Cashier’s Check vs. Money Order: What’s the Difference?

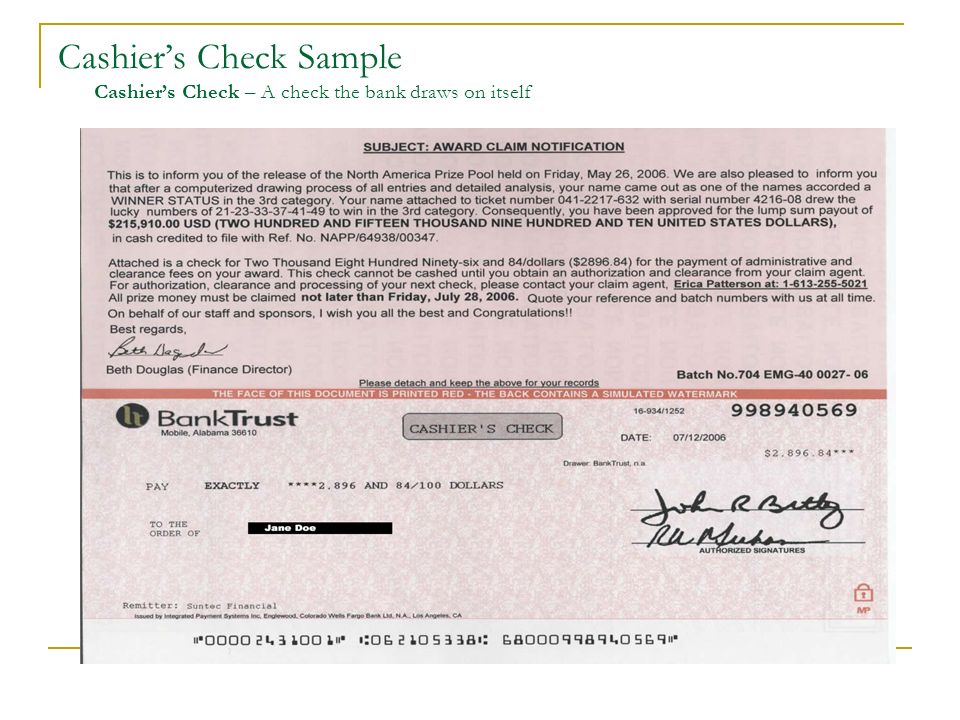

Examples of Cashier’s Check Scams

As a result, they shouldn’t bounce (or get returned unpaid) like personal checks. In many nations money orders are a popular alternative to cashier’s checks and are considered safer than personal bank checks. However, in the United States, they are generally not recognized as “guaranteed funds” under Reg CC and are limited to a specified maximum amount ($1,000 or less under U.S. law for domestic postal money orders). Due to an increase in fraudulent activities, starting in 2006 many banks insist upon waiting for a cashier’s check to clear the originating institution before making funds available for withdrawal.A cashier’s check looks much like a personal check, but it carries the signature of a bank teller or cashier instead of the purchaser. When you buy a cashier’s check at a bank, you designate the recipient and the amount, and the bank takes that money immediately from your account. From that point on, the bank is responsible for paying the recipient, who can now deposit the cashier’s check and receive the funds. Payment usually clears within one day, making cashier’s checks much quicker than other forms of payment.

Cashier’s Check vs. Money Order: An Overview

Personal checks will thus have the same utility in such transactions. Genuine cashier’s checks deposited into a bank account are usually cleared the next day. The customer can request “next-day availability” when depositing a cashier’s check in person. Forged cashier’s checks may bounce 2 weeks after being deposited. A cashier’s check (or cashier’s cheque) is a check guaranteed by a bank, drawn on the bank’s own funds and signed by a cashier.

How Do You Get a Cashier’s Check?

In theory, checks issued by a financial institution but drawn on another institution, as is often the case with credit unions, are teller’s checks. A cashier’s check is a form of guaranteed payment that is paid with a bank’s own funds, rather than with money from a personal account. You can get a cashier’s check by requesting one at your local bank branch and permitting them to debit the funds from your bank account. The counterfeit cashier’s check scam is a scheme wherein the victim is sent a cashier’s check or money order for payment on an item for sale on the Internet.

This gives the victim a false feeling of security that the money order was real, so they proceed with the transaction. When the bank eventually discovers that the money order is counterfeit and reverses the account credit many days later, the customer will usually have already mailed the item. In many cases the “check” or “money order” is for more than the amount owed, and the victim is asked to refund the difference in cash. In the United States, under Article 3 of the Uniform Commercial Code, a cashier’s check is effective as a note of the issuing bank.

Cashier’s Check vs. Other Forms of Payment

Some banks contract out the maintenance of their cashier’s check accounts and check issuing. One leading contractor is Integrated Payment Systems, which issues cashier’s checks and coordinates redemption of the items for many banks, in addition to issuing money orders and other payment instruments.Cashier’s checks are treated as guaranteed funds because the bank, rather than the purchaser, is responsible for paying the amount. They are commonly required for real estate and brokerage transactions. Money orders are a cheaper but limited alternative to checks. Rather than going to a bank to draft a check, you can purchase a money order from the post office or a Western Union location. While money orders have a $1,000 limit on their value, they are just as safe as cashier’s checks and certified checks.

What Are the Best Ways to Get a Cashier’s Check?

- From that point on, the bank is responsible for paying the recipient, who can now deposit the cashier’s check and receive the funds.

- When you buy a cashier’s check at a bank, you designate the recipient and the amount, and the bank takes that money immediately from your account.

- A cashier’s check looks much like a personal check, but it carries the signature of a bank teller or cashier instead of the purchaser.

If you don’t have a checking account at a bank or credit union, you might need to open one. Banks and credit unions are the only institutions that can issue cashier’s checks, and they aren’t required to provide them to people who aren’t customers. Some do it, but at least three national banks don’t issue them to anyone but account holders.When a counterfeit is discovered after the deposit, the bank will take back the funds from the payee, which can cause terrible problems if the funds are already withdrawn or spent. @Keshlam, in most states, the bank would be required after a certain period of time to turn the money over to the state so that the state can determine who it goes to. They must then use a money-transfer service to send the funds to the scammer and “evaluate” the service. In a real estate transaction, nobody wants to wait for processing on a personal check. Again, it’s a significant amount of money—so down payments often happen with a cashier’s check or wire transfer.The length of a hold varies (2 days to 2 weeks) depending on the bank. It is not clear what length of time may pass before a bank can be held responsible for accepting a bad cashier’s check. Many of these banks offer free cashier’s checks to their premium checking account-holders, who pay higher maintenance fees or meet higher minimum deposit requirements in exchange for more bank services.A cashier’s check is a secure way to make large payments. The check itself is written by a financial institution such as a bank or credit union against its own funds.

How does a cashiers check work?

Cashier’s checks, also known as teller’s checks, are checks that draw on the bank’s own funds to make the payment. They’re as good as money in the bank because, well, they are the bank’s money in the bank. Once a bank creates a cashier’s check, the bank guarantees to pay the amount printed on the check.

Low-Cost Ways To Transfer Money

If opening a bank account isn’t practical, a money order might be your next-best option. When you deposit a check, you might see the money in your account, but you can’t withdraw all of that money until the bank “clears” the deposit. With personal checks, that might take several days or weeks, but with cashier’s checks and government-issued checks, the funds are typically available within one business day.Typically, banks charge from $25 to $30 each month in maintenance on a premium checking account, which roughly translates to three or four cashier’s checks per month. Obtaining a cashier’s check requires visiting a bank or credit union, but not every place issues cashier’s checks to non-customers. The few that do will often charge extra for the service. This means it’s most logical to start looking at your own bank, where you can have the necessary funds transferred out of your existing checking or savings account.

Is a cashier’s check the same as cash?

The upside of using a cashier’s check to pay someone (or receive payment) in place of a personal check or cash is that it is secure. Because the bank takes the money directly from your account and puts it into its own, the check is guaranteed not to bounce.

Likewise, brokerage firms may require settled funds for certain transactions, and cashier’s checks can be used to satisfy that need. They are considered “safe” forms of payment because you can only purchase them with cash (or cash-like instruments such as a debit card or cash advance on a credit card).

What Is a Cashier’s Check?

When you request a cashier’s check from your bank, money is moved out of your account and into the bank’s account, and then a bank representative (usually a teller) signs it over to a named third party. Because banks are required to make the funds from a cashier’s check available within one day, a fake check will often escape detection until the payee has already received the money.