Examples of key journal entries — AccountingToolsClose the income statement accounts with debit balances (normally expense accounts) to the income summary account. After all revenue and expense accounts are closed, the income summary account’s balance equals the company’s net income or loss for the period. To update the balance in the owner’s capital account, accountants close revenue, expense, and drawing accounts at the end of each fiscal year or, occasionally, at the end of each accounting period. For this reason, these types of accounts are called temporary or nominal accounts.There are four closing entries, which transfer all temporary account balances to the owner’s capital account. A term often used for closing entries is “reconciling” the company’s accounts. Accountants perform closing entries to return the revenue, expense, and drawing temporary account balances to zero in preparation for the new accounting period. Service revenue account is debited and its balance it credited to income summary account. After closing, the balance of Expenses will be zero and the account will be ready for the expenses of the next accounting period.

What are the 4 closing entries?

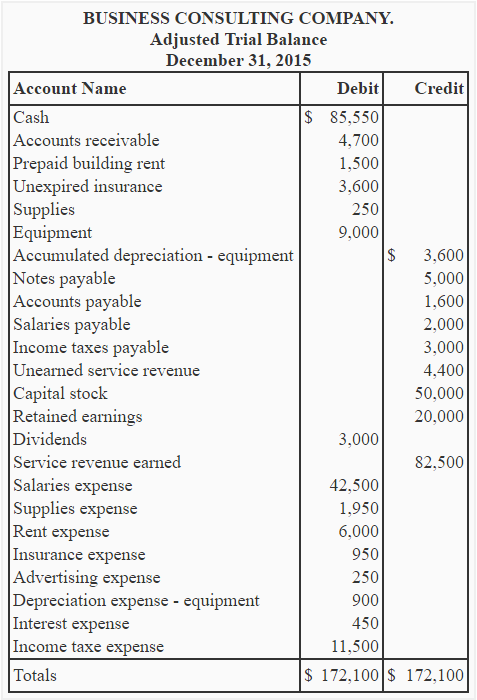

Closing entries are journal entries made at the end of an accounting period which transfer the balances of temporary accounts to permanent accounts. Closing entries are based on the account balances in an adjusted trial balance. Temporary accounts include: Revenue, Income and Gain Accounts.We need to do the closing entries to make them match and zero out the temporary accounts. Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. Temporary – revenues, expenses, dividends (or withdrawals) account.Now Paul must close theincome summary accountto retained earnings in the next step of the closing entries. If a company’s revenues were greater than its expenses, the closing entry entails debiting income summary and crediting retained earnings. In the event of a loss for the period, the income summary account needs to be credited and retained earnings are reduced through a debit.

Learn About the 8 Important Steps in the Accounting Cycle

To return them to zero, you must perform a debit entry for each revenue account to move the balance to the income summary account. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190.

Financial Accounting

The temporary accounts get closed at the end of an accounting year. Since the temporary accounts are closed at the end of each fiscal year, they will begin the new fiscal year with zero balances. Now that all the temporary accounts are closed, the income summary account should have a balance equal to the net income shown on Paul’sincome statement.

What is a Closing Entry?

Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. If the income summary account has a credit balance after completing the entries, or the credit entry amounts exceeded the debits, the company has a net income. If the debit balance exceeds the credits the company has a net loss. Now, the income summary must be closed to the retained earnings account.At this point, the credit column of the Income Summary represents the firm’s revenue, the debit column represents the expenses, and balance represents the firm’s income for the period. Closing entries are the journal entries used to transfer the balances of these temporary accounts to permanent accounts.Temporary accounts include revenue, expenses, and dividends and must be closed at the end of the accounting year. The income summary account serves as a temporary account used only during the closing process. It contains all the company’s revenues and expenses for the current accounting time period. In other words, it contains net incomeor the earnings figure that remains after subtracting all business expenses, depreciation, debt service expense, and taxes. The income summary account doesn’t factor in when preparing financial statements because its only purpose is to be used during the closing process.

- However, an intermediate account called Income Summary usually is created.

- After the closing entries have been made, the temporary account balances will be reflected in the Retained Earnings (a capital account).

- Revenues and expenses are transferred to the Income Summary account, the balance of which clearly shows the firm’s income for the period.

What are Closing Entries?

After the closing entries have been made, the temporary account balances will be reflected in the Retained Earnings (a capital account). However, an intermediate account called Income Summary usually is created.Revenues and expenses are transferred to the Income Summary account, the balance of which clearly shows the firm’s income for the period. A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet.Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts. In other words, the temporary accounts are closed or reset at the end of the year. Income summary effectively collects net income (NI) for the period and distributes the amount to be retained into retained earnings.

Balance Sheet vs. Profit and Loss Statement: What’s the Difference?

This accounts list is identical to the accounts presented on the balance sheet. This makes sense because all of the income statement accounts have been closed and no longer have a current balance. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Next, the balance resulting from the closing entries will be moved to Retained Earnings (if a corporation) or the owner’s capital account (if a sole proprietorship).When an accountant closes an account, the account balance returns to zero. Starting with zero balances in the temporary accounts each year makes it easier to track revenues, expenses, and withdrawals and to compare them from one year to the next.

Understanding Closing Entry

With today’s accounting software, the closing entries are effortless. Closing entries are dated as of the last day of the accounting period, but are entered into the accounts after the financial statements are prepared. Closing entries involve the temporary accounts (the majority of which are the income statement accounts). Both closing entries are acceptable and both result in the same outcome. All temporary accounts eventually get closed to retained earnings and are presented on thebalance sheet.

The Purpose of Closing Entries

How are closing entries done in accounting?

The four basic steps in the closing process are: Closing the revenue accounts—transferring the credit balances in the revenue accounts to a clearing account called Income Summary. Closing the expense accounts—transferring the debit balances in the expense accounts to a clearing account called Income Summary.Perform a journal entry to debit the income summary account and credit the retained earnings account. Locate the revenue accounts in the trial balance, which lists all of the revenue and capital accounts in the company’s ledger.