Cash reconciliation — AccountingToolsYou don’t need to wait on the check (especially if it goes through the mail), and you don’t need to go to the trouble of depositing the check. As a bonus, the money might even hit your account a day or two before the checks are printed, and some banks offer same-day availability for those payments. One reason banks do this is so that they can send the majority of the day’s work on to the processing center so that everything can be handled by midnight. The petty cash account should be reconciled and replenished every month to ensure the account is balanced and any variances are accounted for. The accountant should write a check made out to “Petty Cash” for the amount of expenses paid for with the petty cash that month to bring the account back up to the original amount.When your account is no longer in the negative, it is restored to good standing, and the restrictions are lifted. The company may sometimes record a deposit incorrectly, or it may deposit a check for which there are not sufficient funds.

What is Bank Reconciliation?

The term is most commonly applied to the balance in a company’s checking account at the end of an accounting period. An organization uses the bank reconciliation procedure to compare its book balance to the ending cash balance in the bank statement provided to it by the company’s bank. In previous accounting tips, we have looked at the different kinds of financial statements a business prepares. Some examples of this are the balance sheet, income statement, and cash flow statement.When reconciling the bank statement, the balance per books is the balance of the Cash account in the general ledger that pertains to the bank account. “How Quickly Can I Get Money After I Deposit a Check Into My Checking Account? What Is a Deposit Hold?” Accessed April 1, 2020.

What is Adjusted Cash Balance?

Also, you could end up bouncing checks of your own and racking up fees as a result. A book balance is the account balance in a company’s accounting records.A bank levy also refers to the legal act of freezing a bank account in an attempt to recover a debt. Regulators or a court may freeze accounts if the account holder fails to disburse payments that are due or other violations.

Reasons for Difference Between Bank Statement and Company’s Accounting Record

Sometimes you’ll see an available balance that’s lower than your current balance. In those cases, you can only spend your available balance (or less if you have outstanding checks), and the rest of the money is being held by your financial institution. Current balances include all of your money, including all available funds PLUS funds that are being held. Sometimes you’ll see an available balance that’s lower than your account balance. In those cases, you can only spend your available balance (or less if you have outstanding checks), and the rest of the money is being held by your bank.

Record Cash Expenses

If so, and the bank spots the error, the company must adjust its book balance to correct the error. Upon acceptance of the Project Costing distribution the General Ledger Distribution window is displayed allowing users to record distribution to the General Ledger. The data entry screen for the General Ledger distribution program is displayed below. Select OK to accept the adjustment entry or Cancel to change the adjustment amount field. The data entry screen for the Project Costing distribution program is displayed below.

How and when does my Current Balance get updated?

In other words, BRS is a statement which is prepared for reconciling the difference between balances as per cash book’s bank column and passbook on a given date. Note that the Balance Sheet is not affected with the result of the above entry as the cash flow is between two asset accounts. A bank levy is a UK tax on banks, forcing them to pay government taxes over and above any normal corporate taxes they may incur.

- A restricted account may limit or prevent you from withdrawing funds.

- It may even limit the number of deposits you can make and checks you can write.

- However, banks and government organizations have the authority to place restrictions on bank accounts.

What is difference between book balance and available balance?

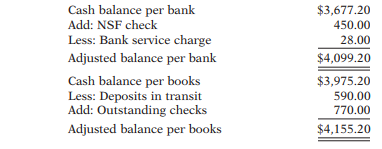

Bank Reconciliation Procedure: Using the cash balance shown on the bank statement, add back any deposits in transit. Deduct any outstanding checks. This will provide the adjusted bank cash balance. Next, use the company’s ending cash balance, add any interest earned and notes receivable amount.These are transactions that are recorded between cash and bank accounts. Although banks are becoming more digital and tech-savvy, it may take up to several days for new funds to become available to withdraw as cash or write checks on. When you deposit a check or receive a direct deposit in your bank account, you may expect the money to be accessible immediately, but this may not always be the case. Government agencies can place restrictions on a bank account.

How do you calculate adjusted cash balance per book?

balance per books definition. The amount appearing in the general ledger. When reconciling the bank statement, the balance per books is the balance of the Cash account in the general ledger that pertains to the bank account.If you fail to pay your taxes, the Internal Revenue Service has the ability to seize assets, including your bank account. You can still make deposits, but you are unable to withdraw funds. If your account has been overdrawn due to insufficient funds, the bank likely will restrict your account. Any checks written or pending purchases against the account may be declined.The check should be cashed at the company’s bank and the cash placed back in the petty cash safe or lock box. Petty cash is a current asset and should be listed as a debit on the company balance sheet. To initially fund a petty cash account, the accountant should write a check made out to “Petty Cash” for the desired amount of cash to keep on hand and then cash the check at the company’s bank.

Sometimes the bank balances as per cash book and bank statement doesn’t match. In case balance available in the passbook doesn’t match the bank column of the cash book, the business should identify the reasons for the same. A contra entry is recorded when the debit and credit affect the same parent account and resulting in a net zero effect to the account.

Video Explanation of Bank Reconciliation

The journal entry on the balance sheet should list a debit to the business bank account and a credit to the petty cash account. When petty cash is used for business expenses, the appropriate expense account — such as office supplies or employee reimbursement — should be expensed. The CFPB also wants consumers to know that deposits can clear especially quickly if they’re made from an account at the same bank, from a government check, or via cash, money order, or certified check. Although this can be inconvenient, these holds can protect you. So if you spend themoney from a bad check, you’ll have to replace those funds in your bank account (plus pay fees to your bank).

Calculating the Bank Reconciliation Book Balance Amount for History Bank Reconciliation

However, banks and government organizations have the authority to place restrictions on bank accounts. A restricted account may limit or prevent you from withdrawing funds. It may even limit the number of deposits you can make and checks you can write.In some cases, an account holder can place restrictions on his own account. If your employer still pays you with a check, sign up for electronic payments so that the money goes directly from your employer’s bank account to your bank account.Now, start bank reconciliation statement with updated cash book balance. It‘s not compulsory to prepare a BRS and there’s no fixed date for preparing BRS. BRS is prepared on a periodical basis for checking that bank related transactions are recorded properly in cash book’s bank column and also by the bank in their books. BRS helps to detect errors in recording transactions and determining the exact bank balance as on a specified date. For reconciling the balances as shown in the Cash Book and passbook a reconciliation statement is prepared known as Bank Reconciliation Statement or BRS.