Owner’s equity is simply the on-paper value of a company’s assets minus its liabilities. Owner’s equity refers to the portion of a business that is the property of the business’ shareholders or owners. The simple explanation of owner’s equity is that it is the amount of money a business would have left if it shut down its operations, sold all of its assets, and paid off its debts.

- The amount of treasury stock is deducted from the company’s total equity to get the number of shares that are available to investors.

- Let’s assume that Jake owns and runs a computer assembly plant in Hawaii and he wants to know his equity in the business.

- It’s important to note when it comes to publicly traded companies that owner’s equity and market capitalization (market cap) are two very different concepts.

- To truly understand a business’ financials, you need to look at the big picture, not just how much its theoretical book value is.

- For this reason, owner’s equity is only one piece of the puzzle when it comes to valuing a business.

- Now that you have a better understanding of what the owner’s equity is not, you may want to find out what owner’s equity is and how it is calculated.

Some of the reasons that may cause the amount of equity to change include a shift in the value of assets vis-a-vis the value of liabilities, share repurchase, and asset depreciation. It represents the owner’s claims to what would be leftover if the business sold all of its assets and paid off its debts. Owner’s equity is one of the many accounting concepts that every business owner must learn to calculate. If you have followed this post, then you should already know how to calculate your business’ equity and should probably understand by now what your business is worth. Calculating an owner’s equity is no doubt one of the simplest business calculations you’ll ever do.

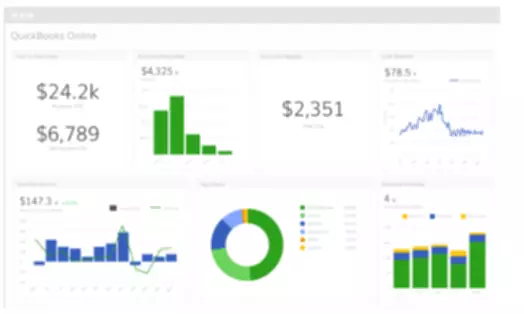

In real-world situations, small business accounting software can help you calculate your owner’s equity. Generally, increasing owner’s equity from year to year indicates a business is successful. Just make sure that the increase is due to profitability rather than owner contributions keeping the business afloat. Perhaps, you need to get a loan or investment for your business at some point, then your owner’s equity at the year-end and the previous year is crucial.

Treasury stocks (decrease).

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Owner’s equity isn’t the same thing as the actual market value of a business. The owner should expect $477,500 left in the company after all liabilities have been paid. To further illustrate owner’s equity, consider the following two hypothetical examples.

Owner’s equity is the value you arrive at when your business’ liabilities are deducted from your business’s total assets. So, the simple answer of how to calculate owner’s equity on a balance sheet is to subtract a business’ liabilities from its assets. If a business owns $10 million in assets and has $3 million in liabilities, its owner’s equity is $7 million.

How Do I Calculate Owner’s Equity?

It’s actually a concept that allows you to see how your share of business is valued from an accounting standpoint. You’ll need to know your business assets, liabilities, and owners’ shares in order to calculate individual owner equity. Owner’s equity or shareholder’s equity is an important concept for all business owners and investors to understand, as it can show the actual intrinsic value and financial health of a business. Knowing the basics of how to read a balance sheet and calculate owner’s equity is an important skill for owners of businesses of all sizes, as well as for investors of public companies. On the other hand, market capitalization is the total market value of a company’s outstanding shares. Apple’s current market cap is about $2.2 trillion, so investors clearly think Apple’s business is worth many times more than the equity shareholders have in the company.

Finally, it’s important to note that owner’s equity is different from an owner’s draw, which refers to money that is actually paid to the owner(s) of a business. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. Before you set off to find out what equity is and how to calculate it, you need to understand a few things first.

What is a statement of owner’s equity?

That includes the $20,000 Rodney initially invested in the business, the $75,000 he took out of the company, and the $150,000 of profits from this year’s operations. There are many misconceptions about what owner’s equity is, which has left many business owners confused. In this post, you will understand exactly what owner’s equity is and how to calculate it like an expert in no time.

What is Shareholder’s Equity?

But don’t look to owner’s equity to give you a complete picture of your company’s market value. Owner’s equity can be negative if the business’s liabilities are greater than its assets. In this case, the owner may need to invest additional money to cover the shortfall.

The liabilities represent the amount owed by the owner to lenders, creditors, investors, and other individuals or institutions who contributed to the purchase of the asset. The only difference between owner’s equity and shareholder’s equity is whether the business is tightly held (Owner’s) or widely held (Shareholder’s). For this reason, owner’s equity is only one piece of the puzzle when it comes to valuing a business. And that’s also why a balance sheet is only one of three important financial statements (the other two are the income statement and cash flow statement).

Shareholder’s equity refers to the amount of equity that is held by the shareholders of a company, and it is sometimes referred to as the book value of a company. It is calculated by deducting the total liabilities of a company from the value of the total assets. Shareholder’s equity is one of the financial metrics that analysts use to measure the financial health of a company and determine a firm’s valuation. Owner’s equity is one of the simplest yet most helpful accounting concepts. Some might incorrectly assume that owner’s equity tells you how much your business will sell for.

To truly understand a business’ financials, you need to look at the big picture, not just how much its theoretical book value is. The additional paid-in capital refers to the amount of money that shareholders have paid to acquire stock above the stated par value of the stock. It is calculated by getting the difference between the par value of common stock and the par value of preferred stock, the selling price, and the number of newly sold shares. The withdrawals are considered capital gains, and the owner must pay capital gains tax depending on the amount withdrawn. Another way of lowering owner’s equity is by taking a loan to purchase an asset for the business, which is recorded as a liability on the balance sheet. If you look at the balance sheet, you can see that the total owner’s equity is $95,000.

Let’s assume that Jake owns and runs a computer assembly plant in Hawaii and he wants to know his equity in the business. The balance sheet also indicates that Jake owes the bank $500,000, creditors $800,000 and the wages and salaries stand at $800,000. The book value of owner’s equity might be one of the factors that go into calculating the market value of a business.