Does an expense appear on the balance sheet? — AccountingTools

Cost of Improvements

Current assets are generally reported on the balance sheet at their current or market price. Interest is defined as a fee paid by a borrower of assets to the owner as a form of compensation for the use of the assets. It is most commonly the price paid for the use of borrowed money, or money earned by deposited funds.Intangible assetsare nonphysical assets, such as patents and copyrights. They are considered as noncurrent assets because they provide value to a company but cannot be readily converted to cash within a year. Long-term investments, such as bonds and notes, are also considered noncurrent assets because a company usually holds these assets on its balance sheet for more than a year.

Controlling and Reporting of Real Assets: Property, Plant, Equipment, and Natural Resources

Now, 100 years later, a real estate appraiser inspects all of the properties and concludes that their expected market value is $50 million. However, if the company uses historical accounting principles, then the cost of the properties recorded on the balance sheet remains at $50,000.Many might feel that the properties’ worth in particular, and the company’s assets in general, are not being accurately reflected in the books. Due to this discrepancy, some accountants record assets on a mark-to-market basis when reporting financial statements. Equipment is not considered a current asset even when its cost falls below the capitalization threshold of a business.The current assets section is compared to current liabilities to figure out your basic liquidity, or ability to pay off short-term debt. Current assets include cash, securities and accounts receivable, which can all generally be converted to cash within 12 months. Most accounting balance sheets classify a company’s assets and liabilities into distinctive groupings such as Current Assets; Property, Plant, and Equipment; Current Liabilities; etc. For example, suppose company ABC bought multiple properties in New York 100 years ago for $50,000.

Capitalizing Interest Costs

Where does building go on a balance sheet?

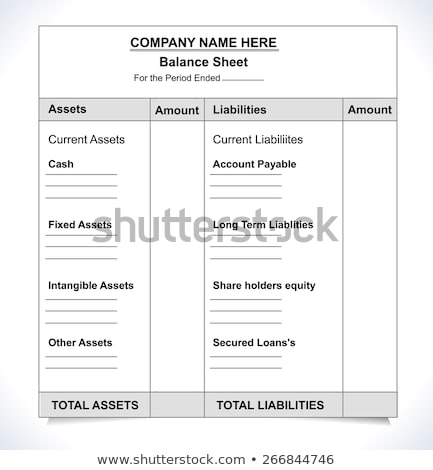

Buildings is a noncurrent or long-term asset account which shows the cost of a building (excluding the cost of the land). Buildings will be depreciated over their useful lives by debiting the income statement account Depreciation Expense and crediting the balance sheet account Accumulated Depreciation.The impairment expense is calculated as the difference between the current market value and the purchase price of the intangible asset. Goodwill is recorded as an intangible asset on the acquiring company’s balance sheet under the long-term assets account.It is typically used by lenders, investors, and creditors to estimate the liquidity of a business. The balance sheet is one of the documents included in an entity’s financial statements. Of the financial statements, the balance sheet is stated as of the end of the reporting period, while the income statement and statement of cash flows cover the entire reporting period.The purchase of a capital asset such as a building or equipment is not an expense. The assets section shows items your company owns that have tangible value. It includes current assets, along with property and equipment, investments and intangible assets, and are usually listed in order of liquidity.

Is buildings a current asset?

Buildings are listed at historical cost on the balance sheet as a long-term or non-current asset. Buildings are subject to depreciation or the periodic reduction of value in the asset that is expensed on the income statement and reduces net income.

- Asset improvements are capitalized and reported on the balance sheet because they are for expenses that will provide a benefit beyond the current accounting period.

- Noncurrent assetsare a company’slong-term investments that have a useful life of more than one year.

- They are required for the long-term needs of a business and include things like land and heavy equipment.

Interest Costs on the Balance Sheet

Similarly, the liabilities section begins with accounts payable and usually ends with long-term debt, for the same reason. The balance sheet is a report that summarizes all of an entity’s assets, liabilities, and equity as of a given point in time.Buildings are listed at historical cost on the balance sheet as a long-term or non-current asset, since this type of asset is held for business use and is not easily converted into cash. Since buildings are subject to depreciation, their cost is adjusted by accumulated depreciation to arrive at their net carrying value on the balance sheet. For example, on Acme Company’s balance sheet, their office building is reported at a cost of $150,000, with accumulated depreciation of $40,000. The building’s net carrying value or net book value, on the balance sheet is $110,000.The capitalization of interest costs involves adding the amount of interest expense incurred and/or paid during the asset’s construction phase to the asset’s cost recorded on the balance sheet. The asset’s intended use should be for the generation of company earnings. Interest cost capitalization does not apply to retail inventory constructed or held for sale purposes. In double-entry bookkeeping, expenses are recorded as a debit to an expense account (an income statement account) and a credit to either an asset account or a liability account, which are balance sheet accounts. Typical business expenses include salaries, utilities, depreciation of capital assets, and interest expense for loans.Goodwill is considered an intangible (or non-current) asset because it is not a physical asset like buildings or equipment. This is the minimum a company is worth and can provide a useful floor for a company’s asset value because it excludes intangible assets. A stock would be considered undervalued if its market value were below book value, which means the stock is trading at a deep discount to book value per share. Asset valuation plays a key role in finance and often consists of both subjective and objective measurements.

Buildings on the Balance Sheet

The value of a company’s fixed assets – which are also known as capital assets or property plant and equipment – are straightforward to value, based on their book values and replacement costs. However, there’s no number on the financial statements that tell investors exactly how much a company’s brand and intellectual property are worth. Companies can overvalue goodwill in an acquisition as the valuation of intangible assets is subjective and can be difficult to measure. Depending on the type of asset, it may be depreciated, amortized, or depleted.Asset or capital improvements are undertaken to enhance or improve a business asset that is in use. The cost of the improvement is capitalized and added to the asset’s historical cost on the balance sheet. Since the cost of the improvement is capitalized, the asset’s periodic depreciation expense will be affected, along with other factors used in calculating depreciation.Noncurrent assetsare a company’slong-term investments that have a useful life of more than one year. They are required for the long-term needs of a business and include things like land and heavy equipment. Asset improvements are capitalized and reported on the balance sheet because they are for expenses that will provide a benefit beyond the current accounting period. For example, costs expended to place the company logo on a delivery truck or to expand the space on a warehouse would be capitalized because the value they provide will extend into future accounting periods. Examples of expensed costs include payment of regular service maintenance on equipment and machinery.In this case, the equipment is simply charged to expense in the period incurred, so it never appears in the balance sheet at all – instead, it only appears in the income statement. Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment. Within each of these categories, line items are presented in decreasing order of liquidity. Thus, the presentation within the topmost block of line items (for assets) begins with cash and usually ends with fixed assets (which are much less liquid than cash) or goodwill.

Equipment and the Balance Sheet

For example, when a vertical analysis is done on an income statement, it will show the top-line sales number as 100%, and every other account will show as a percentage of the total sales number. For the balance sheet, the total assets of the company will show as 100%, with all the other accounts on both the assets and liabilities sides showing as a percentage of the total assets number. Other noncurrent assets include the cash surrender value of life insurance. A bond sinking fund established for the future repayment of debt is classified as a noncurrent asset.

Cost of Land

When an asset is constructed, a company typically borrows funds to finance the costs associated with the construction. The amount of cash borrowed will incur interest expense to the borrower; the interest paid by the borrower serves as interest income to the lender.