Difference Between Horizontal and Vertical Analysis” Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year. There are three primary limitations to balance sheets, including the fact that they are recorded at historical cost, the use of estimates, and the omission of valuable things, such as intelligence. The balance sheet is a formal document that follows a standard accounting format showing the same categories of assets and liabilities regardless of the size or nature of the business.Intangible assets like goodwill are shown in the balance sheet at imaginary figures, which may bear no relationship to the market value. The International Accounting Standards Board (IASB) offers some guidance (IAS 38) as to how intangible assets should be accounted for in financial statements. In general, legal intangibles that are developed internally are not recognized, and legal intangibles that are purchased from third parties are recognized. Therefore, there is a disconnect–goodwill from acquisitions can be booked, since it is derived from a market or purchase valuation. However, similar internal spending cannot be booked, although it will be recognized by investors who compare a company’s market value with its book value.

What is a common size balance sheet?

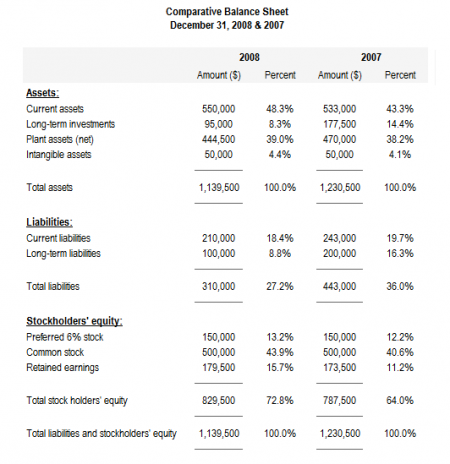

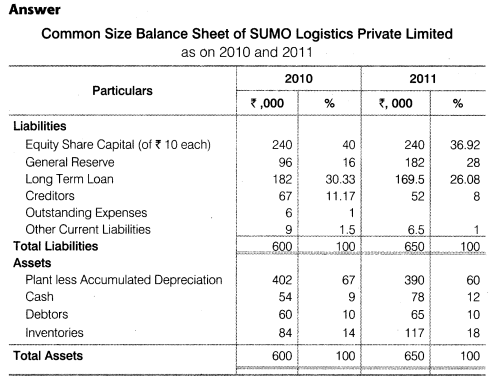

What is a Common Size Balance Sheet? A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.Without the income statement, statement of cash flows, and the ability to ask management questions, we can’t know for sure what drove these changes to the company’s balance sheet. This company could be winding down operations, it could be going out of business, or it may have tripped a loan covenant and been forced to deleverage quickly. Whatever the case, our comparative analysis revealed major changes across the entire balance sheet.

Vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item. This means that every line item on an income statement is stated as a percentage of gross sales, while every line item on a balance sheet is stated as a percentage of total assets. Every company that sells and offers its stock to the public must file financial reports and statements with the Securities and Exchange Commission (SEC).If you’re looking at your business expenses, for example, you might calculate common size ratios for rent, utilities, and raw materials. The ratios can tell you if one particular expense makes up a very big or very small part of your total costs. It helps you analyze your finances so you can make smarter business decisions.

What Is a Common Size Income Statement?

The ratios tell investors and finance managers how the company is doing in terms of revenues, and they can make predictions of future revenues. Companies can also use this tool to analyze competitors to know the proportion of revenues that goes to advertising, research and development, and other essential expenses. Some of the current assets are valued on estimated basis, so the balance sheet is not in a position to reflect the true financial position of the business.

Formula for Common Size Analysis

On the income statement, changes in the mix of revenues and in the spending for different types of expenses can be identified. However, a look at the common size financial statement of the two businesses, which restates each company’s figures as a percent of sales, reveals Company B is actually more profitable. The common size income statement for Company A shows operating profits are 25% of sales (25/100). The same calculation for Company B shows operating profits at 75% of sales (15/20).The three main financial statements are the balance sheet and income statement. The cash flow statement is an important document that helps open a wind interested parties insight into all the transactions that go through a company. When you’re looking at your company’s income statements or balance sheets, you might want to know how each line item compares to the others. That’s where the common size ratio comes in — it tells you the size of items in comparison to the whole.

Spotting Creative Accounting on the Balance Sheet

The common size statements make it easy to see that Company B is proportionally more profitable and better at controlling expenses. The two financial statements that analysts common size most often are the income statement and the balance sheet. Analysts study the income statement for insights into a company’s historic growth and profitability. The balance sheet provides relevant information about a company’s liquidity and financial strength. The Income Statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

- It’s equally important to consider its income statement and statement of cash flow.

- Remember, though, that the company’s balance sheet is just a snapshot in time.

- And, at the end of the day, the company’s financial statements are just a report of how the company has performed over time.

Generally accepted accounting principles (GAAP) are based on consistency and comparability of financial statements. A common size income statement makes it easier to see what’s driving a company’s profits.

Balance Sheet vs. Profit and Loss Statement: What’s the Difference?

The common size percentages also help to show how each line item or component affects the financial position of the company. As a result, the financial statement user can more easily compare the financial performance to the company’s peers. Common size analysis is used to calculate net profit margin, as well as gross and operating margins.Common-size analysis converts each line of financial statement data to an easily comparable amount measured as a percent. Income statement items are stated as a percent of net sales and balance sheet items are stated as a percent of total assets (or total liabilities and shareholders’ equity). Common-size analysis allows for the evaluation of information from one period to the next within a company and between competing companies. Horizontal and vertical analysis are two main types of analysis methods used for this purpose.

How do you calculate a common size balance sheet?

Balance Sheet Common Size Analysis Assets = Liabilities + Equity common size analysis mostly uses the total assets value as the base value. On the balance sheet, the total assets value equals the value of total liabilities and shareholders’ equity. It also represents the residual value of assets minus liabilities.Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a “snapshot of a company’s financial condition.

Importance of Common Size Analysis

Let’s take a few moments to review what we’ve learned about common size analysis and how to apply it. Common size, or vertical analysis, allows an owner to express each financial statement item as a percentage of a base. A company can use common size analysis on its balance sheet, which summarizes its assets (the items it owns), liabilities (the amounts it owes or debts) and equity (the owner’s investment). It can also be used on its income statement, which shows its revenues (amounts it earns from selling its goods and services) and its expenses (the cost of earning the revenues).Remember, though, that the company’s balance sheet is just a snapshot in time. It’s equally important to consider its income statement and statement of cash flow. And, at the end of the day, the company’s financial statements are just a report of how the company has performed over time.

What is a Common Size Balance Sheet?

Always take the time to take what you’ve learned from the numbers and apply it to what’s actually happening at the company. That last step is the key to taking a financial analysis and translating it into an actionable investment decision. Investors, creditors, and regulatory agencies generally focus their analysis of financial statements on the company as a whole. Since they cannot request special-purpose reports, external users must rely on the general purpose financial statements that companies publish.

Common Size Analysis Template

These statements include the balance sheet, an income statement, a statement of stockholders ‘ equity, a statement of cash flows, and the explanatory notes that accompany the financial statements. Common‐size analysis (also called vertical analysis) expresses each line item on a single year’s financial statement as a percent of one line item, which is referred to as a base amount. The base amount for the balance sheet is usually total assets (which is the same number as total liabilities plus stockholders’ equity), and for the income statement it is usually net sales or revenues. By comparing two or more years of common‐size statements, changes in the mixture of assets, liabilities, and equity become evident.Accounting is considered the language of business because its concepts are time-tested and standardized. Even if you do not utilize the services of a certified public accountant, you or your bookkeeper can adopt certain generally accepted accounting principles ( GAAP ) to develop financial statements. The strength of GAAP is the reliability of company data from one accounting period to another and the ability to compare the financial statements of different companies.