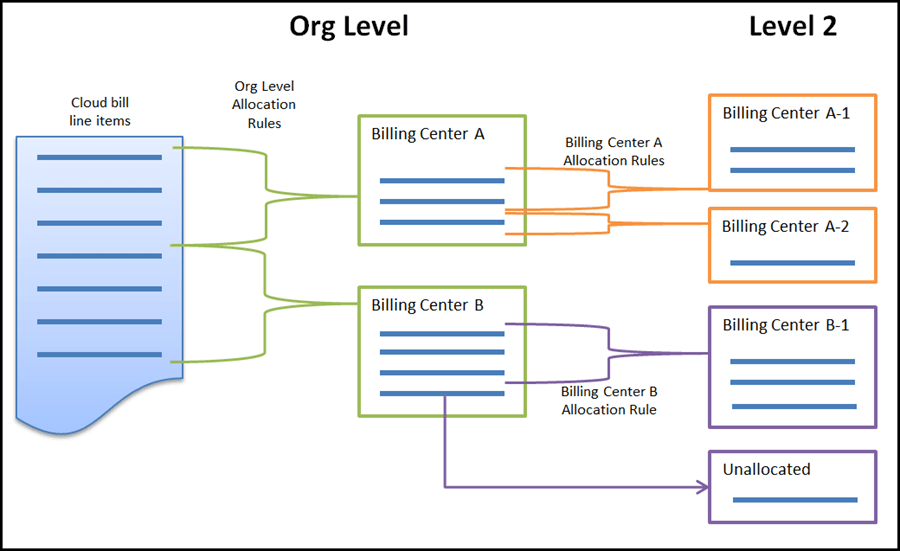

Direct allocation method — AccountingToolsOne of the most commonly tracked allocation rates is the allocation rate paid to a 401(k)from an employee’s paycheck. In many employee benefit plans, the employer will match the employee’s allocation rate up to a certain percentage.Charge the applicable cost of these departments directly to the production part of the business. These costs form a portion of the overhead cost of production, which is then allocated to inventory and the cost of goods sold. This method provides a better picture of how costs are incurred, but requires more accounting effort.You might also name your spouse as the primary beneficiary of 50% of the account, with your children each named as 25% primary beneficiaries. You can name more than one primary beneficiary and more than one contingent beneficiary—you’re not limited to one of each. You can allocate percentages for each beneficiary, specifying what portion of the account they should receive or inherit. Contingent beneficiaries can only inherit if the primary beneficiary does not. The account manager will release the asset in question to your contingent beneficiary if your primary beneficiary can’t be located, declines the inheritance, isn’t legally able to accept it, or predeceases you.

allocate – Computer Definition

Many investors choose to build their retirement plans through an individual retirement account (IRA). Wrap accounts through both brokerage firms and robo-advisors offer investors another alternative for making automated investments at a predetermined allocation rate. Generally, an allocation rate will refer to a percentage of income an investor chooses to allocate to specific investments in an automatic investment plan.It also tends to delay the recognition of expenses until a later period, when some portion of the produced goods are sold. They should know they’re beneficiaries—either primary or contingent—and they should have the details of what they’re inheriting.

allocate

Accounts with beneficiary designations are often referred to as “will substitutes.” Your selection of a beneficiaries overrides any instructions you might leave in your will for the same assets. It’s not required that you name either primary or contingent beneficiaries. However, it will help you avoid having these assets end up in your probate estate if something goes wrong, potentially complicating it and costing your estate additional money to settle.

Allocation Rate

The allocation rate most often refers to the amount of capital invested in a product net of any fees that may be incurred through the investment transaction. An allocation rate may also be used when determining the percentage of income an investor plans to contribute to specified investments through an automatic investment plan. To ensure all the hours are accounted for when allocating, assign the Allocation matches Allocation Categories validation in the timesheet template.A contingent beneficiary is someone or something that receives the benefits of an account if the primary beneficiary can’t or won’t do so after the account owner’s death. Contingent beneficiaries stand in the wings, next in line to inherit assets if something should go wrong. allocated time for recreation; appropriated funds for public education; designated a location for the new hospital; money earmarked for a vacation. For example, you might name your spouse as the primary beneficiary of 100% of the account, and your two adult children as contingent beneficiaries to receive 50% each.

v distribute according to a plan or set apart for a special purpose

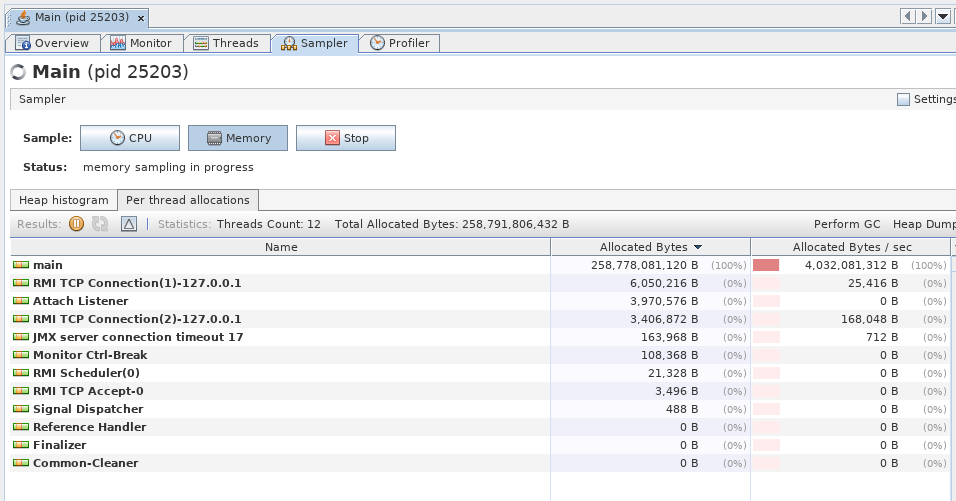

If the allocation totals do not match the total hours available for each category, an error will be shown on the timesheet. This applies for each day individually; each day’s total allocation must match the total hours.

Understanding time allocation

- However, it will help you avoid having these assets end up in your probate estate if something goes wrong, potentially complicating it and costing your estate additional money to settle.

- Accounts with beneficiary designations are often referred to as “will substitutes.” Your selection of a beneficiaries overrides any instructions you might leave in your will for the same assets.

- It’s not required that you name either primary or contingent beneficiaries.

Try to allocate yourself a set time each day to practice your exercises. As part of the organization of the organization’s money, it is important for the board of directors of the organization to allocate a portion of the funds raised to be placed into the fund. An example of allocate is when a boss schedules a certain amount of time each morning in order to go over the day’s business with their employees. Calculating the allocation rate percentage helps an investor to understand better how their money is being utilized.The first rule avoids cluttering up the key with identifiers that account for only a small fraction of the total storage allocated. The store is not structured as a stack because storage can be allocated at any time during action performance. The care of women allocated to the routine primary care group was left to the discretion of their primary care teams. The initial amounts received from customers or subscribers should be allocated to two liability accounts.

What allocation means?

The definition of allocation is a process in business and accounting. An example of allocation is when a company portions out their expenses and attributes a certain amount to each division. Allocation is defined as the act of being portioned out for a certain reason.

When should we use allocation?

What does it mean to allocate something?

allocate. To allocate is to set aside a certain amount of money for an expense. Aside from money, a common thing to allocate is time: “The old woman in the shoe had so many children she could only allocate 2.7 minutes per day to talk to each one individually.” Resources are also often allocated.To allocate is to set aside a certain amount of money for an expense. You usually hear about the government allocating funds for education or the military, but you may personally allocate some of your allowance to buying comic books. This page contains a description and explanation of submetered and allocated utility billing. The Public Utility Commission of Texas (PUC) writes and adopts rules to govern billing practices for water and sewer utility services provided by property owners to tenants (or by condominium associations to members). The rest of the funds have been allocated to the building project and cannot be used for other purposes.An equal amount of space in the gallery has been allocated for each artist.

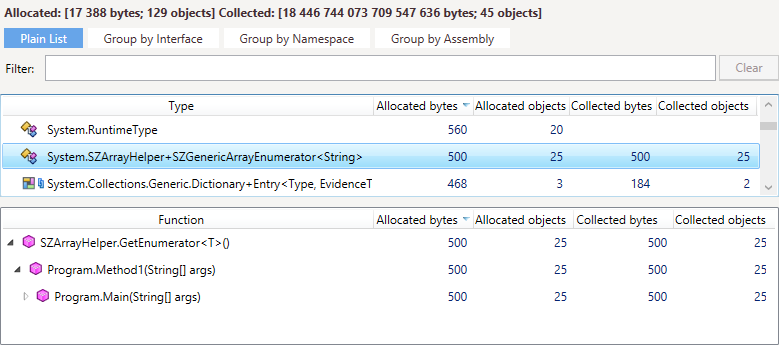

Allocation Rates for Automated Investment

For example, you have 10 hours to allocate – 8 regular time hours and 2 overtime hours. If you select Work Hours, the total working hours for the day are available for allocation. Based on the user’s in and out times and the selected distirbution category, the system calculates how many hours are available for allocation for each day on the timesheet.It also shows how much they are investing in a product, which will form the basis for total assets invested and future capital gains. The higher the fee charged for an investment, the lower the allocation rate. An allocation rate shows the total amount of investment in a product. Because only 7 of the 8 hours have been allocated, an error is shown when the user attempts to submit the timesheet. If you select Payroll, the total hours for the day are grouped by pay code, as determined by the user’s assigned pay rule.

You can even name a nonprofit charitable organization as your primary or contingent beneficiary, although you’ll probably want to talk to an account representative or tax professional about how to do this. The allocation rate is a percentage value that helps an investor measure the total amount of capital invested in any one sort of investment vehicle whether that be a stock, REIT, or something else. It can be useful in helping an investor to measure the fees paid for an investment in a product. It can also be a metric used for determining investments through an automatic investment plan. An allocation rate is a percentage of an investor’s cash or capital outlay that goes toward a final investment.It’s often up to them to make claims for the assets in question when the time comes. Contingent beneficiaries and primary beneficiaries can easily be changed unless the account is irrevocable (some insurance policies and trusts are).

To distribute according to a plan, generally followed by the adposition “to”The bulk of K–12 education funds are allocated to school districts that in turn pay for the cost of operating schools. Allocation rates can also be useful when making all types of investments through various automatic investment plans.