Dividend Per ShareThis naturally means that a company that pays dividends has been through the major growth phase and gotten to the point where they can pay out at least some of their earnings to their shareholders. Given this, there is an element of safety with dividend stocks vs newer, higher growth stocks. With high growth stock, investors come to expect that level of growth to be sustained and if it is not, the company’s stock prices can drop like a hot potato. In such cases investment earnings will come from share price appreciation when you sell.Investors often use dividend yields to determine whether to make certain investments or not. For instance, an investor who’s looking for a steady, regular source of income might invest in a company with a high dividend yield. On the other hand, an investor who’s willing to take a risk for the chance of a major payout might invest in a young company with lots of growth potential. Such companies often keep most of their profits as retained earnings and won’t pay out much in the form of dividends until they are more established.

Is common stock a dividend?

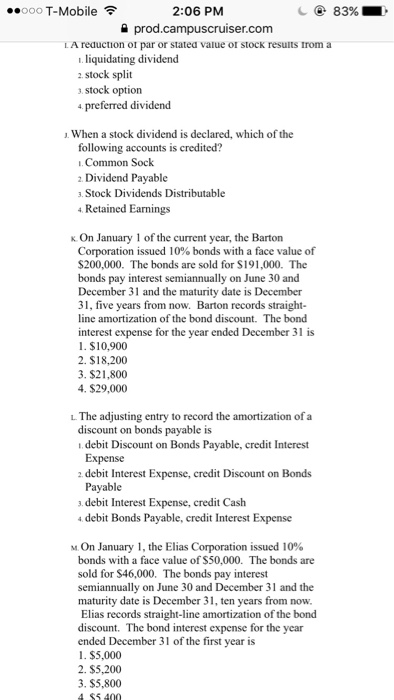

When a company declares a stock dividend, it may do so as a percentage of shares outstanding, such as a “10% stock dividend.” The first step in calculating stock dividends distributable is to divide that percentage by 100 to convert it into a decimal. In our example, 10% would become 0.10.

It is important to always research a stock before making an investment. A safe and reliable dividend can be a much better choice for dividend investors than a high yield stock that could cut its dividend at any time. The utilities sector is broken into electricity, gas, and water utilities. Companies in this industry require a large amount of infrastructure and therefore hold large amounts of debt. When interest rates go up or down, debt payments will increase or decrease accordingly.

Investing Tools

This has the practical effect of increasing liquidity in the stock. The “25 Year Dividend Increasers” charts above do not highlight the highest yielding stocks of each sector, but instead present some of the most reliable dividend payers. A stock that has a dividend yield well above (or below) its industry average may have that yield for a reason.

The Significance of Dividends and Retained Earnings

For example, a stock that is subject to a 3-1 split should see its shares initially cut in third. The benefit to the shareholders comes about, in theory, because the split creates more attractive opportunities for other future investors to ultimately buy into the larger pool of lower priced shares. As a result, stock splits help make shares more affordable to small investors and provides greater marketability and liquidity in the market. A stock split is usually done by companies that have seen their share price increase to levels that are either too high or are beyond the price levels of similar companies in their sector. The primary motive is to make shares seem more affordable to small investors even though the underlying value of the company has not changed.However, a higher yield may indicate that the dividend is not safe and may be cut in the future. As can be seen in the 2017 dividend cuts that GE has executed, this strategic move can have immediate negative affects on overall share price and, consequently, investor sentiment. With that in mind, investors should always proceed with caution when pursuing dividend income. Some companies, like utilities or real estate investment trusts, have a history of increasing dividends over time. A growing dividend makes a stock more valuable to investors and may push up the stock price.

In many cases, companies will have dividend yields that are similar to their peers, but that is not always the case. Check out the chart below to see how the stocks you own measure up with their sector averages. The answer is not in the financial statement impact, but in the financial markets. Since the same company is now represented by more shares, one would expect the market value per share to suffer a corresponding decline.Some investors buy stocks for dividend income, which is a good conservative equity investment strategy, provided they take into account dividend safety and growth. A good dividend yield will vary with interest rates and general market conditions, but typically a yield of 4 to 6 percent is considered quite good. A lower yield may not be enough justification for investors to buy a stock just for the dividend income.

How do you calculate common stock dividends distributable?

A common stock dividend distributable is a dividend payable to the holders of a corporation’s common stock that has been declared by the entity’s board of directors, but not yet paid. Once declared, this amount is classified as a liability of the corporation.

- On the other hand, an investor who’s willing to take a risk for the chance of a major payout might invest in a young company with lots of growth potential.

- Investors often use dividend yields to determine whether to make certain investments or not.

- For instance, an investor who’s looking for a steady, regular source of income might invest in a company with a high dividend yield.

Assessing Dividend Growth

If you’re involved in a dividend reinvestment program, find out how much of your dividends you’re investing so that you know how many shares you own and your calculation remains accurate. The process above is designed to work for relatively simple cases where the number of stocks owned is a fixed quantity. If you’ve arranged for a dividend-reinvestment program as part of your investment, keep an updated tally of shares you own so that your calculations will be accurate. When a stock splits, it can also result in a share price increase following a decrease immediately after the split. Since many small investors think the stock is now more affordable and buy the stock, they end up boosting demand and drive up prices.Reality Shares Advisors provides a DIVCON health rating for dividend-paying stocks that estimates the probability a dividend will grow or be cut within the next 12 months. The rating system is based on a company’s cash flow and earnings, among other factors.Calculating the dividend that a shareholder is owed by a company is generally fairly easy; simply multiply the dividend paid per share (or “DPS”) by the number of shares you own. It’s also possible to determine the “dividend yield” (the percentage of your investment that your stock holdings will pay you in dividends) by dividing the DPS by the price per share.

Stock Dividends

Every share of the $20 company will earn you 2/20 or 10% of your initial investment per year, while every share of the $100 company will earn you just 2/100 or 2% of your initial investment. When a company makes money, it usually has two general options. On one hand, it can reinvest this money in the company by expanding its own operations, buying new equipment, and so on. (Money spent this way is called “retained earnings.”) Alternatively, it can use its profits to pay its investors.

Common stock dividend distributable

Therefore, the sector generally performs best when interest rates are low. Historically, dividend investors tend to be attracted to utility stocks due to their high yields. For dividend comparison purposes, utility stocks have a 3.96% average dividend yield, while utility stocks in the S&P 500 have a 3.7% average yield. To calculate dividends, find out the company’s dividend per share (DPS), which is the amount paid to every investor for each share of stock they hold. Next, multiply the DPS by the number of shares you hold in the company’s stock to determine approximately what you’re total payout will be.

MANAGING YOUR MONEY

For dividend investors, yield is one of the most important factors to consider when making an investment. Dividend yield can make or break the attractiveness of a dividend stock.

Stock Splits And Stock Dividends

One investment strategy is to invest in stocks with the highest current dividend yields. And the high dividend yield could have resulted more from a drop in the stock price—that may continue—than an increase in the dividend.For example, an investor owns a $20 stock with a 1 percent dividend (20 cents per share). Just like a high dividend yield, a currently growing dividend payout isn’t a sure sign of a company that will continue to pay rising or even substantial dividends in the future.Looking further, we present a dividend yield comparison by sectors and individual companies compared to the average dividend yield of their respective market segment. In addition, those companies that have been truly committed to their investors in the form of dividend increases by raising their dividend every year for 25+ years are highlighted below.