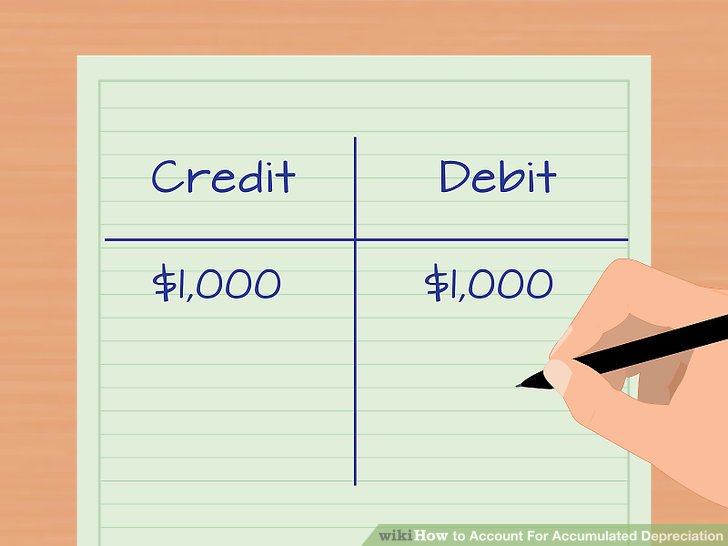

Depreciation DefinitionThe journal entry for this depreciation consists of a debit to depreciation expense, which flows through to the income statement, and a credit to accumulated depreciation, which is reported on the balance sheet. Accumulated depreciation is a contra asset account, meaning its natural balance is a credit which reduces the net asset value. Accumulated depreciation on any given asset is its cumulative depreciation up to a single point in its life. Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero.

What is accumulated depreciation on the balance sheet?

Accumulated depreciation is the total amount of a plant asset’s cost that has been allocated to depreciation expense (or to manufacturing overhead) since the asset was put into service. Accumulated Depreciation is credited when Depreciation Expense is debited each accounting period.

Understanding Accumulated Depreciation

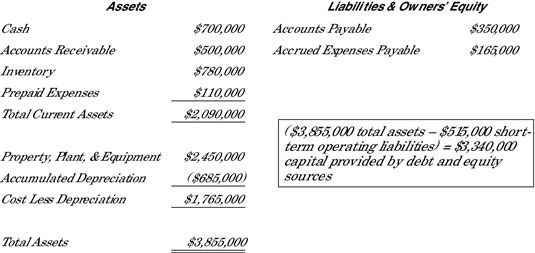

Depreciation expense is recognized on the income statement as a non-cash expense that reduces the company’s net income. For accounting purposes, the depreciation expense is debited, and the accumulated depreciation is credited. Let’s assume that at the beginning of the current year a company’s asset account Equipment reported a cost of $70,000.

AccountingTools

Accumulated depreciation is the cumulative depreciation of an asset that has been recorded.Fixed assets like property, plant, and equipment are long-term assets. Depreciation expenses a portion of the cost of the asset in the year it was purchased and each year for the rest of the asset’s useful life.If a company buys a piece of equipment for $50,000, it could expense the entire cost of the asset in year one or write the value of the asset off over the asset’s 10-year useful life. Most business owners prefer to expense only a portion of the cost, which boosts net income. Depreciation is an accounting convention that allows a company to write off an asset’s value over a period of time, commonly the asset’s useful life. Instead of realizing the entire cost of the asset in year one, depreciating the asset allows companies to spread out that cost and generate revenue from it. Understanding and accounting for accumulated depreciation is an essential part of accounting.While the process can be moderately challenging, you can learn how to account for accumulated depreciation by following a few simple steps. In doing so, you will have a better understanding of the life-cycle of an asset, and how this appears on the balance sheet. Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life.Accumulated depreciation is the sum of depreciation expense over the years. The carrying amount of Fixed assets in the balance sheet is the difference between the cost of asset and total accumulated depreciation.Private companies in the United States, however, may elect to amortize goodwill over a period of ten years or less under an accounting alternative from the Private Company Council of the FASB. At the end of an accounting period, an accountant will book depreciation for all capitalized assets that are not fully depreciated.

When to Use Depreciation Expense Instead of Accumulated Depreciation

Accumulated depreciation allows investors and analysts to see how much of a fixed asset’s cost has been depreciated. The most basic difference between depreciation expense and accumulated depreciation lies in the fact that one appears as an expense on the income statement, and the other is a contra asset reported on the balance sheet. To spread the cost of a capital asset, a corporate bookkeeper debits the depreciation expense account and credits the accumulated depreciation account. The last item is a contra-asset account that reduces the worth of the corresponding fixed resource.

The amount of a long-term asset’s cost that has been allocated to Depreciation Expense since the time that the asset was acquired. Accumulated Depreciation is a long-term contra asset account (an asset account with a credit balance) that is reported on the balance sheet under the heading Property, Plant, and Equipment.

- Goodwill in accounting is an intangible asset that arises when a buyer acquires an existing business.

- Goodwill represents assets that are not separately identifiable.

- Goodwill also does not include contractual or other legal rights regardless of whether those are transferable or separable from the entity or other rights and obligations.

If not, accumulated depreciation equals the asset’s book value minus its residual worth. “Fixed asset” is what finance people call a tangible asset, capital resource, physical asset or depreciable resource.Goodwill in accounting is an intangible asset that arises when a buyer acquires an existing business. Goodwill represents assets that are not separately identifiable. Goodwill also does not include contractual or other legal rights regardless of whether those are transferable or separable from the entity or other rights and obligations. Goodwill is also only acquired through an acquisition; it cannot be self-created.

Example of Accumulated Depreciation

From the time the equipment was put into service until the beginning of the year the related Accumulated Depreciation account shows a credit balance of $45,000. During the current year the company debits Depreciation Expense for $10,000 and credits Accumulated Depreciation for $10,000. Therefore, at the end of the current year the credit balance in Accumulated Depreciation is $55,000. The accumulated depreciation account is acontra asset accountthat lowers thebook valueof the assets reported on the balance sheet. Fixed assets are always listed at their historical cost followed by the accumulated depreciation.Instead, management is responsible for valuing goodwill every year and to determine if an impairment is required. If the fair market value goes below historical cost (what goodwill was purchased for), an impairment must be recorded to bring it down to its fair market value. However, an increase in the fair market value would not be accounted for in the financial statements.Depreciation allows a company to divide the cost of an asset over its useful life, which helps prevent a significant cost from being charged when the asset is initially purchased. Depreciation is an accounting measure that allows a company to earn revenue from the asset, and thus, pay for it over its useful life. As a result, the amount of depreciation expense reduces the profitability of a company or its net income. Accumulated depreciation is the total depreciation expense a business has applied to a fixed asset since its purchase. At the end of an asset’s operating life, its accumulated depreciation equals the price the corporate owner originally paid — assuming the resource’s salvage value is zero.Examples of identifiable assets that are goodwill include a company’s brand name, customer relationships, artistic intangible assets, and any patents or proprietary technology. The goodwill amounts to the excess of the “purchase consideration” (the money paid to purchase the asset or business) over the net value of the assets minus liabilities. It is classified as an intangible asset on the balance sheet, since it can neither be seen nor touched. Under US GAAP and IFRS, goodwill is never amortized, because it is considered to have an indefinite useful life.

How to Calculate Accumulated Depreciation?

The A/D can be subtracted from the historical cost to arrive at the current book value. This presentation allows investors and creditors to easily see the relative age and value of the fixed assets on the books. It also gives them an idea of the amount of depreciation costs the company will recognize in the future. A company can increase the balance of its accumulated depreciation more quickly if it uses an accelerated depreciation over a traditional straight-line method. An accelerated depreciation method charges a larger amount of the asset’s cost to depreciation expense during the early years of the asset.

What is mean by accumulated depreciation?

Accumulated depreciation is the running total of depreciation that has been expensed against the value of an asset. Fixed assets are recorded as a debit on the balance sheet while accumulated depreciation is recorded as a credit–offsetting the asset.

Why is Accumulated Depreciation a Credit Balance?

The accumulated depreciation lies right underneath the “property, plant and equipment” account in a statement of financial position, also known as a balance sheet or report on financial condition. Depreciation expense flows through an income statement, and this is where accumulated depreciation connects to a statement of profit and loss — the other name for an income statement or P&L. Depreciation expenses, on the other hand, are the allocated portion of the cost of a company’s fixed assets that are appropriate for the period.

How Do Tangible and Intangible Assets Differ?

A lot of people confusedepreciationexpense with actually expensing an asset. Fixed assets are capitalized when they are purchased and reported on the balance sheet. Instead, the asset’s costs are recognized ratably over the course of its useful life with depreciation. This cost allocation method agrees with thematching principlesince costs are recognized in the time period that the help produce revenues. Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged against a fixed asset.