How do I know if buying an annuity is right for me?Variable annuities allow the owner to receive greater future cash flows if investments of the annuity fund do well and smaller payments if its investments do poorly. This provides for less stable cash flow than a fixed annuity but allows the annuitant to reap the benefits of strong returns from their fund’s investments. One instance where the difference between an annuity in advance and an annuity in arrears matters is in the valuation of income properties.

Annuity due

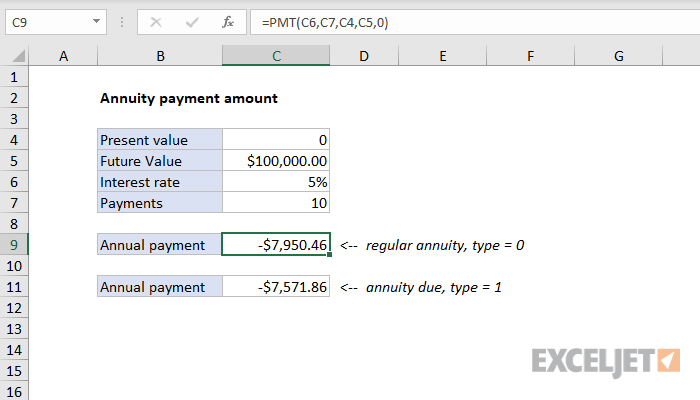

While the payments in an ordinary annuity can be made as frequently as every week, in practice, they are generally made monthly, quarterly, semi-annually, or annually. The opposite of an ordinary annuity is an annuity due, in which payments are made at the beginning of each period. The duration of an annuity depends on the specific terms in the annuity contract.

Annuity (PV)- Solve for n

You may find yourself wondering, though, about the present value of the annuity you’ve purchased. The present value of an annuity is the total cash value of all of your future annuity payments, given a determined rate of return or discount rate. Knowing the present value of an annuity can help you figure out exactly how much value you have left in the annuity you purchased. This makes it easier for you to plan for your future and make smart financial decisions.

How is the Solve for n on Annuity (PV) Formula derived?

If you happen to die before the end of the term, the remainder of the payments can go to a beneficiary such as a spouse or child. Creating streams of regular income is one of the fundamental goals of retirement planning.

When Do Prepaid Expenses Show Up on the Income Statement?

Thus, the higher the discount rate, the lower the present value of the annuity is. An annuity is a financial product that pays out a fixed stream of payments to an individual, and these financial products are primarily used as an income stream for retirees. Annuities are created and sold by financial institutions, which accept and invest funds from individuals. Upon annuitization, the holding institution will issue a stream of payments at a later point in time.After you stop working, you must gain periodic income from other sources in order to maintain the same standard of living you had before retirement. Annuities are a type of financial product where you pay an insurance company a lump sum or a series of payments, and in exchange it will pay you monthly income during retirement.

What Is the Difference Between an Annuity Due vs. an Ordinary Annuity?

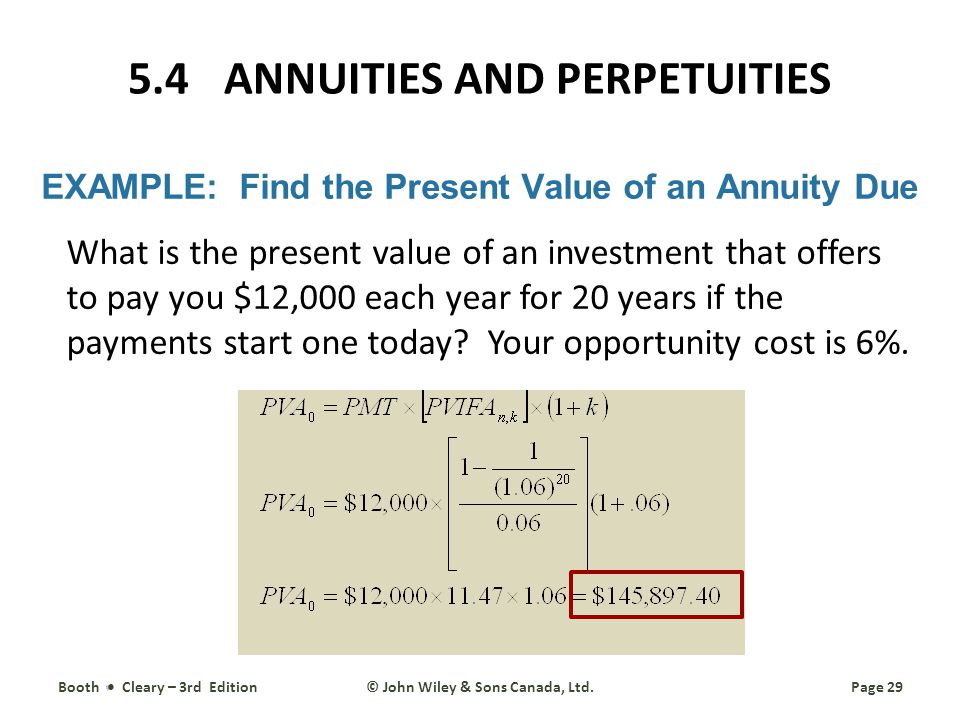

What is the formula for annuity due?

An annuity is a series of payments at a regular interval, such as weekly, monthly or yearly. The payments in an ordinary annuity occur at the end of each period. In contrast, an annuity due features payments occurring at the beginning of each period.

- Lifetime annuities can be attractive options for younger retirees who may live longer than 30 years.

- Another option for annuities is to receive payments for the rest of your life.

- When you die, your lifetime annuity ends — nothing is left behind to a beneficiary.

Another option for annuities is to receive payments for the rest of your life. When you die, your lifetime annuity ends — nothing is left behind to a beneficiary. Lifetime annuities can be attractive options for younger retirees who may live longer than 30 years.However, if you’re on the receiving end of annuity payments, you’ll benefit from having an annuity due, as you’ll receive your payment sooner. An ordinary annuity is a series of equal payments made at the end of each period over a fixed amount of time. Examples of ordinary annuities are interest payments from bonds, which are generally made semi-annually, and quarterly dividends from a stock that has maintained stable payout levels for years. The present value of an ordinary annuity is largely dependent on the prevailing interest rate. For those with an employer-sponsored retirement plan, qualified annuities are an option.An example of an immediate annuity is when an individual pays a single premium, say $200,000, to an insurance company and receives monthly payments, say $5,000, for a fixed time period afterward. The payout amount for immediate annuities depends on market conditions and interest rates.

What is the difference between an annuity and an annuity due?

An annuity due is a repeating payment that is made at the beginning of each period, such as a rent payment. It has the following characteristics: All payments are in the same amount (such as a series of payments of $500). All payments are made at the same intervals of time (such as once a month or year).Since payments are made sooner with an annuity due than with an ordinary annuity, an annuity due typically has a higher present value than an ordinary annuity. On the other hand, when interest rates fall, the value of an ordinary annuity goes up.

Understanding Annuity in Advance

This is due to the concept known as the time value of money, which states that money available today is worth more than the same amount in the future because it has the potential to generate a return and grow. An ordinary annuity is a series of equal payments made at the end of consecutive periods over a fixed length of time.The valuation of an annuity entails concepts such as time value of money, interest rate, and future value. You’ll pay a certain amount of money, either up front or as part of a payment plan. You can receive annuity payments either indefinitely or for a predetermined length of time. The present value of an annuity is the cash value of all of your future annuity payments.

Deferred income annuities

Similar to life insurance, you have the option of choosing annuities that pay out for different periods of time. For example, you could buy an annuity that lasts five, 10, 20 or even 30 years. Annuities that pay a guaranteed amount over a specific period of time are known as period certain annuities.Payouts on most immediate annuities are interest rate sensitive, and so when rates are low, the amount of future income you’ll get from an immediate annuity can be relatively small. Still, as a way to guarantee a stream of income for as long as you live, an immediate annuity can be extremely useful. An immediate annuity is the easiest type of annuity for most people to understand, because in its most common form, it has very basic provisions. You can structure an immediate annuity to pay for the rest of your life, for a fixed period of time, or for as long as you and another person you choose as a beneficiary are still living. If you’re liable for making payments on an annuity, you’ll benefit from having an ordinary annuity because it allows you to hold onto your money for a longer amount of time.If payments are received at the beginning of the rental period rather than at the end of the rental period, the present value of those payments increases. It is also possible to use mathematical formulas to compute the present and future values of an annuity in advance or an ordinary annuity. An ordinary annuity makes payments at the end of each time period, while an annuity due makes them at the beginning. Valuation of an annuity entails calculation of the present value of the future annuity payments.