Landlord Tax GuideA liability, in general, is an obligation to, or something that you owe somebody else. Liabilities are defined as a company’s legal financial debts or obligations that arise during the course of business operations. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses.To help taxpayers avoid a sweat at tax time, the IRS wants taxpayers to know the facts about reporting rental income. Many landlords who have made significant ‘rental losses’ in previous years may not have even realised having never previously made a tax return. These landlords may now be making significant rental profits which they need to declare. They should therefore go back and calculate their rental losses from previous years. This is because these rental losses can be carried forward and set off against rental profits in subsequent tax years.In general, you can only offset that loss against any profits that arise from the same rental business in future years. If HMRC ask you to send in a tax return you must give details of your rental income and expenses for the tax year even if you’ve no tax to pay.

I was talking earlier this week to one professional landlord who sees the current low base rate environment as an opportunity to ramp up his property maintenance and improvement program on his rental portfolio. Over the last few years he has spent over £30,000 upgrading his portfolio. This has the benefit of reducing his tax bill now and also increasing the ‘letability’, rents and income smoothing his future profits when interest rates do finally start to rise. Firstly, landlords should be aware of what their allowable expenses are on a rental property.

What to Declare as Rental Income

But remember that you can also deduct expenses to shrink your tax liability. You can deduct costs like the mortgage interest on your rental property, property taxes, operating expenses, repairs and depreciation. If you own an investment property and collect rent from your tenants, it’s important to declare that rental income on your taxes. You can, however, deduct expenses you incur to maintain your rental property. In other words, becoming a landlord for the first time will make filing your taxes more complicated.

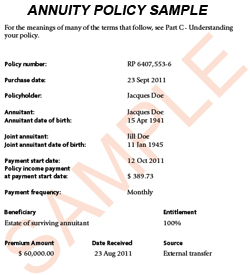

Recording an Upfront Payment

Taxpayers must refer to rules for personal use of a dwelling that they rent, at-risk rules and passive activity loss rules. For detailed information about these rules, see Publication 925, Passive Activity and At-Risk Rules, and Publication 527. Taxpayers can deduct the ordinary and necessary expenses for managing, conserving and keeping their rental property.If you are considering buying rental properties, you should already know how to analyze an investment by penciling out your real estate deal. Like most assets, liabilities are carried at cost, not market value, and underGAAPrules can be listed in order of preference as long as they are categorized. The AT&T example has a relatively high debt level under current liabilities. With smaller companies, other line items like accounts payable (AP) and various future liabilities likepayroll, taxes, and ongoing expenses for an active company carry a higher proportion. When you work out your taxable rental profit you can deduct allowable expenses from your rental income.

Pay By

Ordinary expenses are common and generally accepted in the business, such as depreciation and operating expenses. Necessary expenses are appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance. People often rent out their residential property as a source of income, particularly during the vacation-heavy, warm summer months. Different tax rules apply depending on if the taxpayer renting the property used the property as a residence at any time during the year.

What is rental income in accounting?

To file your rental income, you’ll use Form 1040 and attach Schedule E: Supplemental Income and Loss. On Schedule E, you’ll list your total income, expenses and depreciation for each rental property. Expenses include, advertising, auto and travel, insurance, repairs, taxes and more.

Operating Expenses – Operating expenses include all cash expenditures required to operate the property and command market rents. As for profit, you most likely do make a profit which is more commonly referred to in this industry as “cash flow”. But chances are not one penny of that profit is actually taxable income.

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

- In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions.

- Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses.

Popular ‘Real Estate & Buildings’ Terms

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions. Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities.When you add up all the deductible rental expenses they will more than likely exceed your rental income. Once those deductible rental expenses get your taxable rental income to zero, that’s it. All remaining expenses are carried over to the next year where than can be deducted, provided of course you have the rental income to deduct them from. It might sound like being a landlord and collecting rent is a big tax headache.Find out your tax obligations as a landlord, and how to work out your rental income if you rent out property. If you hire someone to paint the house, his fee is your deductible expense.The expenses must be wholly and exclusively for the purposes of renting out the property. This means that if an expense wasn’t incurred for the purpose of your property rental you can’t offset the cost against the rental income. When you rent a property to a tenant, you pay tax on any profit you make from rental income that is not covered by your personal allowance, which is set at £11,850 for the tax year.

Upfront Payment vs. Delayed Payment

How do you claim rental income?

rental income. The amount of money collected by a landlord from a tenant or group of tenants for using a particular space. Most businesses that lack the funds or credit standing to purchase their premises will have to budget for the cost of paying rental income on a periodic basis that is typically done monthly.The rental income you declare on your income taxes will depend on your method of accounting. Most individuals use the “cash basis method.” This method requires you to report income as you receive it and expenses as you pay them out. As a landlord, you must normally pay income tax on any profit you receive from any rental properties you own.

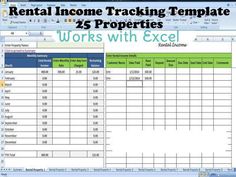

FREELandlord Software

Put simply, your profit is the sum left once you’ve added together your rental income and deducted any allowable expenses or allowances. Liabilities are items on a balance sheet that the company owes to vendors or financial institutions. They can be current liabilities, such as accounts payable and accruals, or long-term liabilities, such as bonds payable or mortgages payable. In most cases, a taxpayer must report all rental income on their tax return. In general, they use Schedule E (Form 1040) to report income and expenses from rental real estate.Net Operating Income is the single most important measurement in commercial real estate. As a landlord, you’ll need to pay income tax on the rent you receive from your properties. This guide explains how you calculate what you pay and how income tax is applied to rental income. If the allowable expenses are greater than your rental income you will have made a loss.

– What is “not for profit rental income”?

If you do the job yourself, you deduct the cost of your paint and other supplies, and the cost of transportation. Trips from your home to the paint store and the house are deductible, either by claiming the actual cost or deducting a standard per-mile rate. If you reporting rental income on a cash basis, as most owners do, you claim the deduction in the same tax year you pay the bill for repairs. If a taxpayer has a loss from rental real estate, they may have to reduce their loss or it may not be allowed.I have a condo purchased for my son which is rented to him at 60% of fair market value. I will enter all rental income on line 21 and will declare no expenses as I do not file Schedule A. My question regards is depreciation allowable for this type of property? I can’t claim it but I am afraid it is classified as allowable and when I sell the property In the future I will have to pay the tax on the recapture of the allowable depreciation which I did not and cannot take.