Job Commitment: Definition & Overview

Business Transition Strategies Start with a Plan

In addition to the specific considerations for accounting and financial reporting for leases that pertain to governmental entities that are lessees and lessors, there are two additional cross-cutting matters related to leasing activities that need to be considered. They are operating leases with scheduled rent increases and fiscal funding and cancellation clauses. Also referred to as the modified cash basis, combines elements of both accrual and cash basis accounting. The modified method records income when it is earned but deductions when expenses are paid out.3) other information required in connection with the interests of the mosque. In order to apply the principle of openness (transparency) and accountability to the community, the management of an organizational entity in this public space mosques need to make corrections administration, including the publication of consolidated financial accountability. The growing demands on the implementation of accountability in this mosque, it will increase the need for transparency of financial information. This financial information serves as a basic consideration in the decision making process. Accountability requires that those who hold positions of public trust should account for their performance to the public or their duly elected representatives.

What is commitment accounting in public sector?

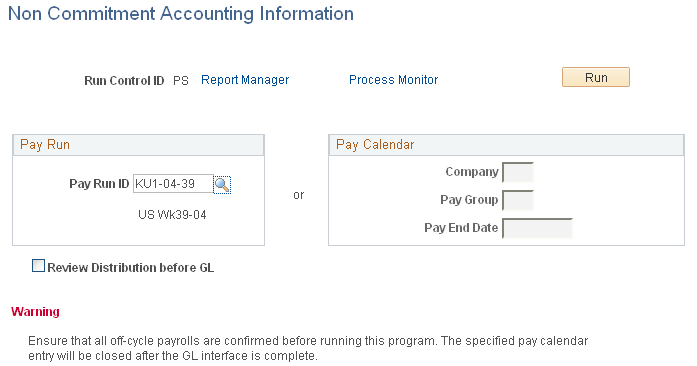

Commitment Accounting allows the recording of a commitment in the general ledger for future or planned expenses before the creation or collection of the underlying documents. Commitment accounting records the reservation of funds for future payment obligations in the general ledger.

Definition of Commitment Amount

The cash basis (EU VAT vocabulary Cash accounting) and the accrual basis is the two primary methods of tracking income and expenses in accounting. This study presents an overview of the recent international movement to increase performance-based accountability at public institutions of higher education. The first section discusses how government reliance on higher education has changed, and the second section addresses how performance- based accountability has emerged as a critical component of higher education funding and planning.Public Sector Accounting is the systematic process of recording, communicating, summarizing, analyzing and interpreting the financial statements and statistics of Government in aggregate and details. It deals with the receipts, custody, disbursement and rendering of stewardship on public funds entrusted”. The main aim of the government is not to make profit but to render essential services to her citizens. proprietary funds and the government-wide financial statements are required to provide disclosures about leases. The chapter illustrates how a lessee would record both an operating lease and a capital lease.To ensure good governance, understanding the way to improve accountability in public sector is very essential. Therefore, to enhance the accountability in the public sector, based on the literature review this study discusses on the organizational internal factors that has influences on accountability; integrity system, internal control system and leadership qualities. This study could assist policy makers to establish more accountability among different departments and agencies of government. Public sector audit has an important role in development by improving transparency and accountability of state finance management. It is observed, however, that many development programs do not meet their objectives.These accountability mechanisms must be strengthened to reduce the level of corruption in the country. The nation’s annual budget must be an instrument of accountability, a stewardship report of what was done in any given financial year and just a reflection of how money was allocated, unspent and subsequently returned to the coffers of the government or even wasted. A basis of accounting is the time various financial transactions are recorded.

What is a commitment in finance?

PURPOSE. To ensure that appropriations and budgets are not overspent as a result of unrecorded obligations that will be incurred prior to the fiscal year end. Commitment accounting requires that all funds required to meet future obligations are tracked when known.Accountability, therefore, implies that decision makers are monitored by, and are responsible to, others, each of whom is, in turn, responsible to the people of the country. In respect of public financial management, there are several mechanisms through which accountability is enforced such as the auditor general, public account committee, and the ombudsman.

commitment

Currently, governance in public administration has become a global issue as a result of the continuous stream of governance failures, fraud, inefficiency, corruption, and poor internal control and financial management. Public sectors worldwide are now under pressure to justify the sources and utilizations of public resources as well as improving the performance in their services delivery. Now it is considered as public rights to monitor the transparency and efficiency of public administration.

- Today, in complex and modern conditions of market and capital action we must not think without having certain financial indicators at all.

- The role of accounting and financial reporting are a key factor that determines many decisions that are taken on a daily or short term basis.

- There is special significance of the state financial reporting no matter of the method of calculation that is used.

What is the difference between a monthly fee and a monthly commitment?

This paper examines accounting changes, such as the introduction of accrual accounting, output and outcome budgets and performance measurement, from an institutionalist point of view. The paper presents experiences of 23 politicians and professional managers with the various changes over a period of fifteen to twenty years. The interviewees, just like various researchers in the field of NPM, were critical of the accounting changes and their effects. However, several of them also made clear that, seen over the long run, the changes did have some effects that they liked and seem to be in line with the ideals presented in NPM literature. The paper suggests that an institutionalist perspective is helpful for studying change processes in organizations and for observing factors and developments that might not be noticed when a more functional and short-term perspective is adopted.The role of accounting and financial reporting are a key factor that determines many decisions that are taken on a daily or short term basis. Today, in complex and modern conditions of market and capital action we must not think without having certain financial indicators at all. There is special significance of the state financial reporting no matter of the method of calculation that is used. Here, I emphasize the importance of setting the goals that will determine the accounting basis and the future accounting policies of the state-government and governmental organizations.

Financial Administration Manual

Similar definition of accrual basis accounting is true for financial accounting purposes, except that revenue can’t be recognized until it is earned, even if a cash payment has already been received by the tax authorities. Changes in public sector accounting in a number of OECD countries over the 1980s were central to the rise of the “New Public Management” (NPM) and its associated doctrines of public accountability and organizational best practice. This paper discusses the rise of NPM as an alternative to the tradition of public accountability embodied in progressive-era public administration ideas. It argues that, in spite of allegations of internationalization and the adoption of a new global paradigm in public management, there was considerable variation in the extent to which different OECD countries adopted NPM over the 1980s.

The fine art of commitment in business

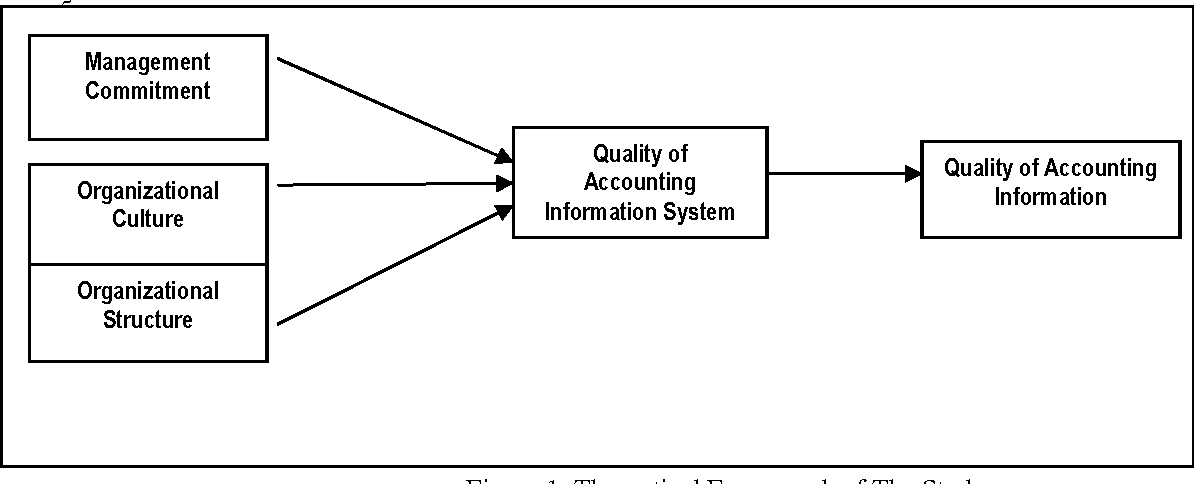

The provision of useful satisfying information is the main purpose determined by the accounting information system. Determining users of such information and the possibility of comparing financial statements is also an important goal. The selection of data shown in the balance sheets of financial and non-financial character becomes very important for government units that work for general purposes. Namely, the quality of government financial reporting is also reflected in the correctness of the decisions of the managers.

What is financial commitment? Definition and example

As a matter of fact, based on the data and information in the financial statements, plans for the future development of the organization or unit are created. In fact, government financial reporting may use a cash basis for accounting and may be presented as a financial reporting on an accrual basis, or an accounting for an occurrence.The same bases are used both as a modified cash basis and a modified accrual basis. Acceptance of a modified cash basis is most often associated with additional disclosure. The application of a specific period is usually the reason for its use. While a modified accrual basis is most often associated with the acceptance or non-acceptance of certain types of assets or sources of funds. Dutch municipalities and provinces, denoted here as local government, have seen a succession of changes in their management accounting systems and have also introduced other changes related to New Public Management (NPM) in the last twenty years.It indicates that the current public sector audit has not been adequate to promote development program effectiveness. The objective of this research is to confirm whether the current public sector audit approach is not adequate to promote development program effectiveness and what additional roles are expected to be fulfilled by public sector audit. This study is based on the Indonesian context and uses a qualitative methodology where 27 semi-structured interviews were conducted to Member of Parliament and officials of the Supreme Audit Institution (SAI) and government entities in Indonesia. The study shows that the existing public sector audit has not been adequate to promote development program effectiveness because it pays more attention to financial and compliance aspects of the development program. Stakeholders expect that public sector audit also needs to provide the solution, provide preventive measures, create a good environment and produce useful information for decision making.