Depreciation Strategies Under the New Tax Law: What You Need to Know

Call us at +1-800-322-7776 or fill out the form below.

How long do you depreciate land improvements?

Land improvements are enhancements to a plot of land to make the land more usable. If these improvements have a useful life, they should be depreciated. If land is being prepared for its intended purpose, then include these costs in the cost of the land asset. They are not depreciated.The gain that is attributable to the depreciation taken will be “recaptured” and taxed at less favorable rates, 25 or up to 37 percent ordinary rates. As such it is important to consult a tax advisor knowledgeable in depreciation recapture when determining hold strategy. Cost Segregation is an engineering-based analysis in which fixed assets are isolated and reclassified into shorter-lived tax categories, resulting in accelerated depreciation, tax deferral, and increased cash flow. A study may be performed throughout the real estate life cycle on acquired, renovated, or newly constructed properties.

Depreciation and Accelerated Depreciation

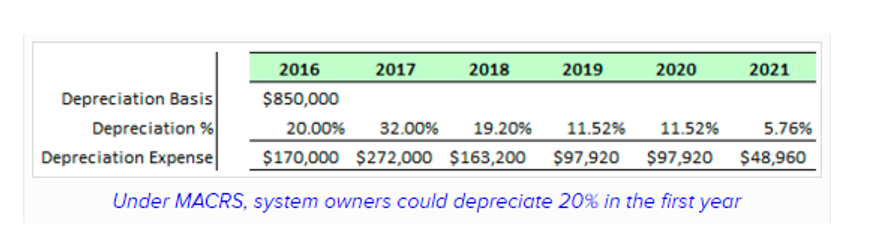

Unless or until Congress passes a technical correction bill, QIP is ineligible for bonus, and it remains firmly among 39-year assets unless accelerated to 5- or 7-year class lives through a Cost Segregation Study. It is crucial for taxpayers to understand that, at this point, the only way to claim bonus on tenant-improvements is through the aforementioned Cost Segregation Study. One asset category that should have qualified for 100% bonus depreciation is Qualified Improvement Property (QIP). QIP is defined as any improvement to an interior portion of a building which is nonresidential real property if the improvement is placed-in-service after the date the building was first placed-in-service by any taxpayer.Fair market value is the price at which the property would change hands between a buyer and a seller, neither under undue pressure to buy or sell, and both having reasonable knowledge of all the relevant facts. Sales of similar property in the area are helpful in figuring out the fair market value of the property.Bonus depreciation was introduced by Congress in 2001, in an attempt to stimulate the economy following the attacks of September 11th. Bonus depreciation is a tax incentive that permits owners of qualified property (that is, property with a recovery period of 20 years or less) to immediately deduct a percentage of the asset’s depreciable basis. Personal property and land improvements are eligible for bonus, though building core and shell assets are not.By doing this, a businesses’ taxable income can be reduced, and businesses can use those tax savings to invest back into their business. In order to appropriately accelerate the depreciation of your assets, property owners will need a cost segregation study. These studies should be performed by professionals with construction, engineering, and appraisal experience to correctly segregate the costs of your assets into either 5, 7, 15, 27.5 or 39-year lives. Consider the new construction of a multifamily garden-style apartment complex with a depreciable basis of $5 million.

How to account for land improvements

You may also elect to have the property’s value appraised as of the date of its conversion to rental property. Either way, it’s very important to have a good estimate of your home’s fair market value on the date of the conversion. Assume, for example, a person purchases a home for $650,000 and spends $50,000 to renovate the kitchen and add a bathroom. After 10 years of owning and living in the home, the homeowner, who is single and files taxes as such, ends up selling the property for a price of $975,000.In a cost segregation study, 15% of assets were moved into 5-year class life, and another 10% moved into 15-year class life. Also, if the gain is significantly more than those sums listed above capital improvements’ effect on the cost basis can be significant.

Repairs

Under the TCJA, QIP replaced Qualified Leasehold Improvement, Qualified Restaurant Improvement, and Qualified Retail Improvement Property. Bonus depreciation can be applied to any new asset with a 20 year life or less.

- The 2018 tax season has been challenging, as this comprehensive change in tax law is implemented on corporate and personal returns for the first time.

- Having a sound cost segregation study performed on any renovation, new construction, or acquisition will allow the owner of real estate to fully take advantage of bonus depreciation.

- Clearly the TCJA will have significant impact on real estate owners in the coming years.

If no capital improvements had been made, the taxable amount for the capital gain would be $75,000 ($975,000 sale price – $650,000 purchase price – $250,000 capital gains exclusion). In addition to improving the home, a capital improvement—per the IRS—increases the cost basis of a structure. That is, expenses incurred upon making the improvements are added to the amount the owner paid to buy or build the property. Augmenting the cost basis, in turn, reduces the size of the taxable capital gain when selling the property.

What is the depreciation method for land improvements?

Certain land improvements can be depreciated over 15 years at 150% DB, with certain personal property depreciated over 7 or 5 years at 200% DB.

Bonus Depreciation – Tax-Saving Tool for Your Business

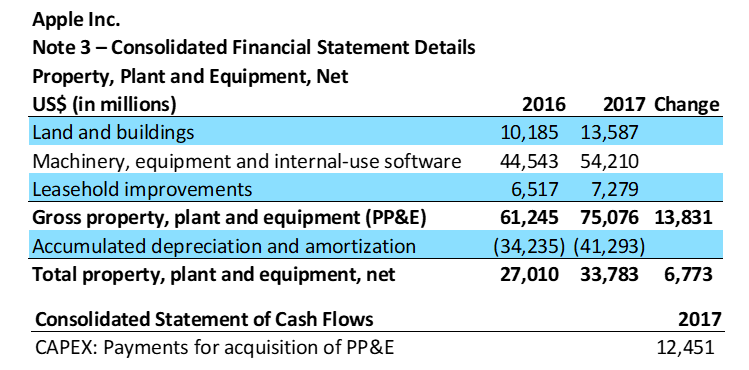

Commercial and residential building assets can be depreciated either over 39-year straight-line for commercial property, or a 27.5-year straight line for residential property as dictated by the current U.S. Certain land improvements can be depreciated over 15 years at 150% DB, with certain personal property depreciated over 7 or 5 years at 200% DB. Depreciation recapture will not come into play until the property is eventually sold. The gain on sale will be increased as the asset’s tax basis is reduced by the depreciation taken. Part of the gain will be taxed at the favorable capital gain rates, 15 or 20 percent.This includes land improvements which are not considered personal property. By using accelerated depreciation, an asset with a tax basis may now be written off more quickly.Many studies are commissioned when properties are initially placed-in-service, but the IRS also permits “look-back” studies. These studies allow taxpayers to retroactively claim all the depreciation that they would have received had they performed a study when the property was originally placed-in-service.

Advantages of Accelerated Depreciation

Having a sound cost segregation study performed on any renovation, new construction, or acquisition will allow the owner of real estate to fully take advantage of bonus depreciation. In addition, it cannot be overstated that seeking advice from CPAs well versed in real estate matters is more important than ever. Partnering with qualified advisors will ensure that the real estate owner is fully aware of the role of bonus depreciation as part of a comprehensive overall tax strategy.Many factors may make a taxpayer breach the $250/500 capital gains levels. These include if the owners acquired the property many decades ago and if local real estate values had dramatically increased since the purchase. Your tax basis is basically the property’s original cost, plus the cost of any improvements you’ve made (but not repairs), minus any depreciation deductions taken–for example, if you claimed the home office deduction.

Examples of Improvements

Clearly the TCJA will have significant impact on real estate owners in the coming years. The 2018 tax season has been challenging, as this comprehensive change in tax law is implemented on corporate and personal returns for the first time.The only way to have your assets depreciated properly is to have a detailed engineering-based cost segregation study performed on your property. Our professionals possess over 150 years of combined cost segregation experience.