Indentured Servants

Bond Indenture

Convertible debentures, which are convertible bonds or bonds that can be converted into equity shares of the issuing company after a predetermined period of time. “Convertibility” is a feature that corporations may add to the bonds they issue to make them more attractive to buyers.

What Is the Trust Indenture Act of 1939?

As a consequence, potential buyers of corporate bonds should know what the indenture specifies before buying them. The term indenture primarily describes secured contracts and has several applications in U.S. law.

What is the difference between a bond agreement and a bond indenture?

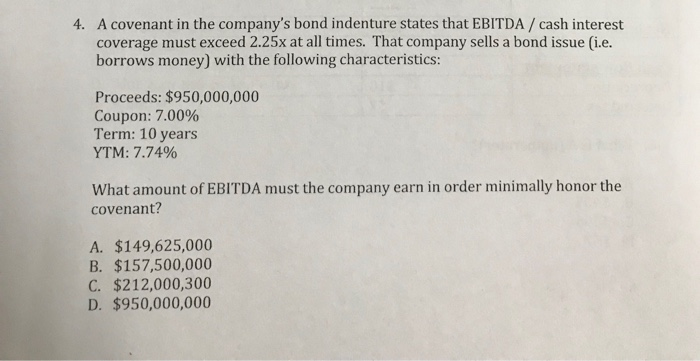

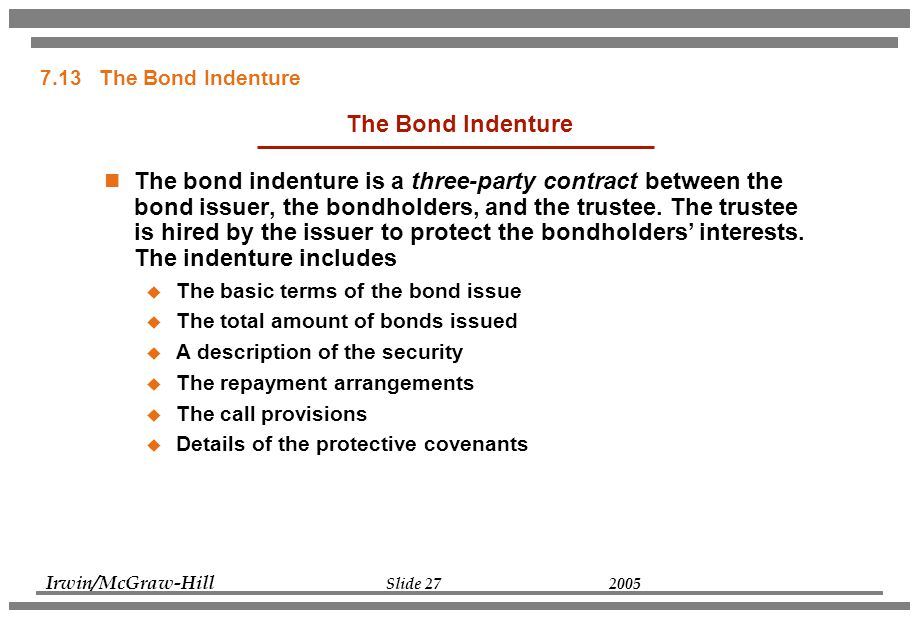

A bond indenture is the contract associated with a bond. The terms of a bond indenture include a description of the bond features, restrictions placed on the issuer, and the actions that will be triggered if the issuer fails to make timely payments. The dates when interest payments will be made to bondholders.

Real Estate Indenture

This decreases risk for the creditors, as a hedge against inflation, bankruptcy, or other risk factors. A sinking fund makes the bond less risky, and therefore gives it a smaller “coupon” (or interest payment). There are also options for “convertibility”, which means a creditor may turn their bonds into equity in the company if it does well. Companies also reserve the right to call their bonds, which mean they can call it sooner than the maturity date. Often there is a clause in the contract that allows this; for example, if a bond issuer wishes to rebuy a 30-year bond at the 25th year, they must pay a premium.A trust indenture describes the bond’s characteristics and the terms of its callability. It also delineates the amount of additional debt the issuer can assume, and the circumstances and procedures in case of issuer default. Investors should review the details of a sinking fund provision in a bond’s indenture and determine their own preferences before investing their money into any corporate bond. Also, in a financial context, an indenture is a written agreement that describes the borrowers’ responsibility to the lenders in a bond or debenture issue. Among other things, the indenture sets the maturity date and the interest rate.

Municipal Bond Tips for the Series 7 Exam

Finally, the concept of indenture has an ignominious place in the history of U.S. labor. Debt issuers are expected to disclose the terms under which a security is issued with a formal written agreement known as a trust indenture. A trust indenture is a contract entered into by a bond issuer and an independent trustee to protect the interests of bondholders. There are also other features that minimize risk, such as a “sinking fund”, which means that the debtor must pay some of the value of the bond after a specified period of time.A debenture is thus like a certificate of loan or a loan bond evidencing the fact that the company is liable to pay a specified amount with interest. Although the money raised by the debentures becomes a part of the company’s capital structure, it does not become share capital. Senior debentures get paid before subordinate debentures, and there are varying rates of risk and payoff for these categories.Bonds are issued to lenders or investors to raise money for a corporation or governmental body. To issue a bond, the issuer hires a third-party trustee, usually a bank or trust company, to represent investors who buy the bond. The agreement entered into by the issuer, and the trustee is referred to as the trust indenture.

Indenture

- To issue a bond, the issuer hires a third-party trustee, usually a bank or trust company, to represent investors who buy the bond.

- Bonds are issued to lenders or investors to raise money for a corporation or governmental body.

- The agreement entered into by the issuer, and the trustee is referred to as the trust indenture.

At its simplest, an indenture is an agreement that declares benefits and obligations between two or more parties. In bankruptcy law, for example, it is a mortgage or deed of trust that constitutes a claim against a debtor. The most common usage of indenture appears in the bond market. Before a bond is issued, the issuer executes a legally binding indenture governing all of the bond’s terms.The contract specifies features of a debt offering, such as the maturity date, the timing of interest or coupon payments, the method of interest calculation, and other features. As an investment product that is used to raise capital, a bond is simply a written document by which a government, corporation, or individual promises to pay a definite sum of money on a certain date. The issuer and the under-writer negotiate provisions such as the interest rate, the maturity date, and any restrictions on the issuer’s actions.If a bond is called, it means that less interest is paid out. In corporate finance, a debenture is a medium- to long-term debt instrument used by large companies to borrow money, at a fixed rate of interest. The legal term “debenture” originally referred to a document that either creates a debt or acknowledges it, but in some countries the term is now used interchangeably with bond, loan stock or note.

How To Legally Start a Hedge Fund In the United States

Some of the aspects covered in a bond indenture, also called a bond indenture agreement, include the maturity date, the coupon rate (stated rate of interest) and any special features of the particular bond. Bonds are required by the Securities and Exchange Commission (SEC), to have indentures, which are typically summarized in the bond prospectus. A prospectus is a formal and legal document that presents details about the structure and goals of the issuing bond company.

Bond Characteristics

However, there are pros and cons to the use of convertible bonds for financing; investors should consider what the issue means from a corporate standpoint before buying in. However, most corporate offerings must include a trust indenture. A copy of it must be filed with the Securities and Exchange Commission (SEC) for corporate bonds with aggregate principal issues of at least $5 million. Corporate issues for less than $5 million, municipal bonds, and bonds issued by the government are not required to file trust indentures with the SEC. Of course, these exempted entities may choose to create a trust indenture to reassure prospective bond buyers, if not to adhere to any federal law.

Credit-rating agencies measure the creditworthiness of corporate and government issues. These entities provide investors with an overview of the risks involved in investing in debt. Similar to most bonds, debentures may pay periodic interest payments called coupon payments. Like other types of bonds, debentures are documented in an indenture. An indenture is a legal and binding contract between bond issuers andbondholders.In simplest terms, a bond indenture is the contract between the bond issuer and an investor. The contract outlines the terms of the bond, the promise of the issuer and your rights as an investor.

How can a bond indenture protect the investor?

In simplest terms, a bond indenture is the contract between the bond issuer and an investor. The contract outlines the terms of the bond, the promise of the issuer and your rights as an investor. A prospectus is a formal and legal document that presents details about the structure and goals of the issuing bond company.In other words, it is a special feature that a corporate bond may carry. As a result of the advantage a buyer gets from the ability to convert, convertible bonds typically have lower interest rates than non-convertible corporate bonds. The company’s credit rating and ultimately the debenture’s credit rating impacts the interest rate that investors will receive.