accounts receivable turnover ratio.The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is collected or being paid. A high receivables turnover ratio can indicate that a company’s collection of accounts receivable is efficient and that the company has a high proportion of quality customers that pay their debts quickly. A high receivables turnover ratio might also indicate that a company operates on a cash basis. The receivables turnover ratio measures the efficiency with which a company collects on their receivables or the credit it had extended to its customers.While the total debt to total assets ratio includes all debts, the long-term debt to assets ratio only takes into account long-term debts. The debt ratio (total debt to assets) measure takes into account both long-term debts, such as mortgages and securities, and current or short-term debts such as rent, utilities and loans maturing in less than 12 months. Both ratios, however, encompass all of a business’s assets, including tangible assets such as equipment and inventory and intangible assets such as accounts receivables. Because the total debt to assets ratio includes more of a company’s liabilities, this number is almost always higher than a company’s long-term debt to assets ratio.It is also quite likely that a low turnover level indicates an excessive amount of bad debt. A/R turnover is an efficiency ratio that tells an analyst how quickly the company is collecting, or turning over, its accounts receivable based on the amount of credit sales it had in the period. It is calculated by dividing the total credit sales by the accounts receivable balance. Some companies use the average of the beginning of year A/R and end of year, while others simply use the end of year balance. The accounts receivable turnover ratio measures a company’s effectiveness in collecting its receivables or money owed by clients.

What is a good accounts receivable turnover ratio?

To calculate the accounts receivable turnover, start by adding the beginning and ending accounts receivable and divide it by 2 to calculate the average accounts receivable for the period. Take that figure and divide it into the net credit sales for the year for the average accounts receivable turnover.

Interpretation of Accounts Receivable Turnover Ratio

To calculate AR turnover, you need to start by finding average accounts receivable. Additionally, some companies, especially larger retailers such as Wal-Mart, have been able to negotiate much longer-than-average payment terms with their suppliers. If a retailer doesn’t offer credit to its customers, this can show on its balance sheet as a high payables balance relative to its receivables balance.Generally, the higher the accounts receivable turnover ratio, the more efficient your business is at collecting credit from your customers. Accounts Receivable is the total amount of money owed to your business by your customers from sales on account. AR is considered an asset of your business, as it represents an amount of cash you will collect at some future date.

Signs your debt is out of control

The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is converted to cash. Accounts receivable turnover ratio is calculated by dividing your net credit sales by your average accounts receivable. The ratio is used to measure how effective a company is at extending credits and collecting debts.

- The debt ratio (total debt to assets) measure takes into account both long-term debts, such as mortgages and securities, and current or short-term debts such as rent, utilities and loans maturing in less than 12 months.

- Both ratios, however, encompass all of a business’s assets, including tangible assets such as equipment and inventory and intangible assets such as accounts receivables.

- While the total debt to total assets ratio includes all debts, the long-term debt to assets ratio only takes into account long-term debts.

If the efficiency remains the same, the A/R balance should increase as sales increase, and fall as sales fall. Changes in the ratio indicate that something is changing in the way accounts receivable are being handled. Along with other standard financial statement analytic tools, the accounts receivable turnover ratio is a useful benchmark for a small business to track regularly. The ratio tells a story about the company’s sales and receivables cycle and can give management an early warning of trouble, in time to be able to correct its policies and procedures without serious financial damage.If the credit policy has changed to allow customers more time to pay, this can have a significant drag on a company’s resources, because it is money that is not coming in as quickly. If the problem is that customers are simply not paying on time, management needs to review collection policies to correct the problem quickly. Like most other financial statement ratios, A/R turnover is not relevant as a stand-alone number. It is the direction that a company’s turnover is going that tells a story as to whether the company is improving or declining.One such calculation, the accounts receivable turnover ratio, can help you determine how effective you are at extending credit and collecting debts from your customers. A company could improve its turnover ratio by making changes to its collection process. It’s important for companies to know their receivables turnover since its directly tied to how much cash they’ll available to pay their short term liabilities. Lastly, a low receivables turnover might not necessarily indicate that the company’s issuing of credit and collecting of debt is lacking.Large retailers can also minimize their inventory volume through an efficient supply chain, which makes their current assets shrink against current liabilities, resulting in a lower current ratio. To calculate the ratio, analysts compare a company’s current assets to its current liabilities. Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory and other assets that are expected to be liquidated or turned into cash in less than one year.

Since the receivables turnover ratio measures a business’ ability to efficiently collect itsreceivables, it only makes sense that a higher ratio would be more favorable. Higher ratios mean that companies are collecting their receivables more frequently throughout the year. For instance, a ratio of 2 means that the company collected its average receivables twice during the year. In other words, this company is collecting is money from customers every six months. This means that Primo collects nearly their entire AR balance at least eight times per year and that it is taking about one-and-a-half months or about 45 days after a sale is made to collect the cash.

What is the Accounts Receivable Turnover Ratio?

Current liabilities include accounts payable, wages, taxes payable, and the current portion of long-term debt. If the accounts receivable balance is increasing faster than sales are increasing, the ratio goes down. The two main causes of a declining ratio are changes to the company’s credit policy and increasing problems with collecting receivables on time.

Example of the Accounts Receivable Turnover Ratio

How do you find average accounts receivable?

Average accounts receivable is the sum of starting and ending accounts receivable over a time period (such as monthly or quarterly), divided by 2.However, the AR balance tells creditors and investors very little about your business. To use the information, they will want to know accounts receivable turnover, or how often you are collecting the value of your accounts receivable.

What Is the Receivables Turnover Ratio?

Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable. The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner. A high turnover ratio indicates a combination of a conservative credit policy and an aggressive collections department, as well as a number of high-quality customers. A low turnover ratio represents an opportunity to collect excessively old accounts receivable that are unnecessarily tying up working capital. Low receivable turnover may be caused by a loose or nonexistent credit policy, an inadequate collections function, and/or a large proportion of customers having financial difficulties.