Investments: Fair Value DisclosuresAlways take the time to take what you’ve learned from the numbers and apply it to what’s actually happening at the company. That last step is the key to taking a financial analysis and translating it into an actionable investment decision.

Balance Sheet vs. Profit and Loss Statement: What’s the Difference?

How is a condensed financial statement prepared?

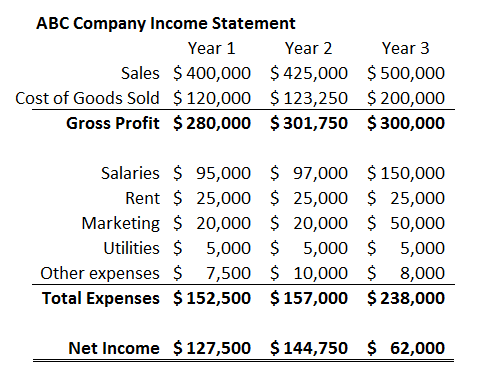

A condensed income statement is one that summarizes much of the income statement detail into a few captions and amounts. For example, a retailer’s condensed income statement will summarize hundreds of categories of sales into one amount with the description Net Sales.Technically, the “interim” concept does not apply to the balance sheet, since this financial statement only refers to assets, liabilities, and equity as of a specific point in time, rather than over a period of time. If a publishing company accepts $1,200 for a one-year subscription, the amount is recorded as an increase in cash and an increase in unearned revenue. Both are balance sheet accounts, so the transaction does not immediately affect the income statement.Goodwill in accounting is an intangible asset that arises when a buyer acquires an existing business. Goodwill also does not include contractual or other legal rights regardless of whether those are transferable or separable from the entity or other rights and obligations. Goodwill is also only acquired through an acquisition; it cannot be self-created. Examples of identifiable assets that are goodwill include a company’s brand name, customer relationships, artistic intangible assets, and any patents or proprietary technology.The notes contain information that is critical to properly understanding and analyzing a company’s financial statements. Remember, though, that the company’s balance sheet is just a snapshot in time.

How Do You Analyze a Bank’s Financial Statements?

If it is a monthly publication, as each periodical is delivered, the liability or unearned revenue is reduced by $100 ($1,200 divided by 12 months) while revenue is increased by the same amount. Presents the assets, liabilities, and equity of the entity as of the reporting date.Another variation is to present the balance sheet as of the end of each month for the past 12 months on a rolling basis. The impairment loss is reported as a separate line item on the income statement, and new adjusted value of goodwill is reported in the balance sheet.Consolidated financial statements aggregate the financial position of a parent company and its subsidiaries. This allows an investor to check the overall health of the company in a holistic manner rather than viewing the individual company’s financial statements separately. In other words, the consolidated financial statements agglomerates the results of the subsidiary businesses into the parent company’s income statement, balance sheet and cash flow statement. The notes (or footnotes) to the balance sheet and to the other financial statements are considered to be part of the financial statements. The notes inform the readers about such things as significant accounting policies, commitments made by the company, and potential liabilities and potential losses.

The trend is your friend when you compare balance sheet accounts over time.

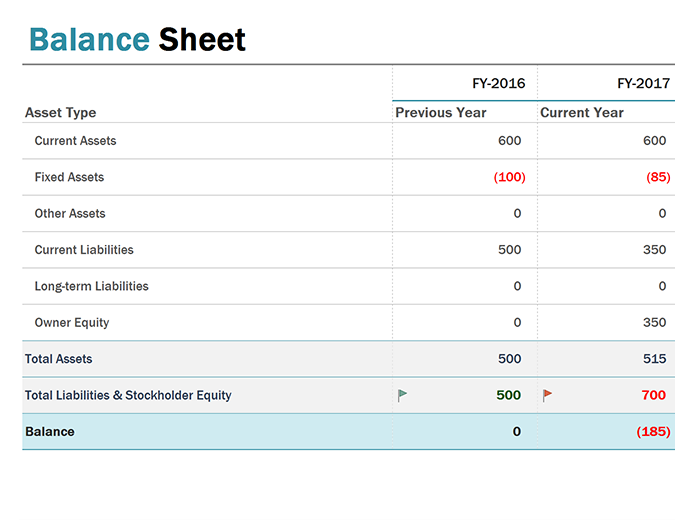

The report format is structured so that the total of all assets equals the total of all liabilities and equity (known as the accounting equation). This is typically considered the second most important financial statement, since it provides information about the liquidity and capitalization of an organization. Assets have a complicated definition in the financial accounting handbook but essentially assets are what generate future income of the business. A company purchases, or holds, assets in the hope that they will produce more income than they cost to buy, or hold. Look at “Inventory” (Current Asset) in an example Balance Sheet; this account represents goods that a business has purchased in the hope that it can later re-sell them at a higher price.A comparative balance sheet presents side-by-side information about an entity’s assets, liabilities, and shareholders’ equity as of multiple points in time. For example, a comparative balance sheet could present the balance sheet as of the end of each year for the past three years.And also it leads them to know the value of the net available resources after deducting the debts which representing the business owners rights and wealth or the (Equity). A condensed balance sheet is a statement of changes in financial position that is presented in a highly aggregated format. This form of presentation may be used in combination with a complete set of condensed financial statements, when the intent is to present just the highlights of an entity’s assets, liabilities and equity. The interim statement concept can apply to any period, such as the last five months.

Condensed balance sheet

- Goodwill also does not include contractual or other legal rights regardless of whether those are transferable or separable from the entity or other rights and obligations.

- Goodwill in accounting is an intangible asset that arises when a buyer acquires an existing business.

- Goodwill is also only acquired through an acquisition; it cannot be self-created.

It’s equally important to consider its income statement and statement of cash flow. And, at the end of the day, the company’s financial statements are just a report of how the company has performed over time.

Breaking Down Condensed Financials

Like all businesses, hedge funds operate using both assets and liabilities, which appear on the fund’s balance sheet. Now I have talked about the financial accounting handbook definitions of the previous two components, but the definition of equity is rather abstract in that is based on a derivative of the previous two definitions. The better way to look at equity is to think of it as what is left for the owners of the business if all the assets were liquidated and the liabilities paid off. Equity represents owner, or shareholder, funds that have been invested, or retained, in the business (although this is not the exact definition).

Notes To Financial Statements

This view of company financials helps provide an overview of the business structure and income performance. The condensed financial statements must adhere to Generally Accepted Accounting Principles and may at times be provided to interested parties in lieu of full financial statements.

An example of a comparative balance sheet analysis

What is a condensed income statement?

A condensed balance sheet is a statement of changes in financial position that is presented in a highly aggregated format.The auditing team conducting an audit of the company will usually view condensed financial statements along with full financial statements for a full picture of the company’s financial standing. This creates a mismatch between the reported assets and net incomes of companies that have grown without purchasing other companies, and those that have.These statements are created to provide a quick overview of the company’s financial status. Items that would normally receive several line items are condensed into one line, such as cost of goods sold or retained earnings.

The goodwill amounts to the excess of the “purchase consideration” (the money paid to purchase the asset or business) over the net value of the assets minus liabilities. It is classified as an intangible asset on the balance sheet, since it can neither be seen nor touched. Under US GAAP and IFRS, goodwill is never amortized, because it is considered to have an indefinite useful life. Instead, management is responsible for valuing goodwill every year and to determine if an impairment is required.If the fair market value goes below historical cost (what goodwill was purchased for), an impairment must be recorded to bring it down to its fair market value. However, an increase in the fair market value would not be accounted for in the financial statements. Private companies in the United States, however, may elect to amortize goodwill over a period of ten years or less under an accounting alternative from the Private Company Council of the FASB. Condensed financial statements are a summary form of a company’s earnings statement, balance sheet, and cash flow statement.