Bank Reconciliation

The difference between book and bank balances…

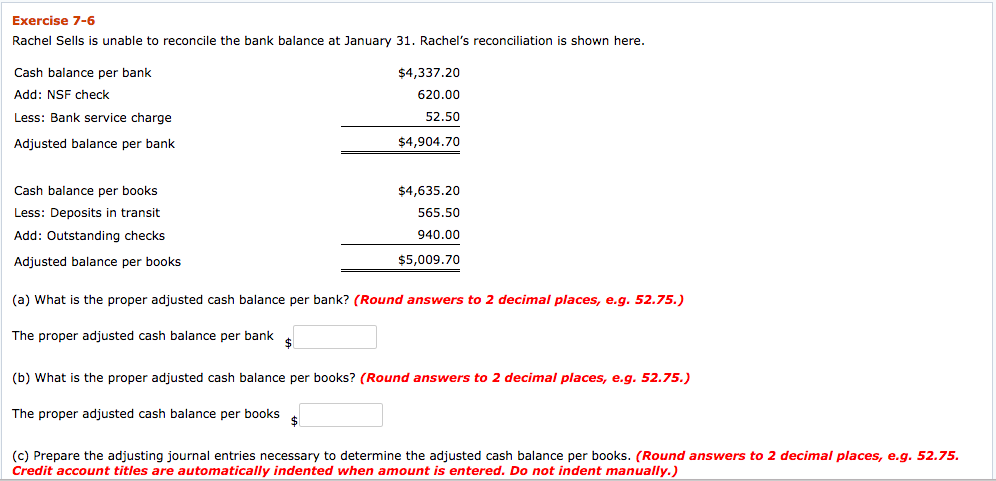

If you’re unclear about a business or personal bank transaction, contact your bank. If there is no undocumented reconciling item, print the bank reconciliation and store it. A check payment that has been recorded by the issuing entity, but which has not yet cleared its bank account as a deduction from cash.Once you finish all of your reconciliation work, your (cash account balance) plus or minus all (reconciling items) should equal the (balance per the bank statement). If that formula does not equal, review your work until you account for all of the reconciling items correctly. When the check posts to the bank account, it is a fraudulent transaction.Then there are always checks or deposits that have not cleared when the bank statement was printed, so the balance is different than what is in the account register. If the bank statement indicates that a “not sufficient funds” check bounced during the month, that means that the check amount was not deposited to your account. You will have to deduct the check amount from your cash account records. If the bank charges you a fee for depositing a bad check, you will also need to deduct that amount.

A company will probably have accounting software that can provide reports.If you’re reconciling your personal bank account, you should review your check register and your deposit slips. A company should print the cash reports, and also review the check register and deposit slips. A bank reconciliation is a critical tool for managing your cash balance. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement.A bank reconciliation will also detect some types of fraud after the fact; this information can be used to design better controls over the receipt and payment of cash. If you are not out of balance for the previous reconciliation the problem is with the CURRENT reconciliation. Check for bank fees, direct debits, un-entered (forgotten) transactions, duplicate entries, or transactions that may have been incorrectly entered. You should also check for any errors on the bank statement. The details of how the petty cash is spent and how much money is left in the petty cash fund are not part of the bank reconciliation.Bank service charges, check printing charges, and other electronic deductions that are not yet recorded in the company’s accounts will become deductions from the cash balance per the books. Electronic deposits not yet recorded by the company will become additions to the cash balance per books. Outstanding checks are a deduction to the balance per bank; deposits in transit are an addition to the balance per bank. And then you’ll be limited to the daily withdraw limit set by your bank.

Want to Increase Your Cash flow?

By completing a bank reconciliation every day, you can spot and correct problems immediately. To prepare a bank reconciliation, gather your bank statement and a list of all of your recent transactions. If you find an error on the bank’s part, contact them as soon as possible to let them know about the discrepancy.

What is the difference between bank balance and book balance?

The balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity. Assets = Liabilities + Equity to the corresponding amount on its bank statement. Reconciling the two accounts helps determine if accounting changes are needed.Each bank is different but it is generally between $200 and $400 per day. If you need to withdraw a larger amount, you’ll most likely have to go and make a withdrawal from a teller inside the bank during regular business hours.|||NO. Your available balance and current balance are usually never the same.

Video Explanation of Bank Reconciliation

If it has not yet cleared the bank by the end of the month, it does not appear on the month-end bank statement, and so is a reconciling item in the month-end bank reconciliation. It is even better to conduct a bank reconciliation every day, based on the bank’s month-to-date information, which should be accessible on the bank’s web site.

- If this occurs at month-end, the deposit will not appear in the bank statement, and so becomes a reconciling item in the bank reconciliation.

- A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement.

- Cash and/or checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the entity deposits the funds.

Part 1 of 2: Adjusting the Bank Statement Balance

This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions. As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement. You may have recorded a transaction incorrectly or forgotten to record a transaction. Sometimes people make addition or subtraction errors.Cash and/or checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the entity deposits the funds. If this occurs at month-end, the deposit will not appear in the bank statement, and so becomes a reconciling item in the bank reconciliation.This helps individuals and businesses to prove that every transaction sums to the accurate ending account balance. No matter the size and stage of a business account reconciliation are quintessential for them all. Common controls used with a bank account are the use of a signature card, deposit tickets, checks, bank statements, and bank reconciliations. Check off in the bank reconciliation module all deposits that are listed on the bank statement as having cleared the bank.They can help you out.|||Both are wrong !!! Reconciliation is a fundamental accounting process of matching and balancing two sets of records. This would mean that the money leaving the account is matching the money spent. This is done by reconciling at the end of a particular accounting period by reviewing documents and analytics.

Bank Reconciliation Procedure:

You will also be charged if you overdraw your account. Check for any errors made by the bank’s processing department. If you’re reconciling a business cash account, your accounting is posted to general ledger. A business should compare the cash account’s general ledger to the bank statement activity. You may come across a transaction that you cannot fully explain.You have to take in account how many checks you have pending and holds on your account and a lot of other factors. Depending on your bank, there may be restrictions on how much you can withdraw per day on your card, if you have a problem talk to someone at your bank.

How to Prepare a Bank Reconciliation

How is balance calculated on a bank statement?

Balance per bank is the ending cash balance appearing on a bank statement. A business will make adjusting entries to its own cash book balance to reconcile the difference between its own balance and the balance per bank. Examples of these adjustments are to record the fees for check processing and bank overdrafts.A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate. The information on the bank statement is the bank’s record of all transactions impacting the entity’s bank account during the past month. When your company receives the bank statement, you should print a report listing all of the checks written and deposits made during the month.

Then, go to the company’s ending cash balance and deduct from it any bank service fees, NSF checks and penalties, and add to it any interest earned. At the end of this process, the adjusted bank balance should equal the company’s ending adjusted cash balance. A bank reconciliation should be completed at regular intervals for all bank accounts, to ensure that a company’s cash records are correct. Otherwise, it may find that cash balances are much lower than expected, resulting in bounced checks or overdraft fees.

Bank Reconciliation

These definitions are different from how the accounting profession uses these terms. If an item is on the bank statement but has not yet been entered on the books, the items are noted as an adjustment to the balance per books.